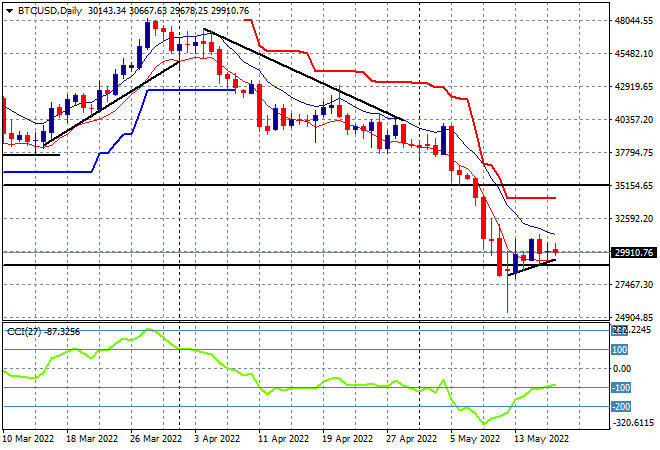

Asian share markets are doing relatively well given the continued bounceback on overseas markets overnight, although Chinese shares are unstable again after a big move higher yesterday. Currency markets are pushing back against the very strong USD although the Australian dollar has slipped back down to the 70 level. Oil prices are also retreating slightly with Brent crude now hovering just above $112USD per barrel while gold is struggling as it falls to the $1809USD per ounce level while Bitcoin looks like rolling over again, barely hanging on just below $30K:

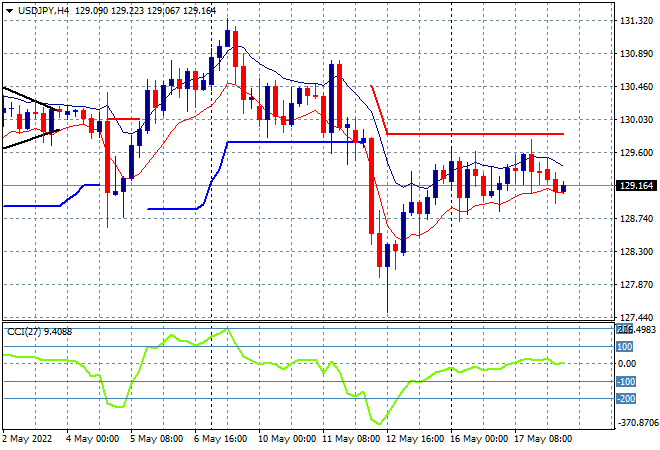

Mainland Chinese share markets are struggling despite some encouraging news about lockdowns domestically with the Shanghai Composite currently down 0.1% to 3092 points while the Hang Seng Index is recovering after a mid session dip, unchanged at 20600 points. Japanese stock markets are doing better, getting out of recovery mode with the Nikkei up nearly 0.7% to 26837 points while the USDJPY pair remains basically unchanged following its small Friday bounce, slipping slightly to just above the 129 handle:

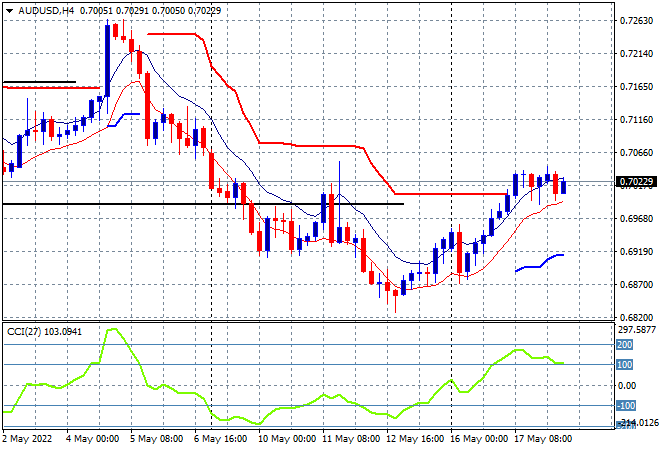

Australian stocks are doing the best in the region with another good session with the ASX200 up nearly 0.9% to 7179 points. Meanwhile the Australian dollar has slipped following the recent wages data print with a return below the 70 level and almost putting in a new weekly high:

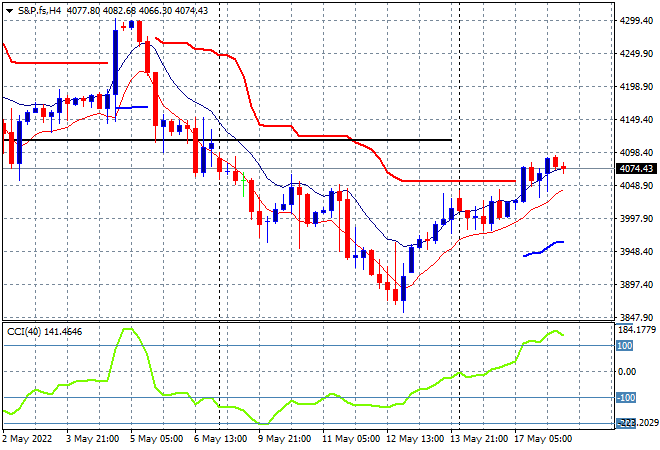

Eurostoxx and Wall Street futures are slowly gaining as we head into the European open with the S&P500 four hourly chart showing price wanting to extend its gains above the 4000 point level and head towards key resistance at the 4100 area as it regains momentum following the Friday night bounce:

The economic calendar includes UK and Euro core inflation prints then US housing starts.