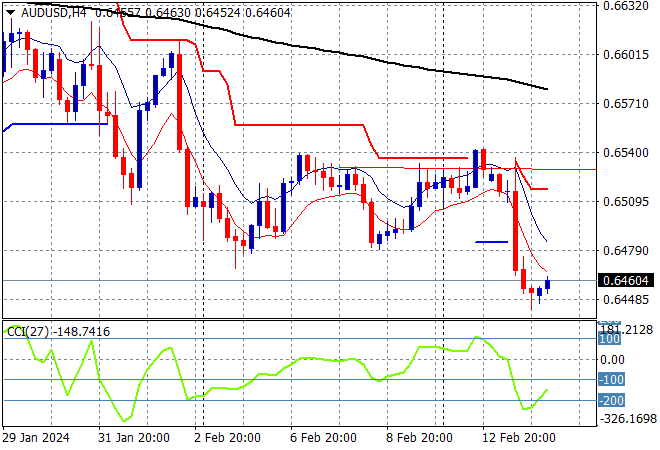

Asian share markets are seeing awide slump in reaction to the overnight selloff on Wall Street in reaction to the surprise upside to US inflation. The vacuum of closed Chinese markets for the Chinese New Year break is not helping with the USD higher against everything while bond markets more importantly also continue their selloff. The Australian dollar is on its knees at the 64 cent level after getting cut down alongside the other undollars overnight.

Oil prices are still climbing slightly with Brent crude inching above the $82USD per barrel level while gold is in a depressive mood as it broke well below the $2000USD per ounce level overnight as support dries up:

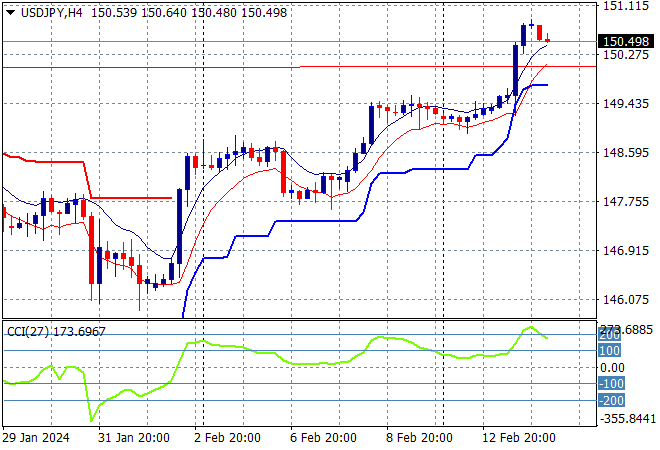

Mainland and offshore Chinese share markets remain closed during the Chinese New Year holiday. Japanese stock markets are reacting in kind with overnight markets with the Nikkei 225 closing nearly 1% lower at 37637 points while the USDJPY pair has pulled back marginally from its record high as it continues to float above the 150 handle:

Australian stocks are still not doing well as the ASX200 reacts to the overnight losses on Wall Street, down nearly 1% at 7532 points while the Australian dollar is holding on to its overnight slump at just above the mid 64 cent level:

S&P and Eurostoxx futures remain down from the overnight retracement following the recent US CPI print with the S&P500 four hourly chart showing price action breaking well above the 5000 point level, and down through ATR support – can it hold here?

The economic calendar includes UK inflation and Euro wide GDP estimates.