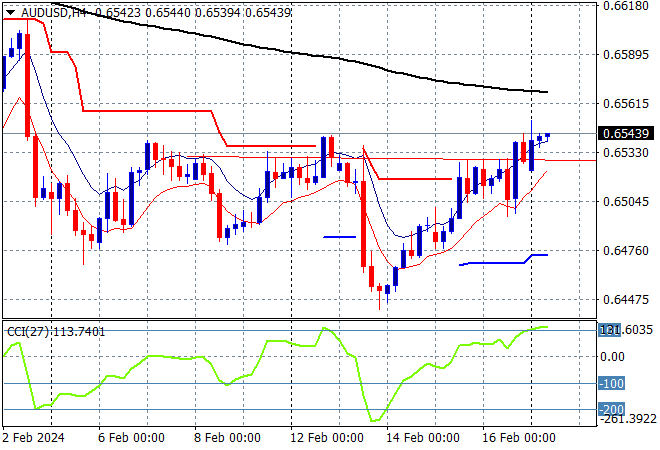

A cautious start to the trading week as Asian share markets absorb the reopening of Chinese equities which started lower despite some upbeat macro news. The USD is slightly lower against all the major currency pairs, especially gold while the Australian dollar is finally making some headway as it climbs above the 65 cent level but remains weak on the medium and long term timeframes.

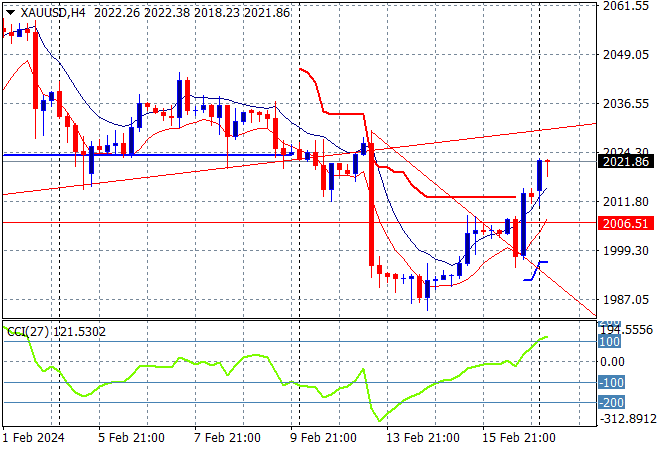

Oil prices are still on trend and holding on to their nascent gains from last week with Brent crude just below the $83USD per barrel level while gold is now bursting out of its once depressive mood as it bounces back to the previous support level above the $2020USD per ounce level:

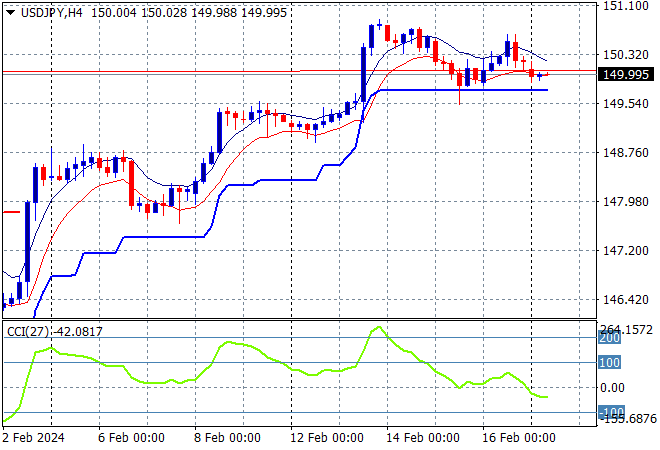

Mainland and offshore Chinese share markets reopened from the Chinese New Year holiday with the Shanghai Composite up nearly 1% while the Hang Seng pulled back an equal amount to 16179 points. Japanese stock markets are going nowhere with the Nikkei 225 closing some 0.1% lower at 38470 points while the USDJPY pair is doing the same, moving listlessly to be just under the 150 handle:

Australian stocks range traded throughout the session with the ASX200 closing just 0.1% higher at 7665 points while the Australian dollar is pushing further from its Friday night bounceback to match its recent two week high just above the 65 cent level:

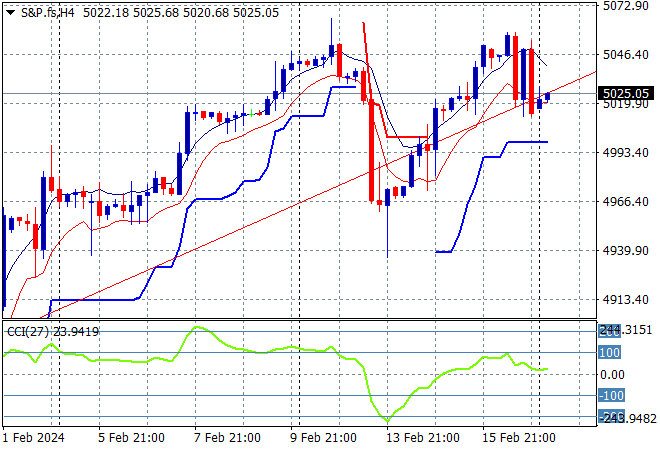

S&P and Eurostoxx futures are stalled at their Friday night lows with the S&P500 four hourly chart showing price action still holding above the 5000 point level:

The economic calendar starts the trading week slowly due to the US long weekend.