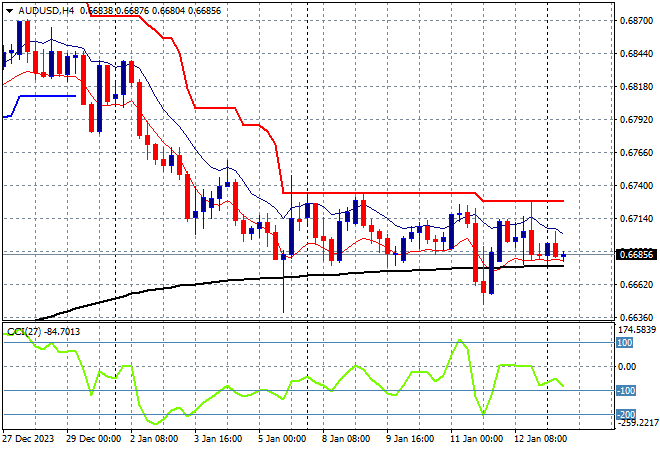

Asian share markets are mixed once again as local shares go nowhere while Japanese markets continue to move higher, as a slightly stronger USD keeps the major currency pairs in check. The Australian dollar in particular remains a bit cautious to again remain well below the 67 cent level in afternoon trade.

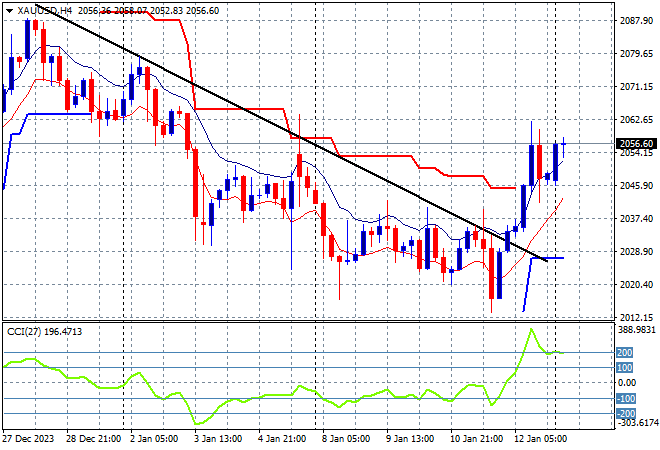

Oil prices are inching slightly higher after the weekend gap with Brent crude heading above the $78USD per barrel level while gold has matched its Friday night breakout high as Asian traders keep the shiny metal buoyant, now well above the $2050USD per ounce level:

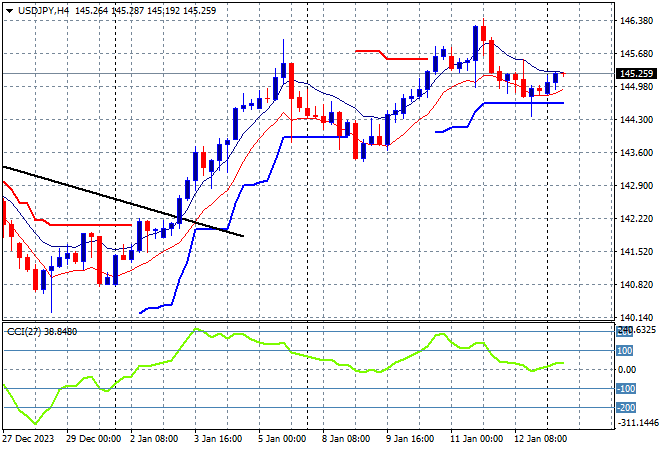

Mainland Chinese share markets are trying to hold onto their early gains as they head into the close as the Shanghai Composite again remains below the 2900 point barrier, currently some 0.1% higher at 2883 points while in Hong Kong the Hang Seng Index is down nearly 0.4% to 16195 points. Japanese stock markets are still moving to the upside with the Nikkei 225 up nearly 1% to 35905 points while the USDJPY pair has a small lift above the 145 level:

Australian stocks were unable to gain any momentum from the flat session on Friday, with the ASX200 down slightly to remain below the 7500 point level while the Australian dollar also wiltered after the weekend gap to remain entrenched below the 67 handle in afternoon trade:

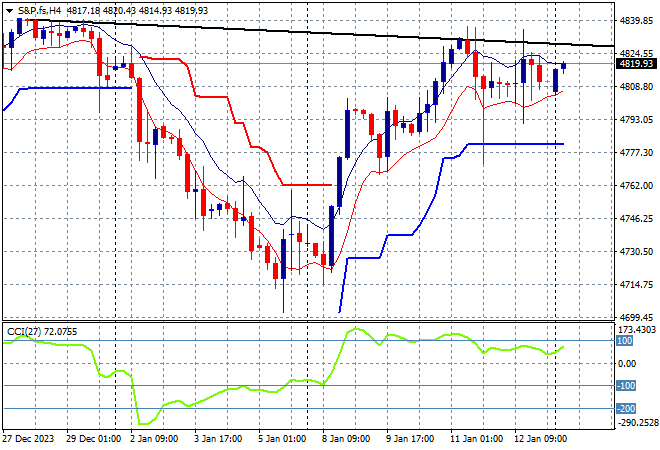

S&P and Eurostoxx futures are looking to stabilise and extend their Friday night moves respectively in the coming session with the S&P500 four hourly chart showing an attempt to get back to last week’s intrasession high and to breach the December highs which remain heavily resisted:

The economic calendar will focus squarely on the latest German GDP print tonight.