- The S&P 500 is down 19.9% in 2022, on track for one of its worst years in history

- Anxiety over rising Fed interest rates and a slowing economy will continue to negatively impact market sentiment in 2023

- Investors should consider buying Occidental Petroleum and Lockheed Martin to hedge against further downside volatility next year

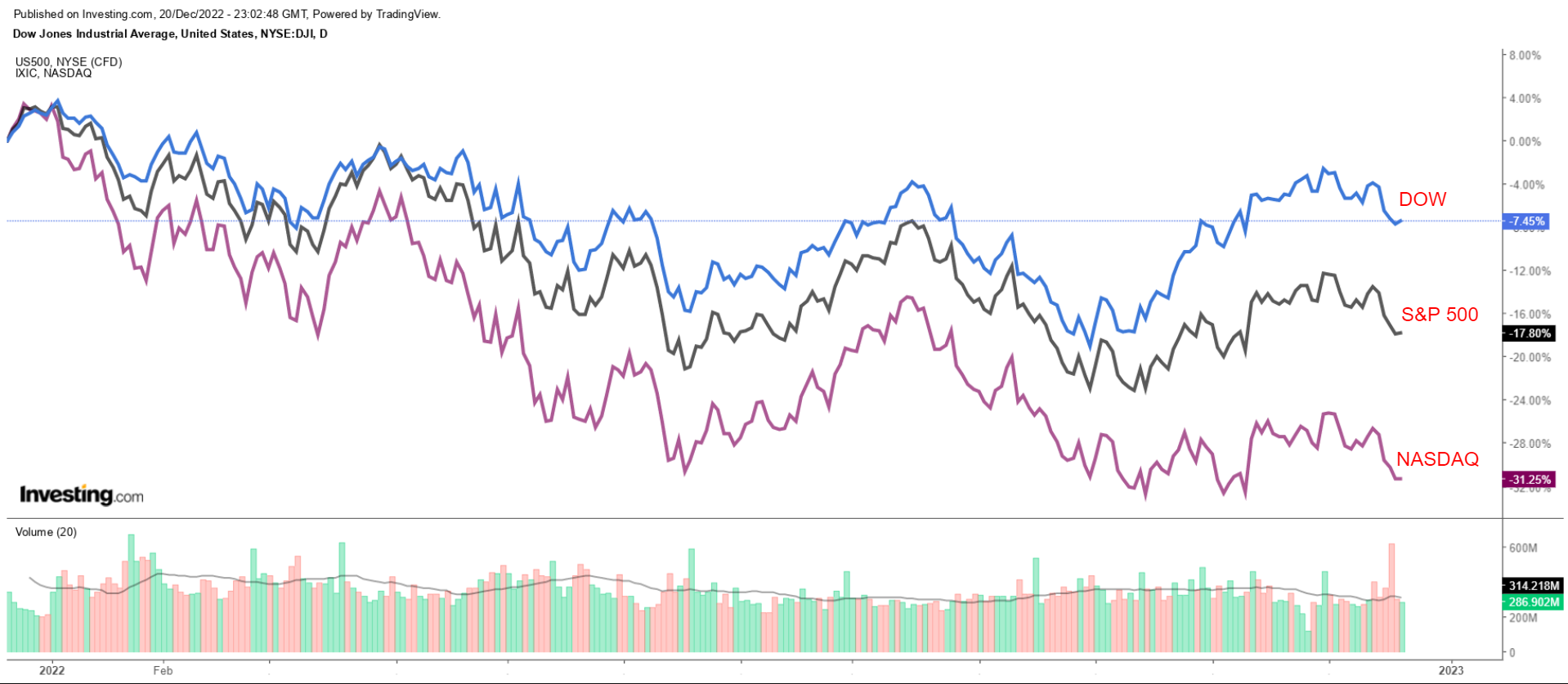

With just about one week left in 2022, Wall Street’s major indices are on course to suffer one of their worst annual performances in recent history amid worries the Federal Reserve’s aggressive rate hikes to fight inflation will tip the economy into recession.

The benchmark S&P 500 index is down 19.9% year-to-date and 20.7% away from its Jan. 3 all-time high. The tech-heavy Nasdaq Composite, which has languished in bear market territory for most of the year, is off by 32.2% YTD and is roughly 35% below its Nov. 19, 2021 record peak.

Meanwhile, the blue-chip Dow Jones Industrial Average is down the least, declining 9.6% YTD and is 11.1% off its record peak reached in January.

