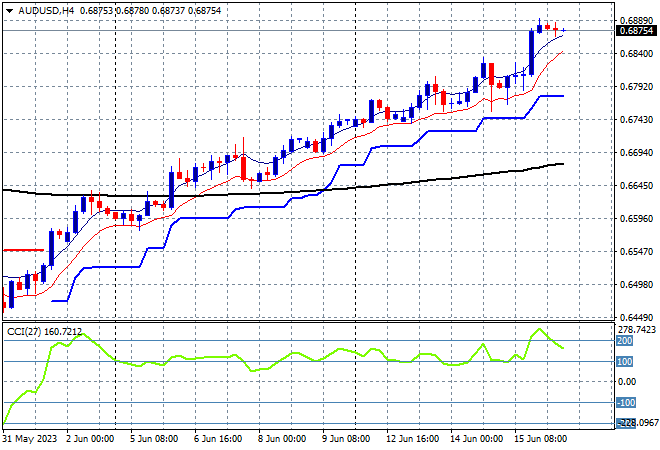

A fairly solid finish to the trading week across Asian stock markets mainly due to a lower USD after last night’s ECB rate hike. The BOJ held its own monthly meeting with no real change and local stocks are finally having a solid session. The Australian dollar is now pushing above the 68 cent level on the back of a weak USD following a very soft PPI print.

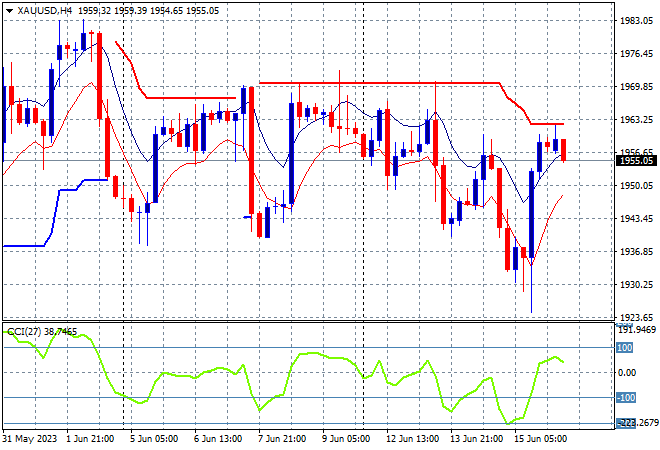

Oil prices are fairly flat with Brent crude holding just above the $75USD per barrel level while gold is struggling to make new highs as it pauses at the $1950USD per ounce level:

Mainland Chinese share markets are lifting going into the close with the Shanghai Composite up nearly 0.3% to climb above the 3200 point level while the Hang Seng Index is pushing even higher, up 0.7% to almost get past the 20000 point level at 19974 points.

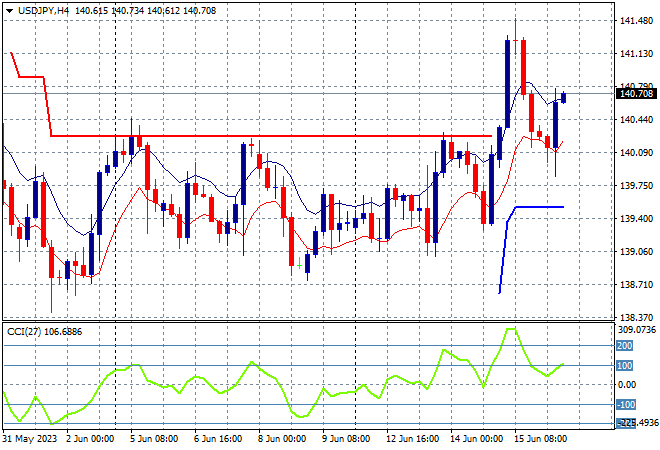

Japanese stock markets are having another breather in response to the BOJ meeting with the Nikkei 225 up just 0.2% to 33555 points with the USDJPY pair regaining some lost ground overnight, holding at just below the 141 level:

Australian stocks are putting in a proper finish to the trading week with the ASX200 closing 1% higher at 7246 points. The Australian dollar holding steady above the 68 handle in response to the ECB rate hike and soft US PPI print as short term momentum remains upbeat:

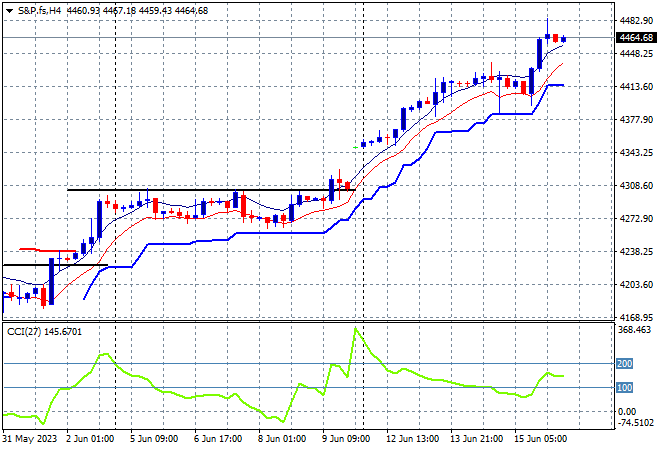

Eurostoxx and S&P futures are going sideways going into the London open with Wall Street wanting to really break free here on the back of tech stocks as traders book in the latest Fed pause on rate hikes amid the lower USD mood.

The S&P500 four hourly chart is showing a desire to break decisively above the 4400 point level after bursting through resistance at the 4300 area last week:

The economic calendar finishes the week with Euro wide core inflation numbers plus the US Michigan consumer sentiment survey.