Last night saw the release of the highly anticipated US CPI print for July which came in a little softer than expected. This gave Wall Street pause and could put a stop to the recoveries here in Asia while the USD pulled back slightly again most of the currency majors. Euro pushed right through the 1.10 handle while the Australian dollar failed to make good on its breakout above the 66 cent level as traders anticipate today’s unemployment print.

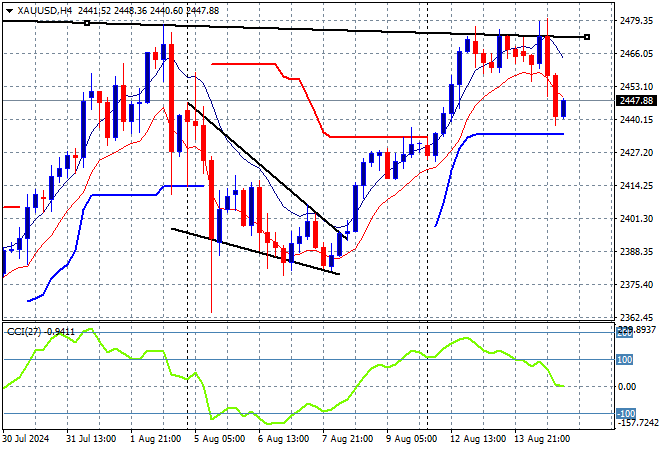

10 year Treasury yields pulled back again, down 2 points to the 3.83% level while oil prices are building in volatility in response to the looming action from Iran although Brent crude retraced to the $80USD per barrel level. Gold didn’t like the CPI print either, retracing below its previous weekly high to settle at the $2450USD per ounce level.

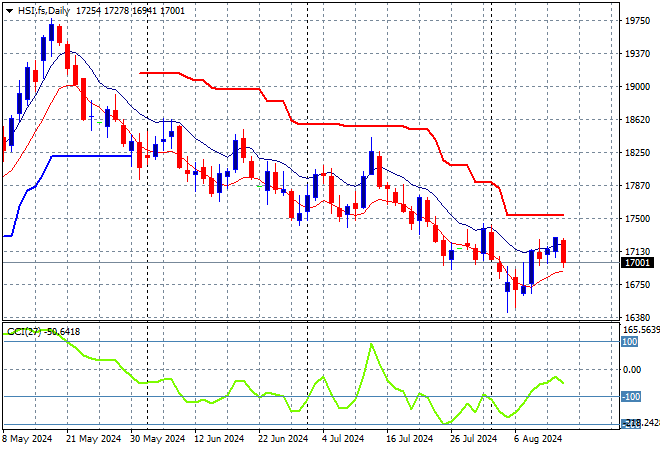

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets are still struggling to find any traction as economic concerns continue to weigh down sentiment as the Shanghai Composite falls more than 0.3% going into the close while the Hang Seng Index was down more than 0.6% at one point, finally closing at 17113 points.

The Hang Seng Index daily chart was starting to look more optimistic a few months back but price action has slid down from the 19000 point level and continues to deflate in a series of steps as the Chinese economy slows. A few false breakouts have all reversed course and another downside move is looming here as the 17000 point level is broken:

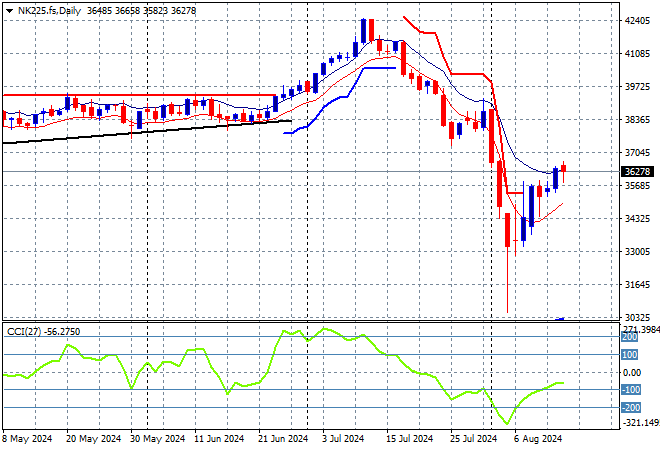

Meanwhile Japanese stock markets are still rising but at a more sustainable pace with the Nikkei 225 closing about 0.5% higher to 36442 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term support subsequently broke on that retracement, and then the front fell off. Yen volatility may still drag the market around:

