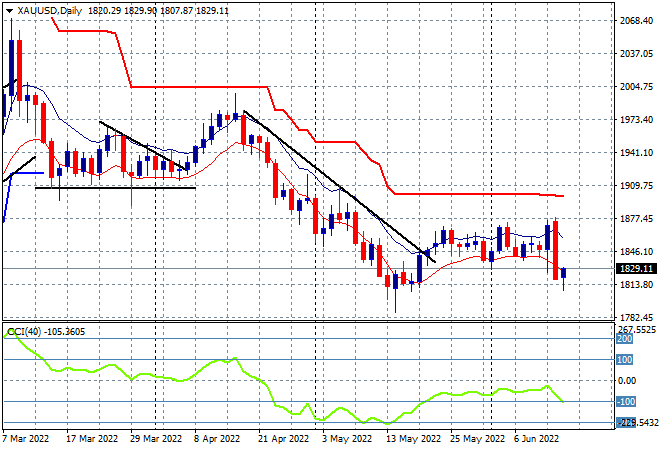

Asian share markets continue their slump as local stocks play catchup, putting two days of selling into one session that has many spooked. The USD remains strong against all the undollars, with gap downs across the complex although stock futures are stabilising going into the European open. Oil prices are drifting slightly higher as tensions in Libya mean well shutdowns, with Brent crude still well above the $120USD per barrel level while gold is trying hard to fightback after a big move lower overnight, currently just above the $1830USD per ounce level:

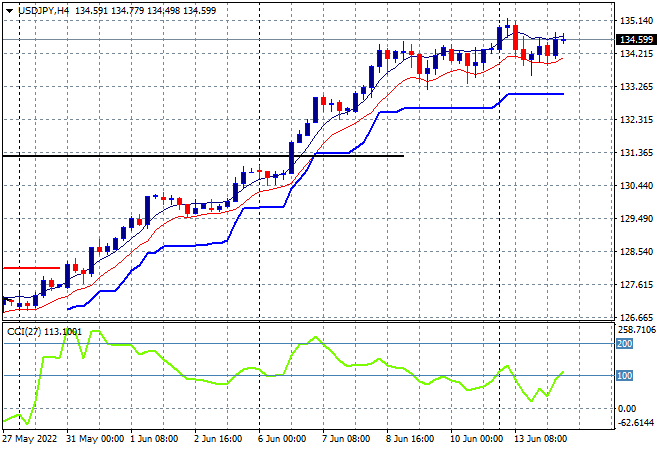

Mainland Chinese share markets are the best of the bunch with the Shanghai Composite only down a handful of points to 3254 while the Hang Seng Index actually gained ground, up 0.1% to close at 21018 points. Meanwhile Japanese stock markets had a sizeable pullback, with the Nikkei 225 index losing 1.3% to 26629 points while the USDJPY pair is holding on to its gains to remain well above the 134 level:

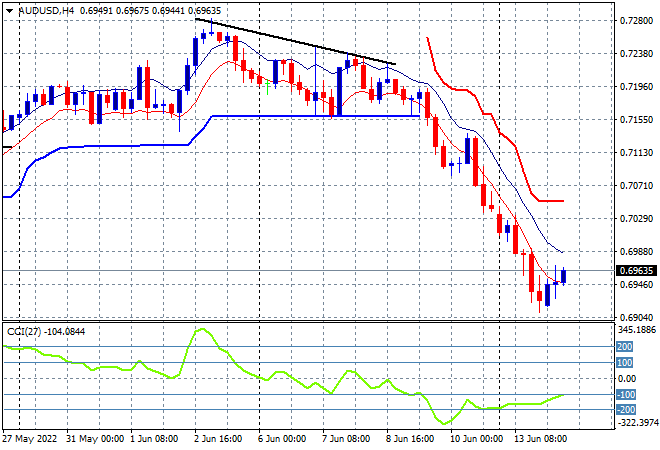

Australian stocks were the wurst of course, down more than 4.5% at one point on the ASX200 before eventually closing some 3.5% lower at 6686 points as it played catchup to other correlated risk markets. The Australian dollar has tried to bounce back up to the 70 cent level this afternoon, but the Pacific Peso is looking very weak here as weekly support has evaporated:

Eurostoxx and Wall Street futures are coming back slowly with the latter showing a nascent sign of bottoming after last night’s big selloff. The S&P500 four hourly futures chart shows price action still crushed well below the 3900 point level and the May lows (lower horizontal black line) as a swing play may give some hope here:

The economic calendar has a busy night with German inflation, UK unemployment, the closely watched German ZEW Survey then the US PPI print.