Asian share markets are putting in fairly strong sessions as the trading week restarts with currency markets still under the weight of a stronger USD in the wake of firmer than expected domestic US economics print from last week. Wall Street is looking to open slightly higher after a poor Friday night session while the Australian dollar remains at its recent lows at the mid 65 cent level as traders’s await for tomorrow’s RBA meeting.

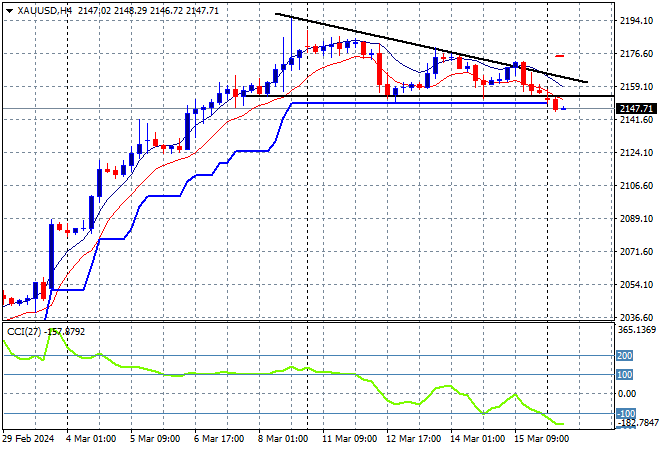

Oil prices are continuing their breaking out after the Ukrainian attack on Russian refineries as Brent crude passes through weekly resistance at the $85USD per barrel level while gold is almost breaking down after its recent gains to fall below the $2150USD per ounce level:

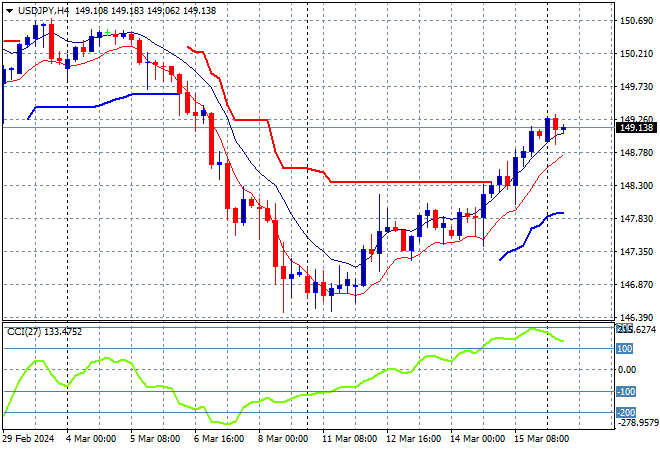

Mainland and offshore Chinese share markets are getting back on track with the Shanghai Composite bouncing back in late afternoon trade, up nearly 1% while the Hang Seng has rebounded slightly with a 0.3% gain to close at 16773 points. Japanese stock markets are the biggest movers however with the Nikkei 225 closing nearly 2.7% higher at 39740 points while the USDJPY pair is continuing its breakout again after falling sharply last week, now climbing above the 149 level:

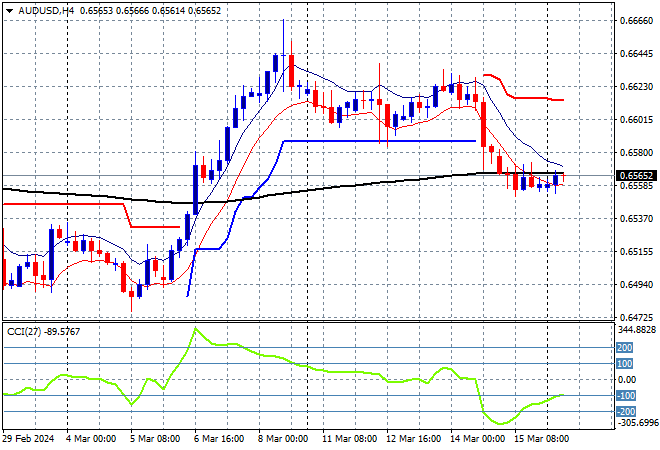

Australian stocks were barely able to advance with the ASX200 gaining just 0.1% to close at 7675 points while the Australian dollar is holding at its recent lows at the mid 65 cent level:

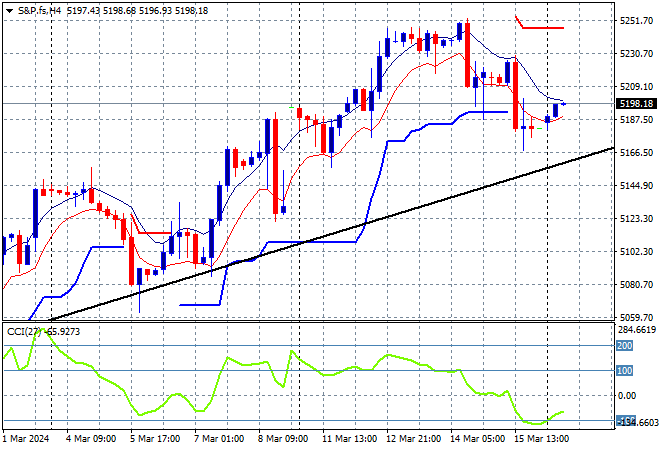

S&P and Eurostoxx futures are trying to bounceback from their Friday night losses as we go into the London session with the S&P500 four hourly chart showing price action trying to get above the 5200 point level with short term support under threat:

The economic calendar starts the trading week with Euro core inflation and some Treasury auctions.