A slightly better day for Asian share markets as risk takes its cue from Wall Street which still sees no problem with the pending conflict in the Middle East with Eurostoxx futures up more than 0.3% going into tonight’ inflation data from the US. Currency markets are relatively unchanged with the USD on the backfoot while the Australian dollar continues to climb above the 66 cent level.

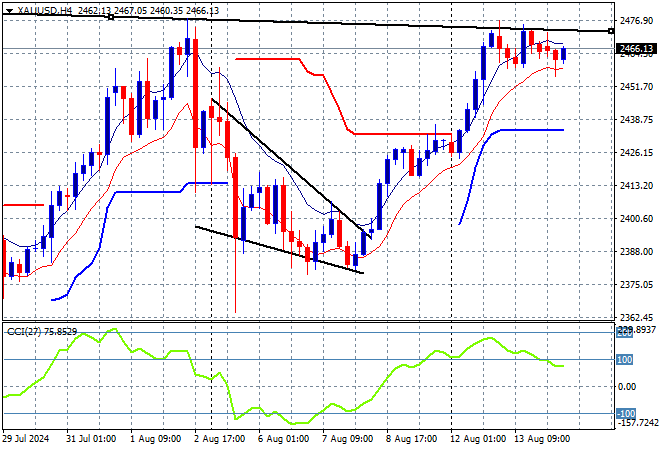

Oil prices are losing a little short term momentum but are still holding on to their breakout as Brent crude hovers around the $81USD per barrel level while gold pulled back slightly on the lack of evidence of the impending Iranian attack but is holding near its recent highs well above the $2460USD per ounce level:

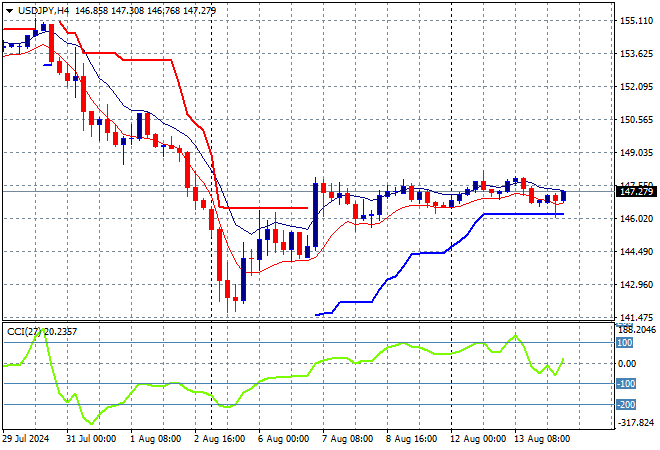

Mainland Chinese share markets are still struggling to find any traction as economic concerns continue to weigh down sentiment as the Shanghai Composite falls more than 0.3% going into the close while the Hang Seng Index is down more than 0.6% at 17067 points. Meanwhile Japanese stock markets are still rising but at a more sustainable pace with the Nikkei 225 closing about 0.5% higher to 36442 points while trading in USDPY was much more subdued as it stays just above the 147 handle:

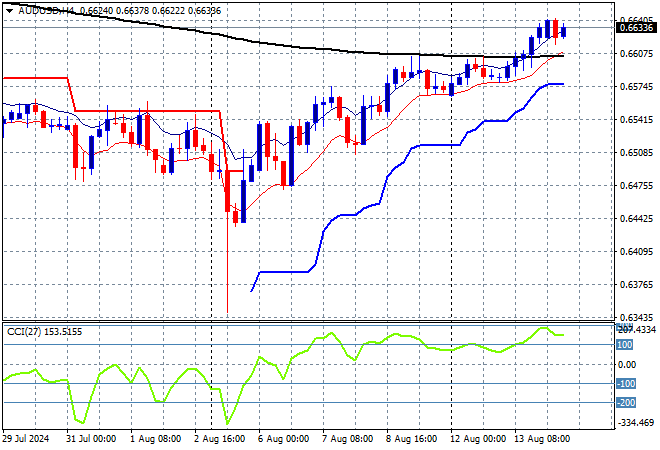

Australian stocks eked out a small gain with the ASX200 lifting just 0.3% to close at 7850 points while the Australian dollar is trying to double down on its recent small breakout as it remains clear of the 66 cent level:

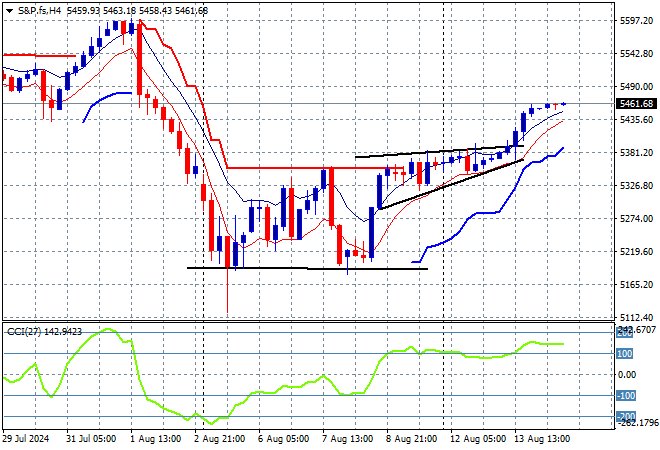

S&P and Eurostoxx futures are up more than 0.3% going into the London session with the S&P500 four hourly chart showing continued stability returning to the major index following the recent breakout which has nice momentum behind it:

The economic calendar gets busy again tonight with UK core inflation, followed by Euro wide GDP estimates for Q2 then the big one – US core inflation for July.