Asian stock markets are still in flux after the rocky start to the trading week following the escalation in conflict across the Middle East, with somewhat hawkish Fedspeak overnight not helping risk sentiment either. The USD remains strong against most of the undollars while bond markets continue their selloff. The Australian dollar is failing to rebound after its recent large reversal as it hovers just above the 64 cent level this afternoon.

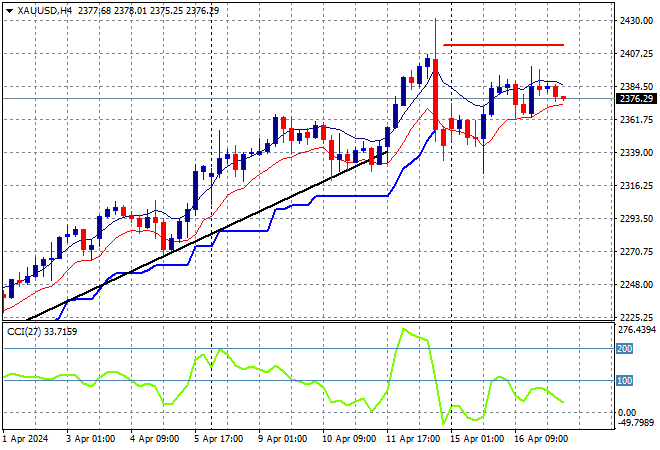

Oil prices are just holding on following the weekend of attacks across the Middle East with Brent crude retracing slightly below the $90USD per barrel level while gold is also having a milder session today, slipping just below the $2380USD per ounce level:

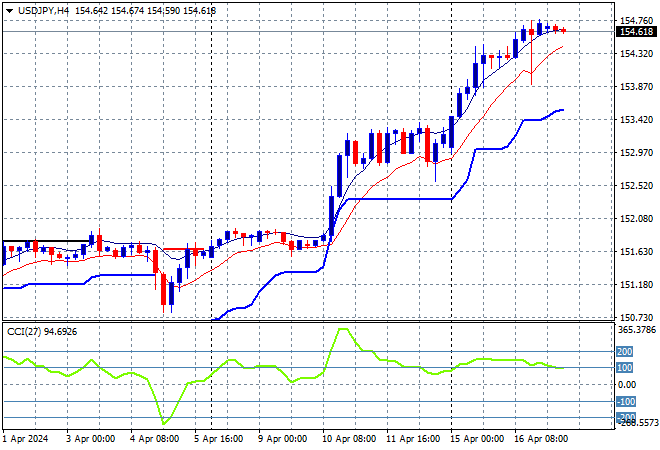

Mainland and offshore Chinese share markets are in a divergent mood again with the Shanghai Composite soaring more than 1% higher while the Hang Seng Index is off by 0.4% to 16180 points. Japanese stock markets are also again leading the selloff with the Nikkei 225 down more than 1% at 38101 points with the USDJPY pair holding above the mid 154 level after its recent breakout:

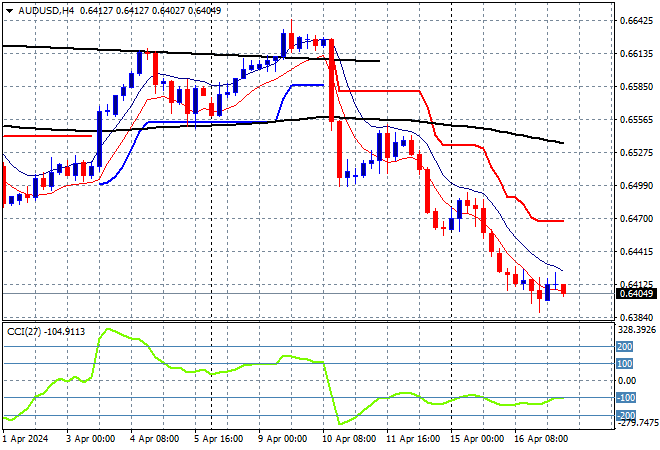

Australian stocks managed to escape further selling with a scratch session on the ASX200, which finished at 7613 points while the Australian dollar is holding itself hostage on the floor after the Friday night rapid selloff, stuck at the 64 cent level:

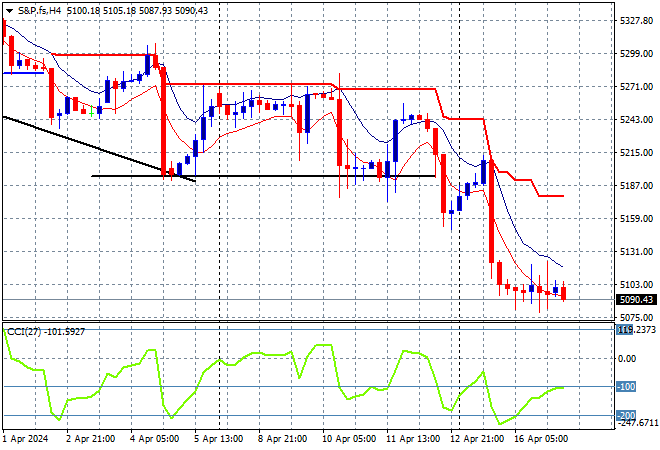

S&P and Eurostoxx futures are failing to fight back from their selloff as we head into the London session with the S&P500 four hourly chart showing price action still in a steep downtrend through a series of steps as it fails to recover from short term resistance:

The economic calendar includes the UK and Euro inflation rate prints tonight.