Asian stock markets are lifting across the board on the very soft US CPI print from overnight, helped by possibly stimulus support coming out of China. The currency complex is indeed still dead against USD although Yen is having a breather while Euro extends well above the 1.11 handle as the Australian dollar jumps above 68 cents.

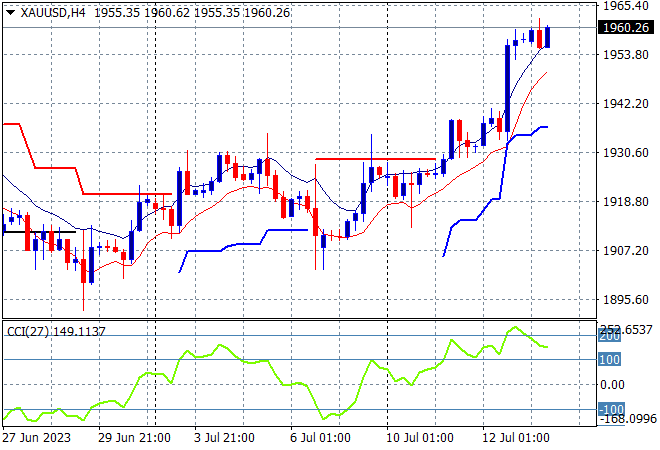

Oil prices are pushing higher with Brent crude extending above the $80USD per barrel level while gold is also finding a bit more life here climbing above the $1960USD per ounce level:

Mainland Chinese share markets have stormed out the gate with the Shanghai Composite about to finish more than 1.2% higher at 3234 points while in Hong Kong the Hang Seng Index is now up nearly 3% in a strong one way move, currently at 19353 points, continuing the start of week bounce.

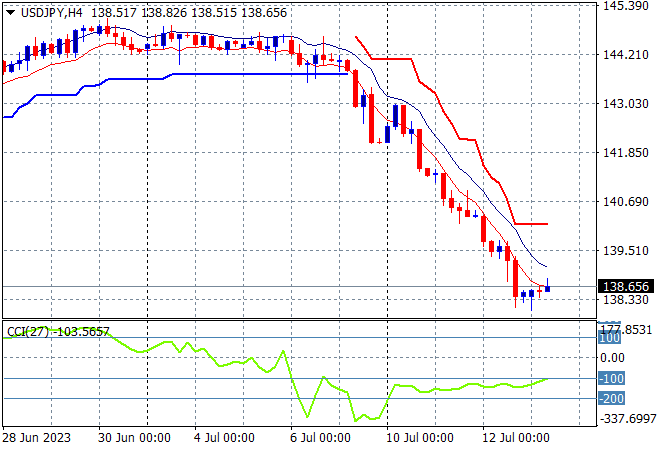

Japanese stock markets are getting in on the action as the Yen appreciation train pauses, with the Nikkei 225 closing 1.5% higher at 32419 points. The USDJPY pair finally stopping its own selloff with some stabilisation here at the mid 138 level after falling nearly 700 pips in less then two weeks:

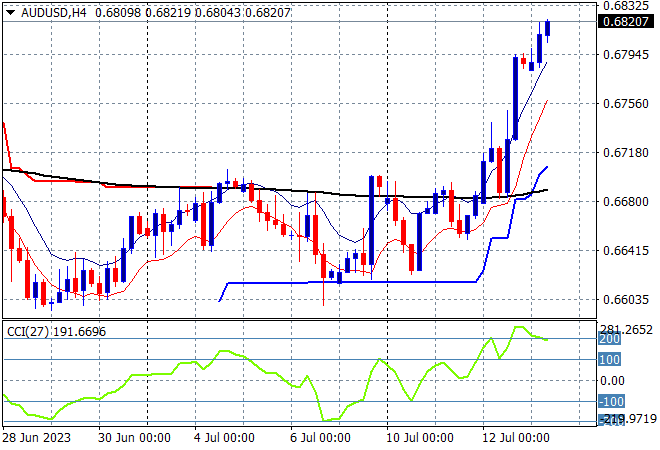

Australian stocks also accelerated higher with the ASX200 closing 1.4% higher at 7246 points. The Australian dollar also continued its breakout as traders push the Pacific Peso well past the 68 handle after last night’s soft US CPI print:

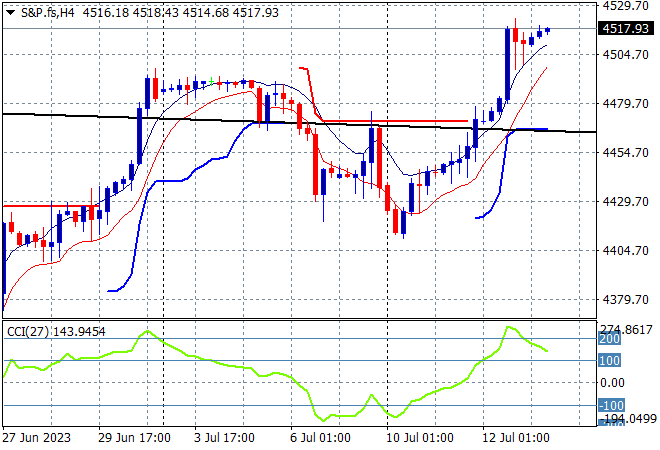

Eurostoxx and S&P futures are relatively flat with the latter up only 0.2% with the S&P500 four hourly chart showing price action wanting to extend above the 4500 point level which had been staunch resistance:

The economic calendar tonight includes the latest ECB minutes release plus the PPI US print and initial jobless claims.