Asian stocks are muted as markets continue to digest this week’s double US CPI/PPI prints with the latest BOJ meeting providing the only catalyst throughout the region as Yen is sold off as they hold off on reducing bond purchases. The USD remains quite firm against the other majors as well with the Australian dollar continuing its retracement back to the 66 cent level.

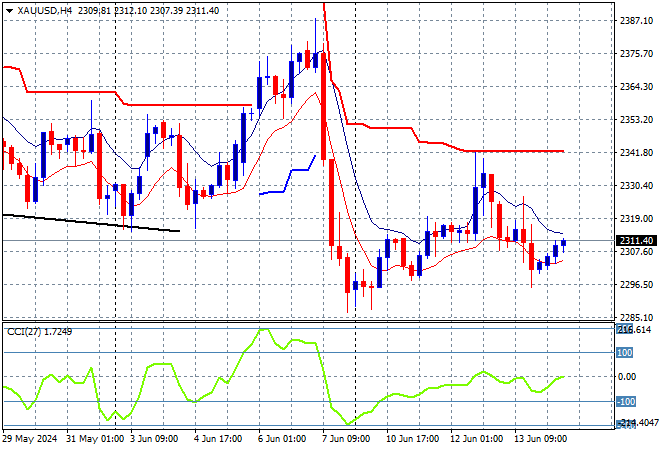

Oil prices are holding steady with Brent crude stuck just above the $82USD per barrel level while gold has inched slightly upwards to the $2310USD per ounce level but still looks incredibly week following its Friday night US jobs print slump:

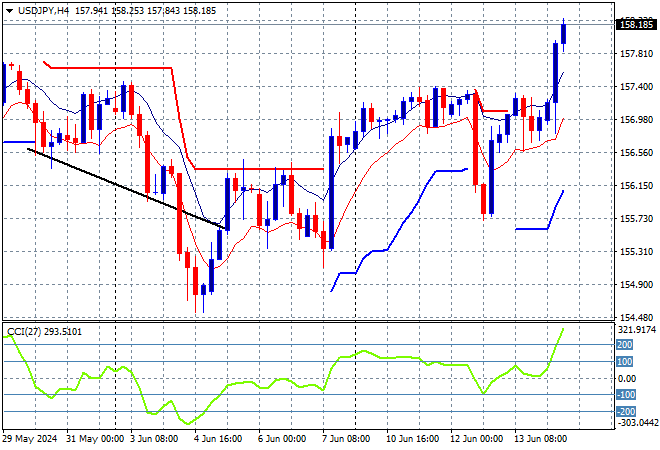

Mainland Chinese share markets are looking hesitant again with the Shanghai Composite off slightly while the Hang Seng Index has restarted its selloff, closing some 0.6% lower to 17998 points. Meanwhile Japanese stock markets are trying to get out of their holding pattern with the Nikkei 225 up 0.2% to 38814 points as the USDJPY pair breaks out above the 158 level on the back of the BOJ meeting:

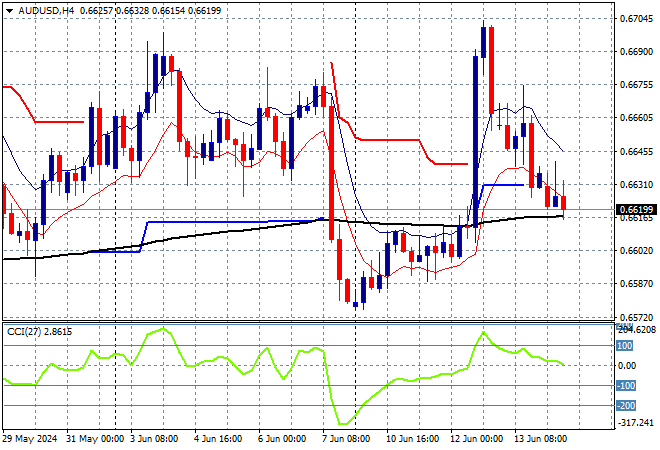

Australian stocks have finished the week on a softer note with the ASX200 down 0.3% to 7724 points while the Australian dollar has drifted slightly lower following yesterday’s unemployment print as it retraces back to the 66 cent handle:

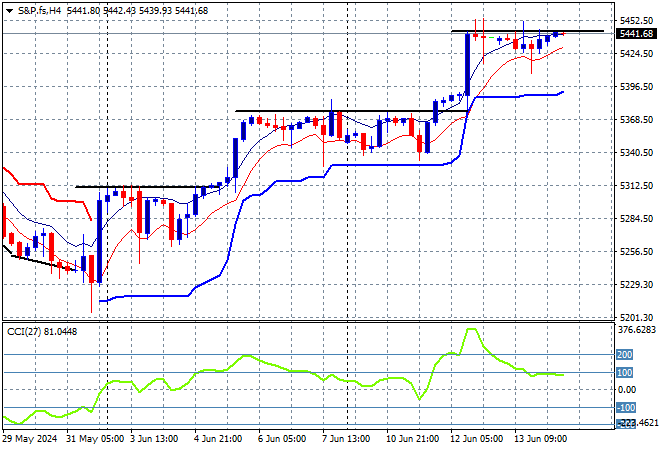

S&P and Eurostoxx futures are both up marginally as we head into the London session with the S&P500 four hourly chart showing price action holding well above the breakout level from earlier in the week, creating another step and another record high – but is hesitation building here?

The economic calendar closes out the trading week with the latest Michigan consumer sentiment survey.