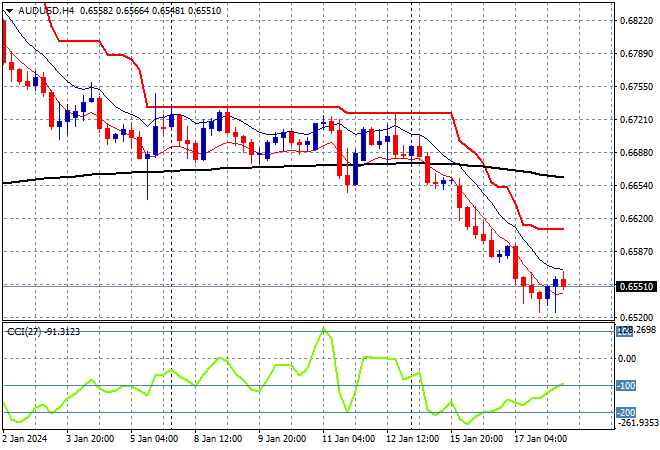

The fallout from the recent Chinese GDP growth figures combined with stronger than expected US prints overnight is still giving risk markets a pause with the USD remaining strong against the major currencies. The Australian dollar was largely unchanged as the latest numberwang unemployment figures surprised to the downside, but is still quite weak overall going into next month’s RBA meeting.

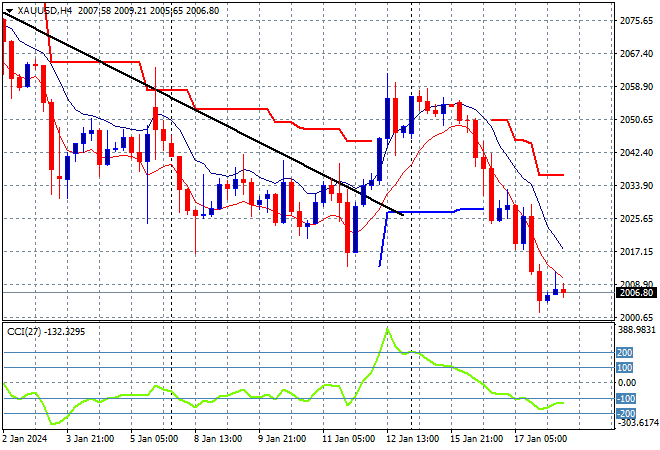

Oil prices are trying to get out of stall mode with Brent crude lifting slightly above the $78USD per barrel level but going nowhere while gold has returned to its previously weekly low as it now dices with the $2000USD per ounce level:

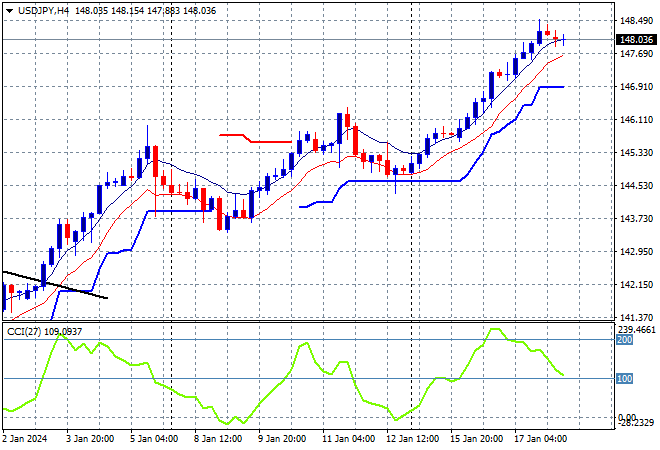

Mainland Chinese share markets are pulling back sharply again as the Shanghai Composite falls nearly 1% to 2808 points while in Hong Kong the Hang Seng Index had a solid rebound, but still relatively small given the large losses recently, up 0.8% to 15411 points. Japanese stock markets are putting in a scratch session after a two day retreat with the Nikkei 225 down marginally to 35467 points while the USDJPY pair has also calmed down after a near 300 pip run up so far this trading week:

Australian stocks are still failing to gain any positive momentum, with the ASX200 losing more than 0.6% to extend below the 7400 point level, closing at 7346 points. Meanwhile the Australian dollar is trying to shore up at the mid 65 cent level after a fairly calm reaction to the latest unemployment print:

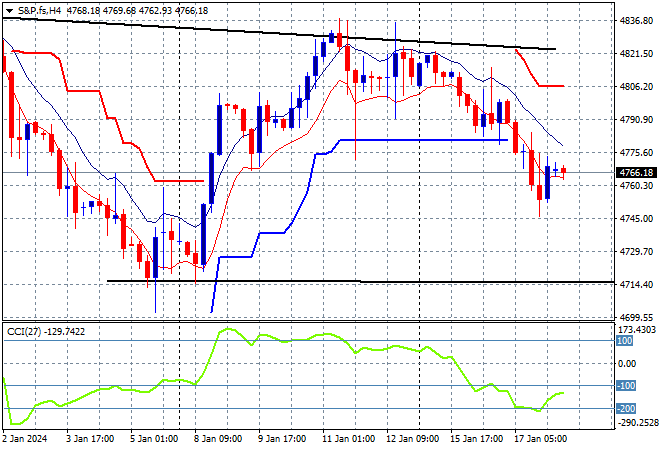

S&P and Eurostoxx futures are relatively calm going into the London session with the S&P500 four hourly chart showing the retracement well below the 4800 point level still intact, as it no longer acts as support:

The economic calendar will focus on the release of the latest ECB minutes, then US housing permits with a few Fed and ECB speeches in between.