Asian stocks are in sell mode following Friday night’s reaction to the latest US PPI print as local stocks continued to fall as the Aussie dollar takes a dive through the 65 cent level, following the Chinese lead on concerns over their property sector.

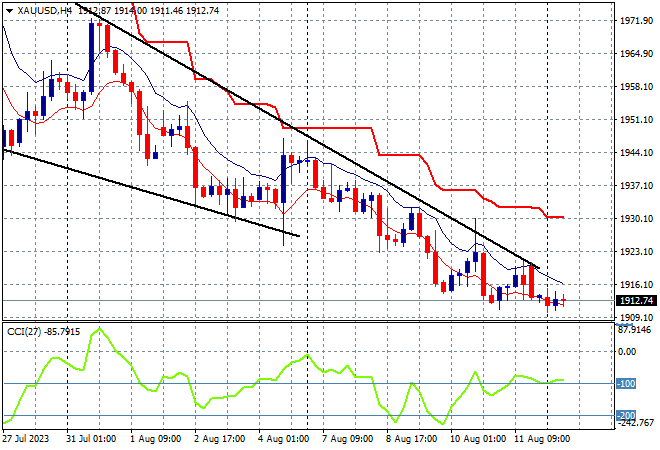

Oil prices have gapped lower over the weekend with Brent crude down below the $86USD per barrel level while gold remains entrenched in a downtrend, falling back to the $1910USD per ounce level:

Mainland Chinese share markets are continuing their selloff from last week with the Shanghai Composite down over 0.4% at 3177 points while in Hong Kong the Hang Seng Index has fallen back 2% to 18675 points.

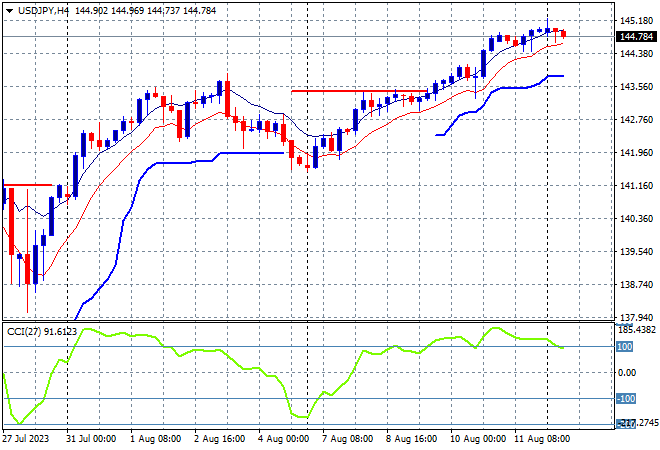

Japanese stock markets reopened with the Nikkei 225 closing more 1.2% lower at 32059 points while the USDJPY kept at its recent high just below the 145 level:

Australian stocks were again unable to get any positivity going with the ASX200 down 0.8% to close below the 7300 point barrier at 7277 points. The Australian dollar gapped lower and decisively below the 65 handle this morning for a new monthly low:

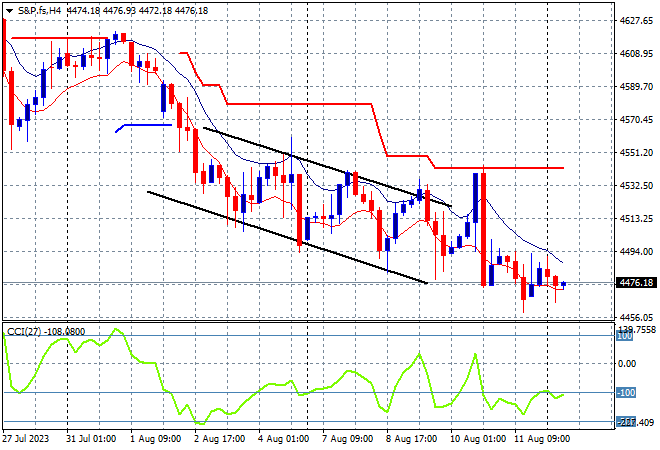

Eurostoxx and S&P futures are down 0.4% or so with the S&P500 four hourly chart showing the downtrend still in place following the previous week’s NFP and CPI reactions. The inability to get back above the 4600 point level before the NFP print is resulting in this trend channel winding down further:

The economic calendar starts the trading week quietly with no major releases of note.