Again only Japanese stocks are extending their own gains as a cautious mood prevails over other Asian stocks today due to the ongoing volatility on Wall Street from the debt ceiling debacle. Only Japanese bourses advanced, clawing back the 1990 highs. In currency markets, the USD is continuing to dominate with the Australian dollar making a new weekly low as it heads to the low 66 cet level.

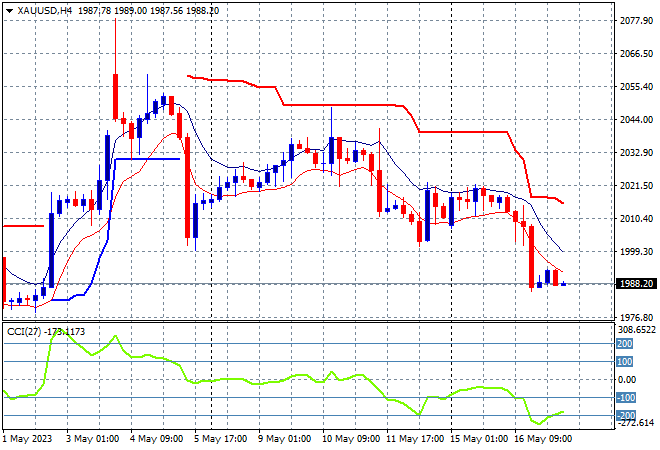

Oil prices remain depressed after losing some ground on Friday night with Brent crude pushed back to the low $74USD per barrel level while gold is barely holding on from last night’s breakdown below the key $2000USD per ounce level.

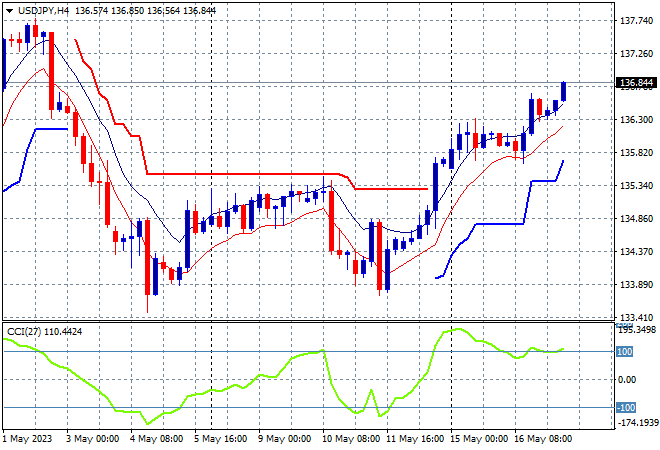

Mainland Chinese share markets are selling off slightly going into the close, with the Shanghai Composite down nearly 0.4% at 3277 points while the Hang Seng is playing catchup, selling off more than 1% to again rebuff the 20000 point level, currently at 19773 points. Japanese stock markets are still the best performers, extending into the 1990 closing levels with the Nikkei 225 lifting nearly 1% higher at 30081 points with the USDJPY pair advancing further above the 136 handle.

Australian stocks were hesitant once again as local traders continued to press the sell button, with the ASX200 closing nearly 0.5% lower to crack the 7200 point levels. The Australian dollar has also returned to its Friday night lows and then slightly lower for a new two week low, heading towards the 66 cent level vs USD quicksmart:

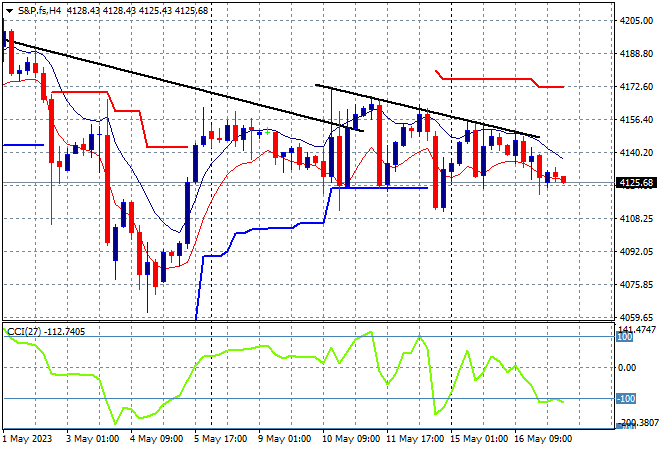

Eurostoxx and S&P futures are down around 0.2% or so with debt concerns on both sides of the Atlantic still lingering. The S&P500 four hourly chart still shows a series of lower highs since mid last week as price action is trying to hold on around the 4100 point area with zero upside potential:

The economic calendar follows up with the Euro wide core inflation print, then US building permits data.