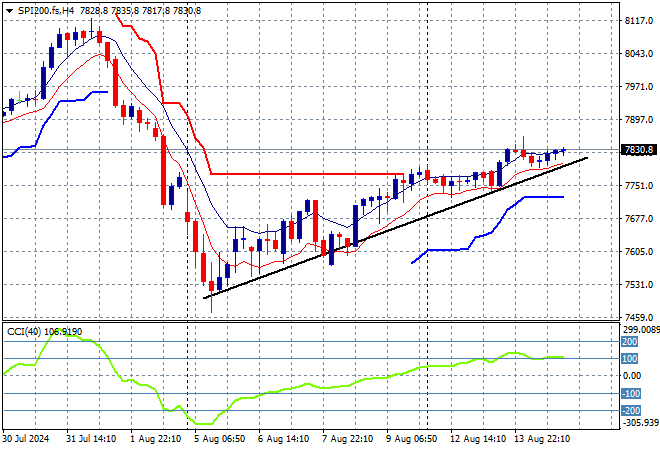

Australian stocks eked out a small gain with the ASX200 lifting just 0.3% to close at 7850 points.

SPI futures are up more than 0.3% again in response to the solid action overnight on Wall Street. Former medium term support at the 7700 point level will remain under pressure here as trader’s absorb the RBA’s signalling of no punchbowl for the rest of 2024, but short term momentum looks more positive:

European markets stabilised and then were able to put in some solid gains across the continent, as the Eurostoxx 50 Index managed to finish 0.7% higher at 4727 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Instead, former ATR support at the 4900 point level was only a temporary anchor point as we remain deep down into correction territory. Price must clear the 4700 local resistance level smartly to get out of trouble:

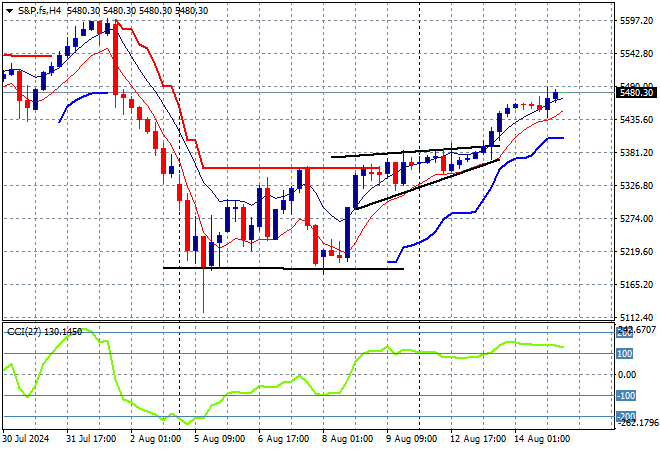

Wall Street initially was up across the board but the NASDAQ pulled back to a scratch session while the S&P500 closed just 0.4% higher at 5455 points.

The four hourly chart illustrates how this bounceback has now cleared short term resistance at the mid 5300 point level with momentum retracing fully from oversold to very positive. The potential for a positive breakout was building here but the question is can it return to the early August highs:

Currency markets continued to move further against USD in the wake of the US CPI print but it was relatively subdued as it was mainly baked in prior to the release. Euro however did spike up through the 1.10 handle overnight before almost retracing below that level this morning.

