Asian stock markets are in somewhat mixed despite the gains on Wall Street overnight as a stronger USD and higher bond yields dampens risk appetite. US and European stock futures are up slightly with the Australian dollar an outlier as the recent RBA minutes give it a boost above the 67 level. Oil prices are holding on after losing some ground overnight with Brent crude just above the $85USD per barrel level while gold is trying to fight back after a push below the $2000USD per ounce level after a failed breakout on Friday night:

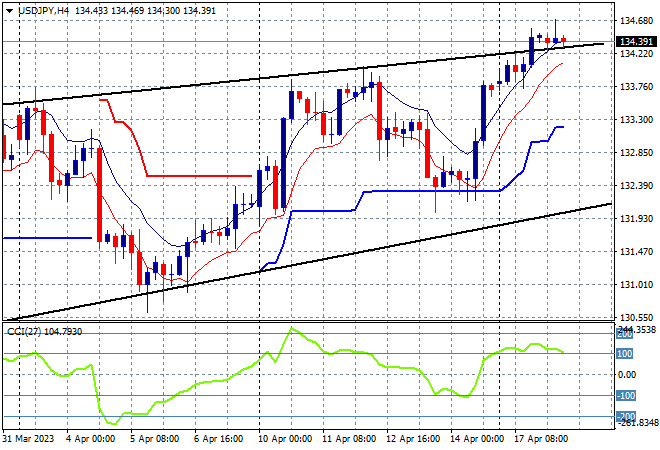

Mainland Chinese share markets are trying to lift from a mixed session into the close, with the Shanghai Composite up just .2% to almost get through the 3400 point barrier at 3393 points while the Hang Seng has pulled back somewhat, down nearly 0.8% to finish at 20629 points. Japanese stock markets have found some lost confidence with the Nikkei 225 closing more than 0.5% higher on a weaker Yen at 28662 points with the USDJPY pair holding on to a bounce above the 134 level again:

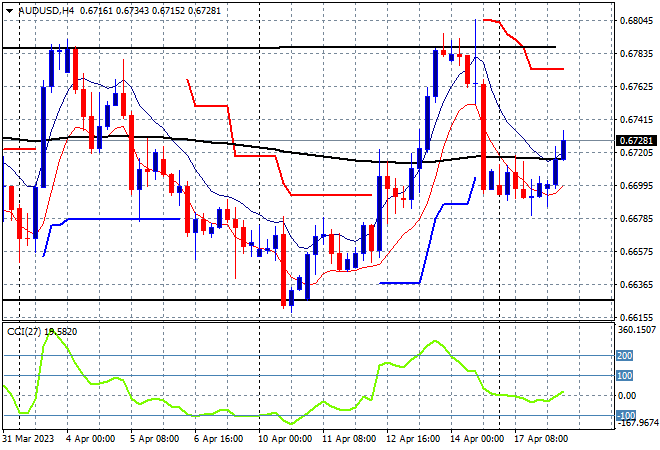

Australian stocks slipped with the ASX200 finishing nearly 0.3% lower to remain below the 7400 point level at 7360 points. The Australian dollar lifted on the release of the RBA Minutes with speculation another rate rise is around the corner, with the Pacific Peso building above the 67 handle, in what could be a move back to resistance at the 68 level:

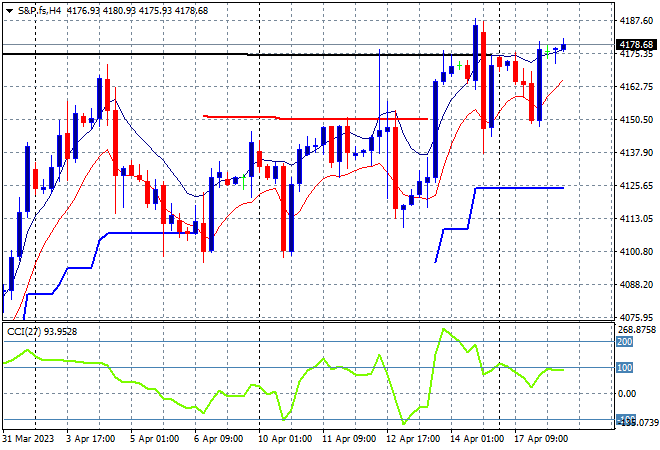

Eurostoxx and US futures are up about 0.2% or so with the S&P500 four hourly chart showing price action ready to burst out above overhead resistance after clearing a point of control at the 4150 point level. The next psychological level to clear is obviously 4200 points, so watch for a breakout tonight:

The economic calendar ramps up tonight with the closely watched German ZEW survey, then US building permit numbers.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.