Asian stocks are mixed given the volatility on Wall Street overnight as the latest Japanese GDP numbers came in stronger than expected, while the PBOC cut rates again as economic data indicating more slowdowns in the Middle Kingdom. With Yuan falling sharply, the USD actually pulled back slightly against the other majors with the Aussie dollar getting back above the 65 cent level on the release of the latest RBA minutes.

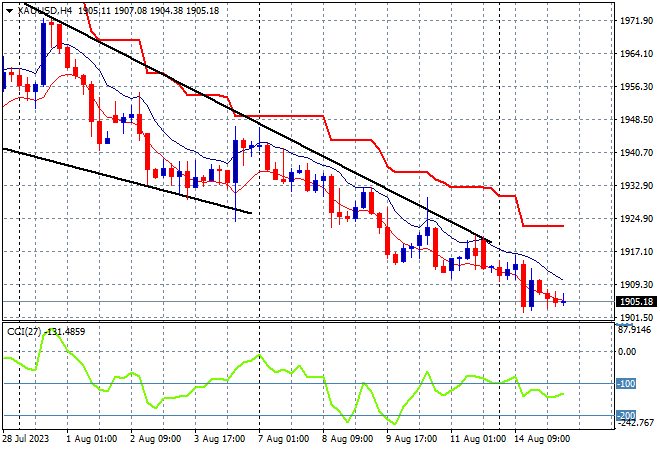

Oil prices have steadied from their minor gap lower over the weekend with Brent crude stuck at the $86USD per barrel level while gold remains entrenched in a downtrend, falling back to the $1905USD per ounce level:

Mainland Chinese share markets are continuing their selloff from last week with the Shanghai Composite down over 0.2% at 3174 points while in Hong Kong the Hang Seng Index has fallen back 0.8% to 18616 points.

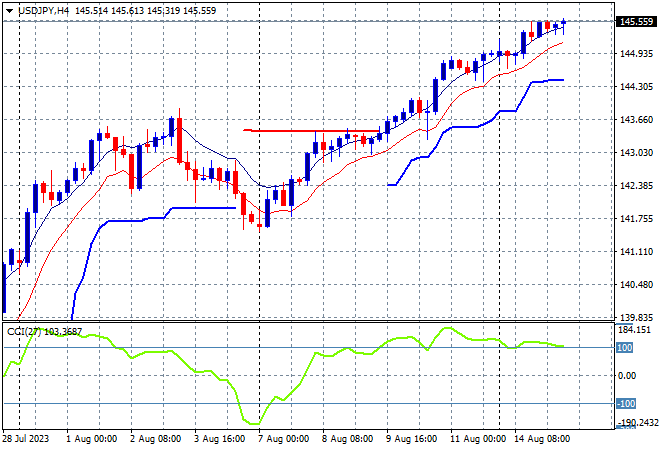

Japanese stock markets liked the GDP print and inflation numbers with the Nikkei 225 closing more 0.8% higher at 3238 points while the USDJPY kept pushing higher, now at the mid 145 level:

Australian stocks were able to make a modest lift in the end with the ASX200 closing 0.4% higher to be just above the 7300 point barrier while the Australian dollar put in a very modest lift to be just above the 65 handle but still can’t shake its new monthly low:

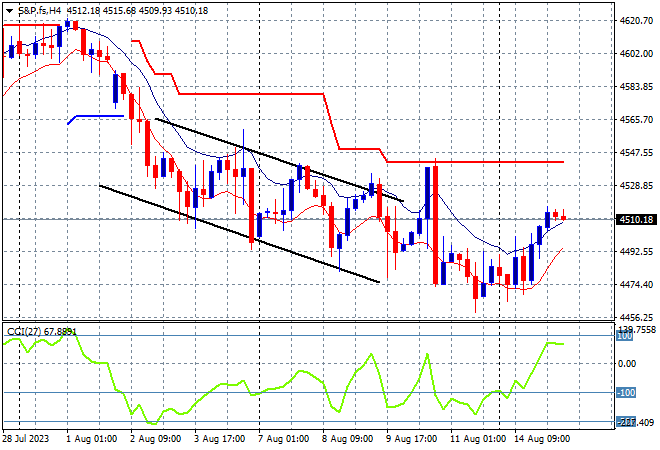

Eurostoxx and S&P futures are up 0.4% or so with the S&P500 four hourly chart showing the downtrend still in place but a possible short term bottoming forming at the 4500 point level. The inability to get back above the 4600 point level before last week’s NFP print is resulting in this trend channel winding down further:

The economic calendar ramps up with the latest German ZEW survey followed by US retail sales.