Despite the year-long selloff, oil-and-gas producer Occidental Petroleum (NYSE:OXY) and defense contractor Lockheed Martin (NYSE:LMT) have managed to buck the downward trend and offer investors a bit of relief, shining in an otherwise challenging market.

With further turmoil expected in 2023, I recommend buying OXY and LMT at these levels, given their solid fundamentals, reasonable valuations, healthy balance sheets, and enormous cash piles.

1. Occidental Petroleum

- Year-To-Date Performance: +115.1%

- Market Cap: $56.5 Billion

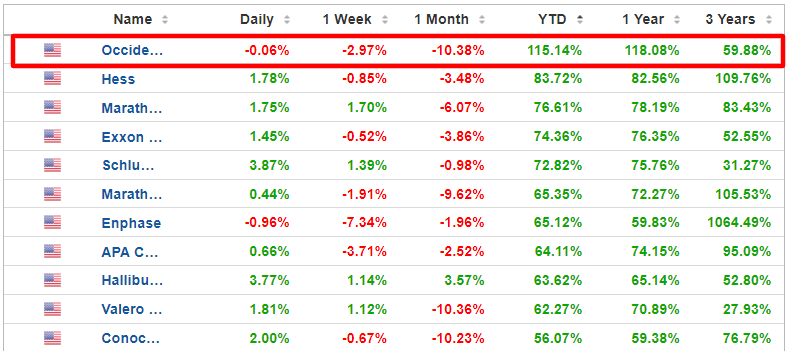

In a year of grim performance across the S&P 500, Occidental Petroleum’s stock has been a rare bright spot as it benefits from a potent combination of high energy prices, increasing global oil demand, and streamlined operations.

Despite the broader market slump, shares of the Houston, Texas-based oil-and-gas exploration and production company have soared by an astonishing 115.1% year-to-date, making it the best-performing S&P 500 stock of 2022 by a wide margin.

In addition to improving fundamentals, investors have also been encouraged by news that Warren Buffett’s Berkshire Hathaway (NYSE:BRKa) has amassed a significant stake in the standout energy company. Berkshire is OXY’s largest shareholder, with roughly 195 million shares - equaling a nearly 21% stake. In August, a U.S. energy regulator gave the Omaha, Nebraska-based conglomerate permission to buy up to 50% of Occidental’s common stock.

Shares - which began the year at $28.99 and rose to a record high of $77.13 on Aug. 29 - closed at $62.37 last night, earning the thriving energy firm a valuation of $56.5 billion.

In my opinion, OXY remains one of the best stocks to own in 2023, thanks to the energy company’s ongoing efforts to return capital to shareholders in the form of higher dividend payouts and share buybacks amid a strong balance sheet and high free cash flow levels.

The cash-rich oil-and-gas producer also boasts a relatively cheap valuation. With a P/E ratio of 5.7, OXY stock comes at a substantial discount when compared to other notable names in the oil-and-gas exploration and production space, such as ConocoPhillips (NYSE:COP), EOG Resources (NYSE:EOG), and Pioneer Natural Resources (NYSE:PXD), which trade at 9.2 times, 11.1 times, and 9.4 times forward earnings, respectively.

Occidental has easily surpassed Wall Street’s sales estimates in the last seven quarters, and I expect it will keep that streak alive next year as it benefits from the higher output at its stellar operations in the Permian Basin - while taking advantage of elevated crude oil and natural gas prices.

Indeed, Wall Street has a long-term bullish view on OXY stock, with 25 out of 28 analysts surveyed by Investing.com rating it as either ‘buy’ or ‘hold’. Shares have an average analyst price target of around $76, representing an upside of roughly 22% from current levels.

