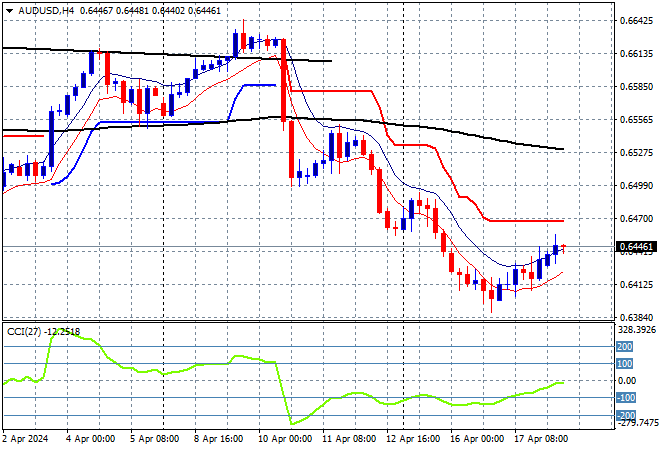

Asian stock markets are trying to rebound from a bad trading week so far following the escalation in conflict across the Middle East, with yet more hawkish Fedspeak overnight not helping risk sentiment . The USD remains strong against most of the undollars but had a small retracement while bond markets calmed down as well. The Australian dollar is trying to rebound after its recent large reversal as it absorbs the fairly tight unemployment print and the lower chance of an upcoming RBA cut, hovering just above the mid 64 cent level this afternoon.

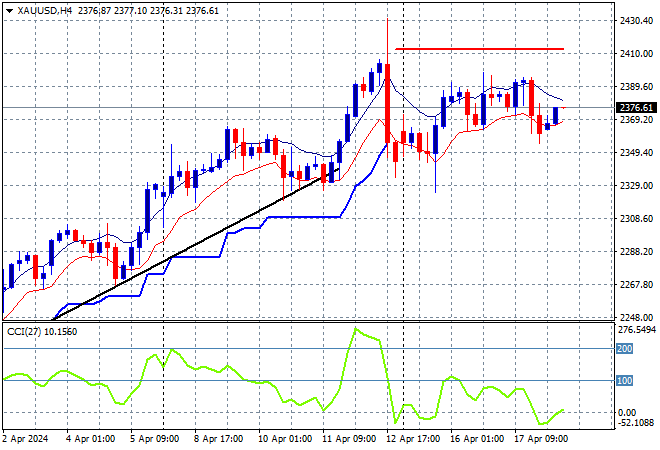

Oil prices are holding on following the overnight retreat without any further downside with Brent crude retracing slightly below the $87USD per barrel level while gold is also having a milder session today, sitting just below the $2380USD per ounce level:

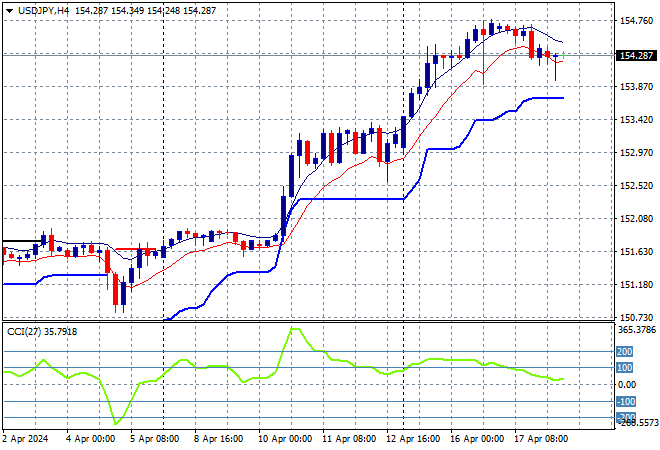

Mainland and offshore Chinese share markets are moving in the same direction with the Shanghai Composite lifting 0.2% going into the close while the Hang Seng Index is putting in a better response, up more than 1% to 16428 points. Japanese stock markets are seeing a mild rebound with the Nikkei 225 up more than 0.5% at 38150 points with the USDJPY pair has been pushed below the mid 154 level after its recent breakout:

Australian stocks had the worst rebound with the ASX200 finishing just 0.4% higher at 7639 points while the Australian dollar is trying to get off the floor to be just below the mid 64 cent level in response to the latest unemployment print:

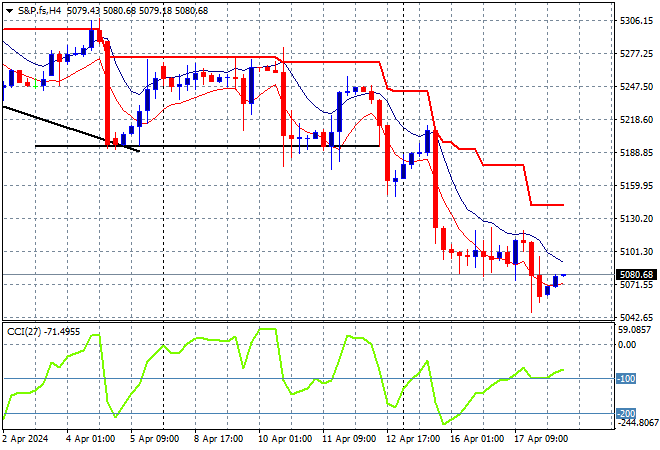

S&P and Eurostoxx futures are trying to fight back from their selloff as we head into the London session with the S&P500 four hourly chart showing price action still in a steep downtrend, trying to find a bottom here:

The economic calendar includes the latest weekly initial jobless claims from the US plus some more Fed speeches.