The mixed session across Asian markets despite the lift on Wall Street as traders await tonight’s US CPI print with speculation about Chinese government property purchases helping lift the Australia dollar alongside last night’s Budget. The USD remains somewhat weak against the other major currency pairs as markets position for that all important inflation print.

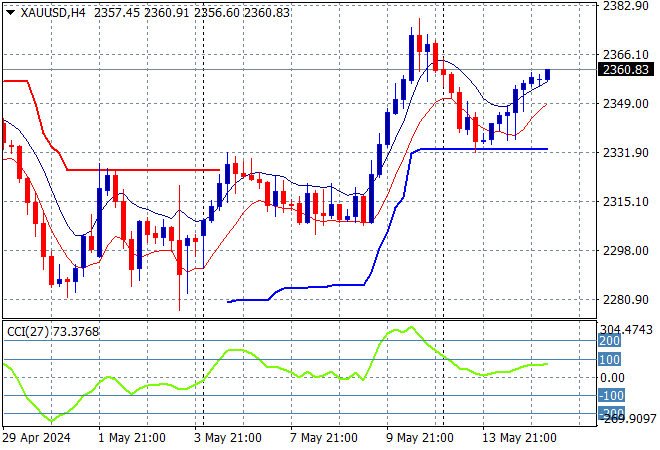

Oil prices are trying to failing after their recent sharp falls with Brent crude staying around the $83USD per barrel level while gold was able to continue its overnight rebound to clear the $2360USD per ounce level this afternoon:

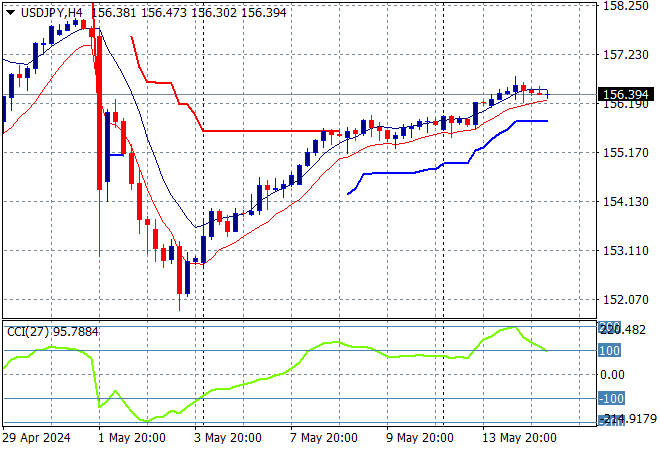

Mainland Chinese share markets are seeing another small pullback with the Shanghai Composite down more than 0.2% while the Hang Seng Index is stalling again, also down 0.2% to 19073 points. Meanwhile Japanese stock markets are the strongest in the region with the Nikkei 225 up 0.6% to 38605 points with the USDJPY pair taking a pause as it struggles to lift above the mid 156 level:

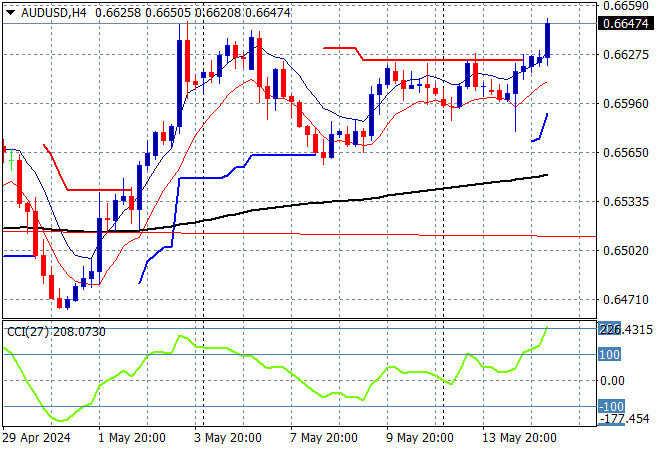

Australian stocks are lifting post Budget with the ASX200 up nearly 0.5% to 7763 points while the Australian dollar is also surging to a new monthly high, finally above the early May high at the mid 66 cent level:

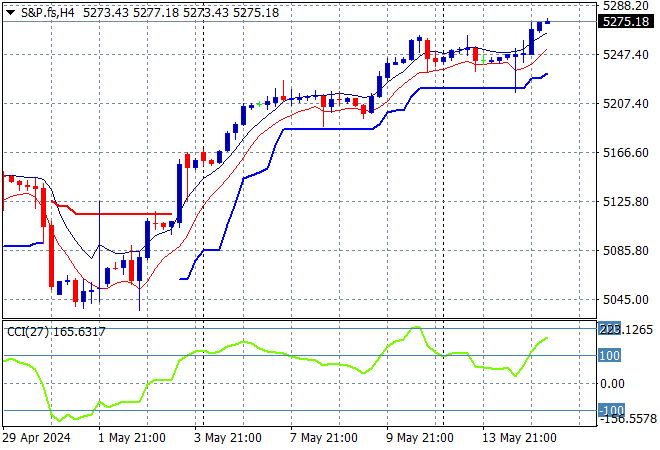

S&P and Eurostoxx futures are surging as we head into the London session with the S&P500 four hourly chart showing price action no longer hesitating after its breakout above the 5200 point level:

The economic calendar ramps up with the latest Euro GDP estimates, but all eyes will be on the US CPI print.