Green across the board here in Asia as stock markets react positively to the overnight pause from the US Federal Reserve, although the central bank did end with a hawkish warning of more rate rises on the way. NZ is officially in recession while the local unemployment rate unexpectedly went down,

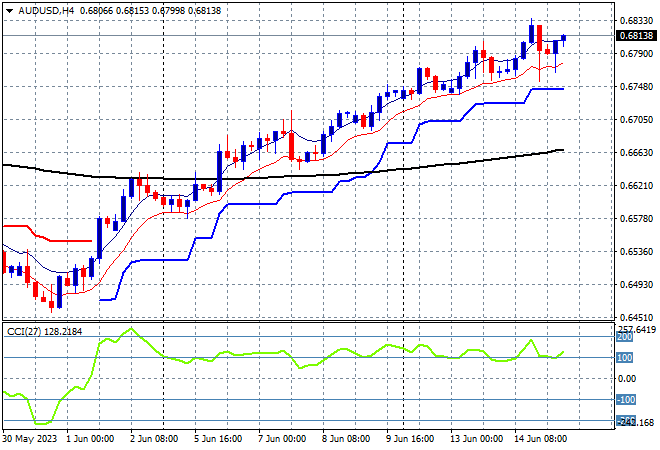

Local stocks are still looking relatively weak compared to regional bourses although Japanese stocks had a pause while the Australian dollar is now pushing above the 68 cent level on the back of a weak USD following a very soft PPI print.

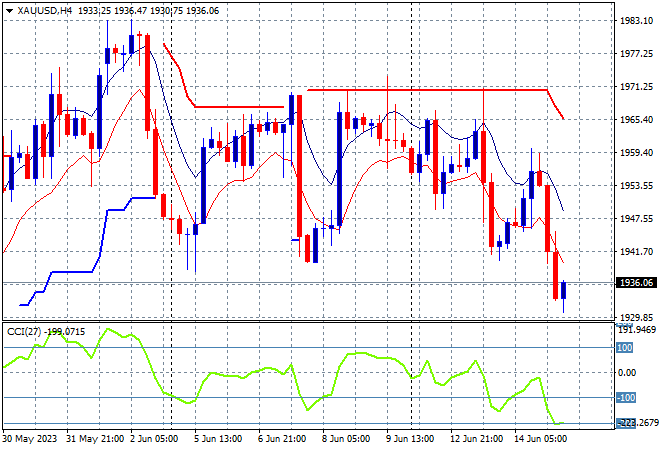

Oil prices remain depressed with Brent crude holding just above the $73USD per barrel level while gold is testing new lows as it falls below the $1940USD per ounce level:

Mainland Chinese share markets are lifting going into the close with the Shanghai Composite up nearly 0.5% to climb above the 3200 point level while the Hang Seng Index is pushing even higher, up 1.5% to extend past the 19000 point level at 19708 points.

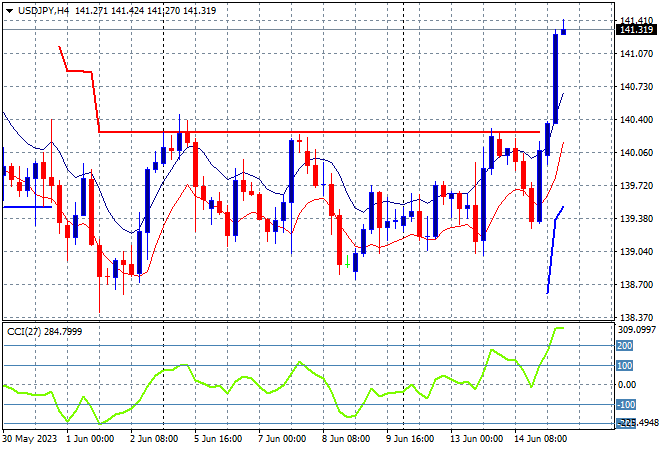

Japanese stock markets are finally having a breather with the Nikkei 225 putting in a scratch session to finish at 33515 points despite the USDJPY pair breaking out to new highs, pushing right through the 141 level in a big move:

Australian stocks are putting in yet another minor positive session with the ASX200 closing just 0.2% higher at 7179 points. The Australian dollar is still climbing higher though, finally sticking above the 68 handle in response to today’s strong unemployment print and the overnight soft US PPI print but momentum is waning:

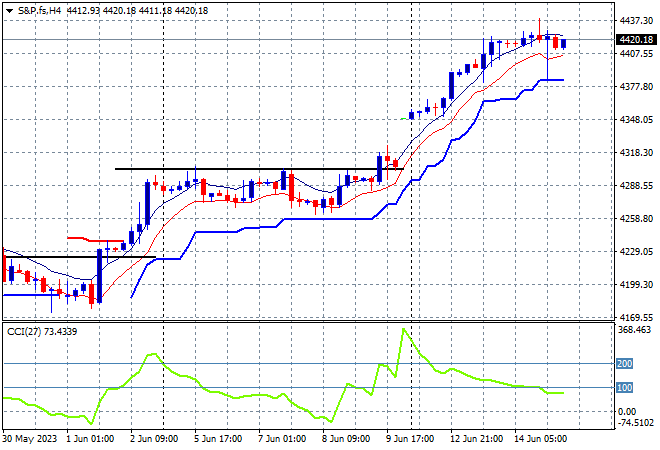

Eurostoxx and S&P futures are going sideways going into the London open with Wall Street wanting to really break free here on the back of tech stocks as traders book in the latest Fed pause on rate hikes.

The S&P500 four hourly chart is showing a desire to break decisively above the 4400 point level after bursting through resistance at the 4300 area last week:

The economic calendar remains busy with everyone waiting for the ECB meeting and US retail sales.