Another mixed session on Asian markets with the surge on Wall Street overnight again not translating to further confidence in the region, with a much firmer USD not helping as European and US stock futures wobble into the London session. The USD is being pushed around by bullyboy Trump who doesn’t want a rate cut until after the election, because you know, screw the American people beforehand! Kiwi is up on unexpectedly higher inflation while the Australian dollar is struggling as it retraces down towards the 67 cent level.

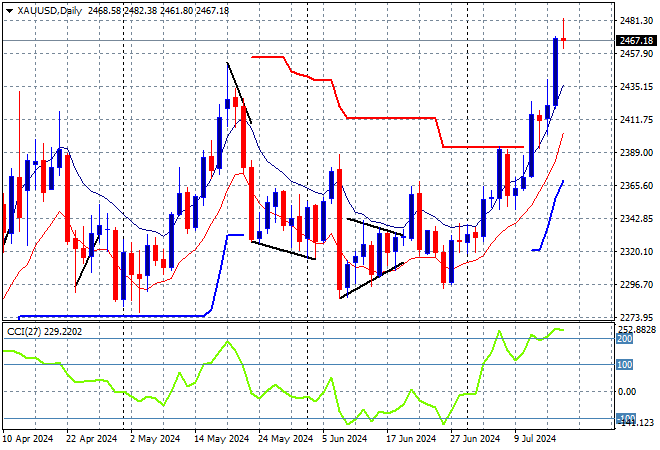

Oil prices have slipped again with Brent crude still below the $84USD per barrel level while gold is now exceeding its previous high, currently floating above the $2460USD per ounce level:

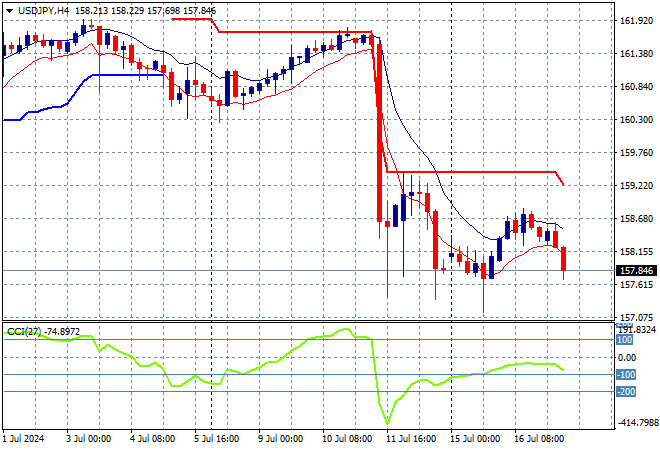

Mainland Chinese share markets are still negative in reaction to the previous GDP print with the Shanghai Composite down more than 0.3% while the Hang Seng Index is flat as it fails to gain momentum, closing at 17749 points. Meanwhile Japanese stock markets are very mixed with the Nikkei 225 closing some 0.4% lower at 41097 points while the USDJPY pair has dropped sharply below the 158 level in afternoon trade:

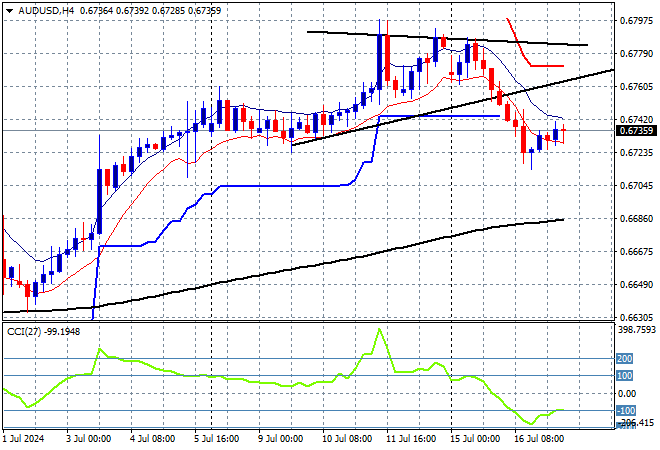

Australian stocks were able to advance the most with the ASX200 pushing further above the 8000 point level, closing 0.7% higher at 8057 points while the Australian dollar has stayed below its Friday night finishing position and could threaten the 67 cent level next as momentum flat lines:

S&P and Eurostoxx futures are down 0.2% or so as we head into the London session with the S&P500 four hourly chart showing price action hesitating around the point of control at the 5700 point level with volatility rising:

The economic calendar follows up with another inflation print, this time Euro core inflation, then US building permits.