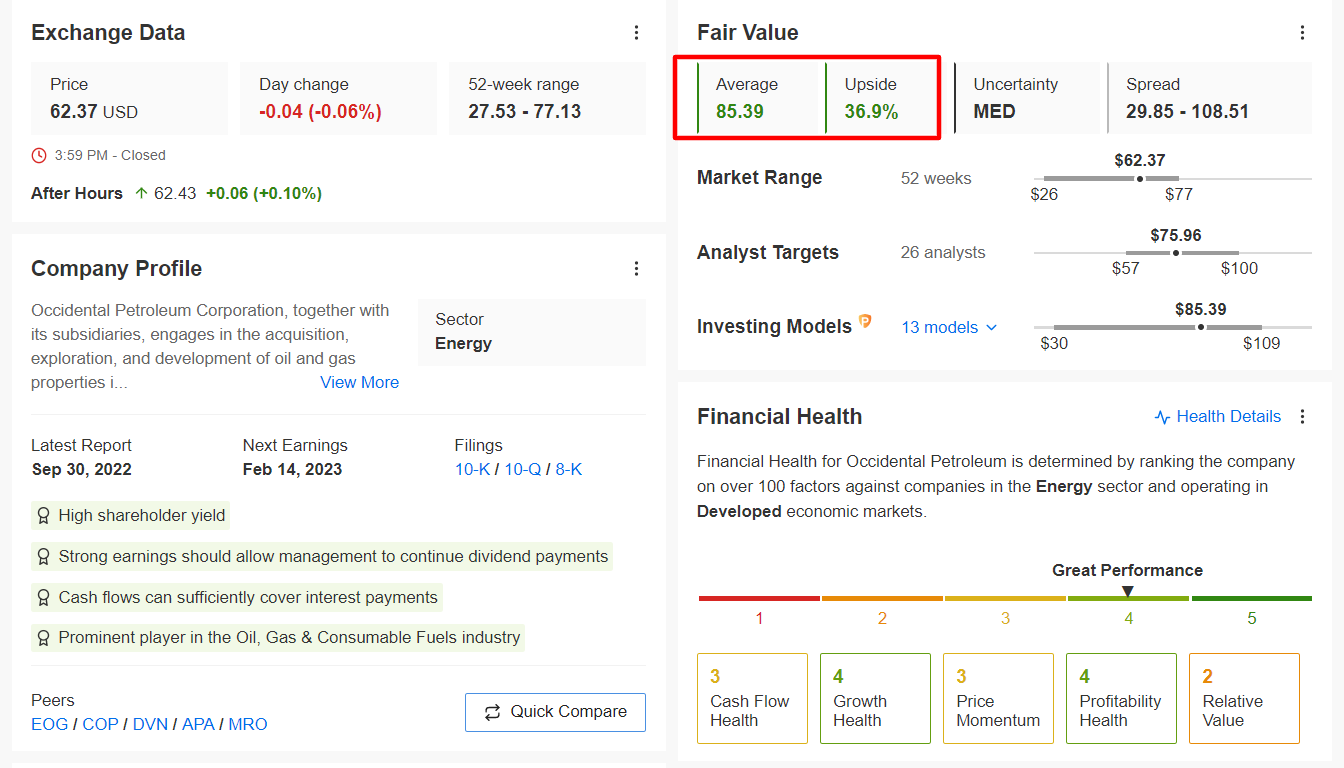

Likewise, the quantitative models in InvestingPro point to a gain of 36.9% in OXY stock over the next 12 months, bringing shares closer to their fair value of $85.39.

Source: InvestingPro

2. Lockheed Martin

- Year-To-Date Performance: +36.8%

- Market Cap: $127.6 Billion

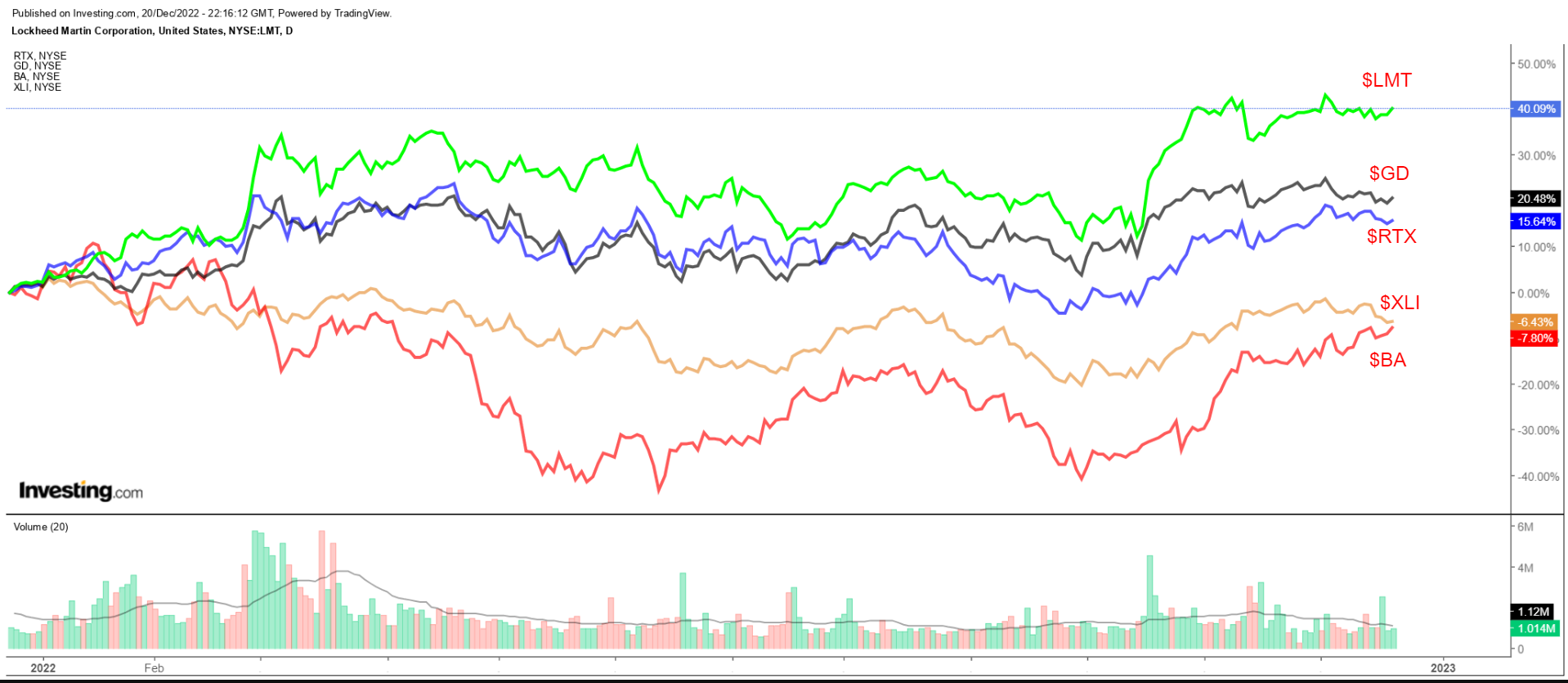

It’s been a blockbuster year for Lockheed Martin, whose stock is on pace for its best annual performance since 2019. While the S&P 500 has wallowed in bear market territory for most of the year, shares of the aerospace and defense giant have risen 36.8% year-to-date amid a worsening global geopolitical backdrop.

LMT stock, which started trading at $355.41 on Jan. 1, 2022, ended Tuesday’s session at $486.15, within sight of its all-time peak of $498.95 touched on Dec. 2, as hostilities between the U.S., its North Atlantic Treaty Organization (NATO) allies, and Russia escalated sharply following Moscow’s invasion of Ukraine earlier this year.

Lockheed has been one of the top-performing stocks of 2022 amongst names found in the Industrial Select Sector SPDR Fund (NYSE:XLI), outpacing major industry peers, such as Raytheon (NYSE:RTN) Technologies (NYSE:RTX) (+14.1% YTD), General Dynamics (NYSE:GD) (+18.3% YTD), and Boeing (NYSE:BA) (-6.5% YTD).

At current levels, Lockheed Martin has a market cap of $127.6 billion, making it the world’s second-largest aerospace and defense company behind Raytheon.

In my view, Lockheed shares will continue their march higher in 2023 as investors are likely to pile into defensive areas of the industrial sector amid ongoing fears over rising interest rates and slowing economic growth. The Bethesda, Maryland-based arms company remains well-positioned to benefit from growing global government and military defense budgets due to the current geopolitical environment.

In a sign of how well its business has performed amid the challenging macro backdrop, Lockheed has beaten Wall Street’s profit expectations in four out of the last five quarters thanks to robust demand for its assortment of military goods and advanced technologies, such as fighter jets, combat ships, hypersonic missiles, and missile defense systems.

Lockheed Martin is one of the world’s leading names in the aerospace, military support, security, and technologies industry. It is best known as the lead developer and manufacturer of a wide range of military aircraft, including the F-16, F-22, and F-35 fighter jets, of which the U.S. military and its NATO allies are the primary buyers. It also makes missile defense systems like the Terminal High Altitude Area Defense (THAAD), which was one of its best-performing units in its most recent quarter.

In addition, Lockheed’s continuous efforts to return more cash to shareholders in the form of higher dividend payouts make it an attractive candidate to outperform in the year ahead. The defense contractor recently boosted its quarterly cash dividend by 7% to $3 per share, marking the 19th consecutive annual increase. This represents an annualized dividend of $12 and a yield of 2.49%.

Unsurprisingly, the average fair value for LMT’s stock on InvestingPro, according to a number of valuation models - including P/E multiples - implies a 17.5% upside from the current market value over the next 12 months to $571.08/share.

Source: InvestingPro

Disclosure: At the time of writing, Jesse is short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P500 (NYSE:SH) and ProShares Short QQQ (NYSE:PSQ). He is long on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV).

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.