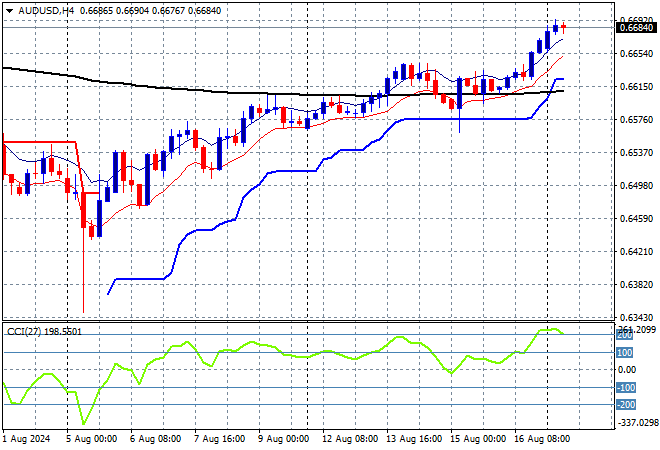

A relatively solid session for Asian share markets given the lack of direction from Wall Street on Friday night with all the volatility still residing in Japan as Yen appreciates sharply against an ever weakening USD. Eurostoxx futures are flat with the USD still on the backfoot versus Euro and other currencies with the Australian dollar looking a lot stronger going into tomorrow’s RBA minutes release, almost threatening the 67 cent level.

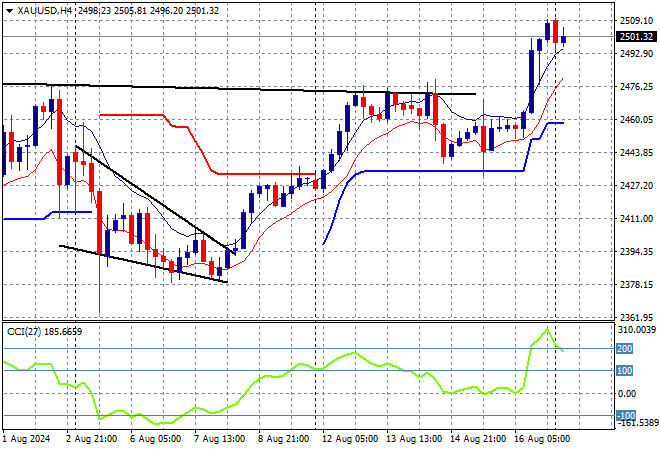

Oil prices are losing further short term momentum as Brent crude retreats below the $78USD per barrel level while gold is holding on to its breakout above the $2500USD per ounce level:

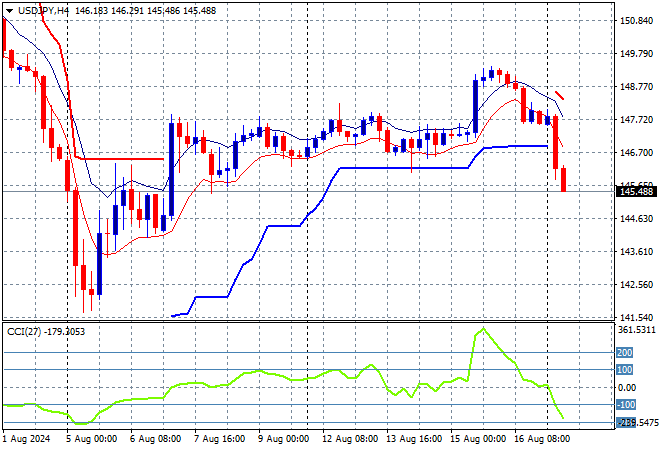

Mainland Chinese share markets are finally finding traction with the Shanghai Composite lifting more than 0.4% going into the close while the Hang Seng Index is up nearly 0.9% at 17579 points. Meanwhile Japanese stock markets are pulling back strongly on Yen volatility with the Nikkei 225 closing nearly 1.8% lower to 37388 points while trading in USDPY has seen a big dip below the 146 handle with the mid 145 level now under threat:

Australian stocks eked out a small gain with the ASX200 lifting just 0.2% to close at 7980 points while the Australian dollar was able to hold on to its move above the 66 cent handle and is actually threatening the 67 cent level:

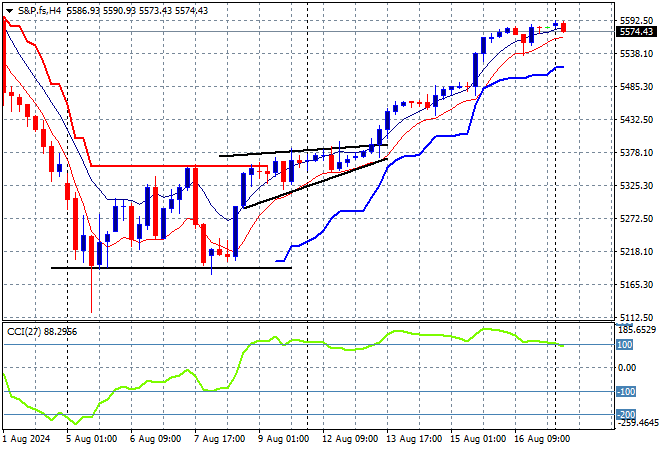

S&P and Eurostoxx futures are dead flat into the London session with the S&P500 four hourly chart showing continued stability returning to the major index following the recent breakout which still has nice momentum behind it:

The economic calendar starts the week very quietly without any major releases to note.