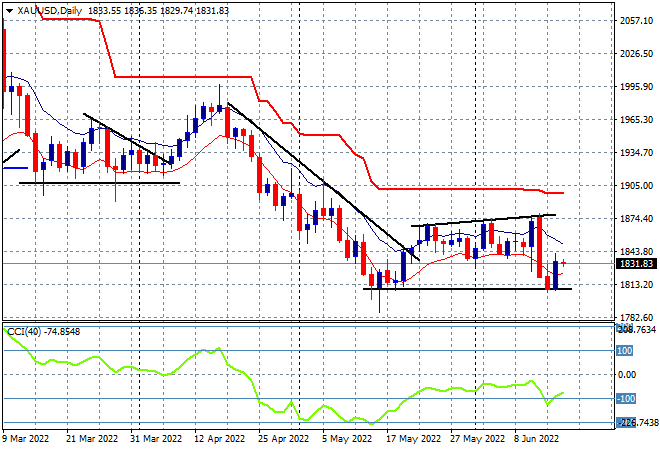

Markets were looking good through the lunch sessions here in Asia, following the upbeat mood on overnight share markets following the FOMC meeting but have turned late in the session, with Chinese stocks leading the way. The USD is still pretty strong against all the undollars, with the bounce in the Australian dollar starting to rollover as it absorbs the unemployment print while Euro is basically unchanged. Oil prices are drifting sideways, with Brent crude just below the $120USD per barrel level while gold is trying hard to follow through on its overnight bounce but is struggling to get off the ropes here at the $1830USD per ounce level:

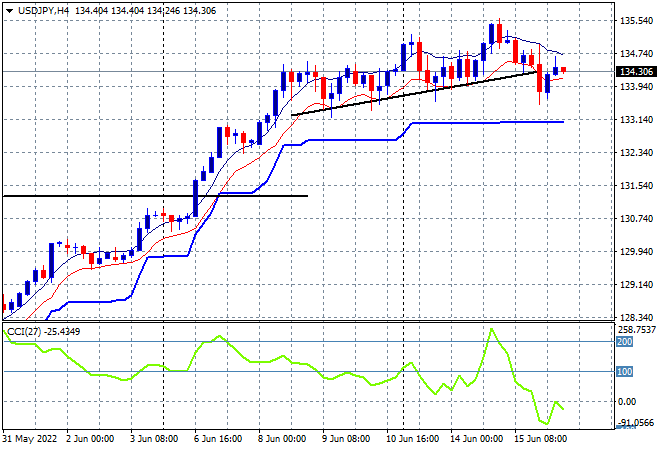

Mainland Chinese share markets are playing catchup to the recent volatility with the Shanghai Composite down more than 0.8% to 3278 points while the Hang Seng Index is losing ground fast, now off by more than 1% going into close at 21037 points. Japanese stock markets however are holding on to their bounce gains, with the Nikkei 225 index closing 0.4% higher at 26449 points while the USDJPY pair has also bounced back from its relatively small losses overnight to try to get back on trend:

Australian stocks were doing well at the start of the session but managed to close in the red, with the S&P/ASX 200 finishing 0.2% lower at 6591 points. The Australian dollar hasn’t been able to move forward on its overnight bounce back through the 70 cent level this afternoon, as I still contend the Pacific Peso is looking very weak here as the RBA is in a pickle (of its own making):

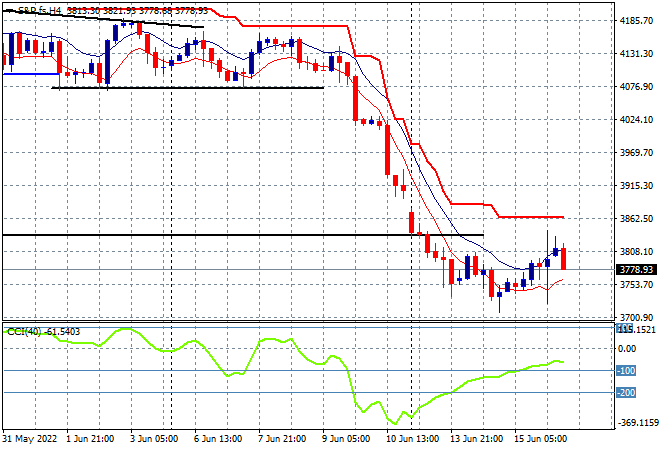

Eurostoxx and Wall Street futures are slowly drifting lower here with the nascent signs of bottoming not exactly turning into anything firm. The S&P500 four hourly futures chart shows price action still crushed well below the 3800 point level and the May lows (lower horizontal black line) as a swing play on reverting momentum may give some hope here:

The economic calendar will now focus on the BOE interest rate decision later tonight, followed by US initial jobless claims.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.