The union currency had previously bottomed out at the 1.07 level before gapping higher earlier in the week with more momentum building to the upside with the 1.0750 mid level as support but there was still too much pressure from King Dollar. This looks much more encouraging but very overbought in the short term:

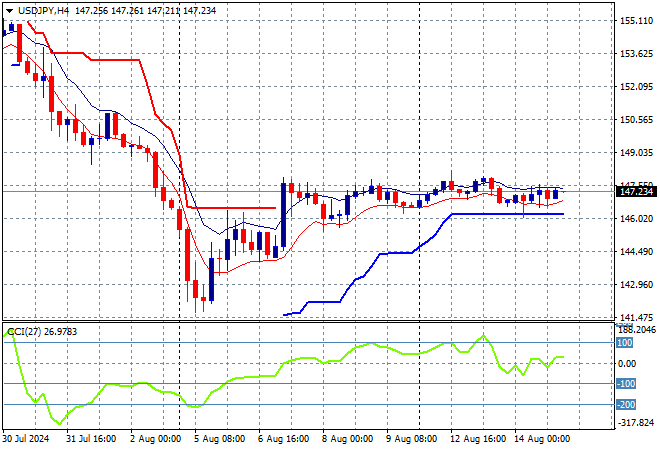

The USDJPY remains on a downwards medium term pattern as the carry trade but this bounceback is starting to waver at the 147 level with almost zero upside potential here as short term momentum slows.

The overall volatility speaks volumes as it pushed aside the 158 level as longer term resistance in the weeks leading up to the BOJ rate hike. Momentum is suggesting a possible bottom is brewing but this maybe just catching knives at this point as the BOJ wants to get this under control:

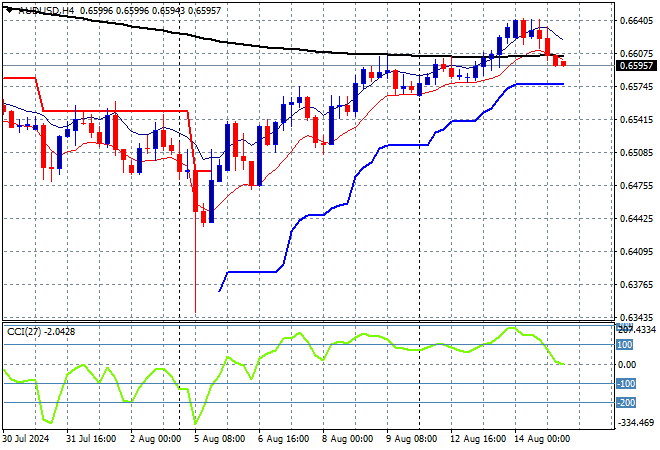

The Australian dollar failed to make good on its breakout above the 66 cent level with a slightly pullback below that level overnight, despite USD weakness as trader’s anticipate today’s unemployment print.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. This level remains key so watch the numberwang response carefully:

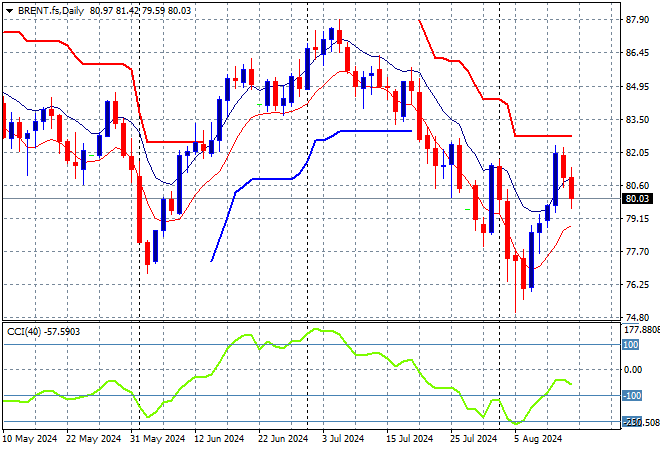

Oil markets are still trying to move out of their previously weak position as the looming Iran/Israel war provides more volatility but this time it was to the downside as Brent crude was pushed back to the $80USD per barrel level overnight.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support had been broken with short term momentum still in oversold mode but watch for a potential follow through on this reversal as this swings into higher volatility:

Gold was finding it tough to get back above the $2400USD per ounce level after last week’s volatility but managed to clear short term resistance mid-week and has kept above that level on Friday night as the classic falling bullish wedge pattern performed as expected. Price action however overnight due to the softer CPI print saw it retrace below the $2450 level.

The longer term support at the $2300 level remains firm while short term resistance at the $2470 level remains the target to push through this week: