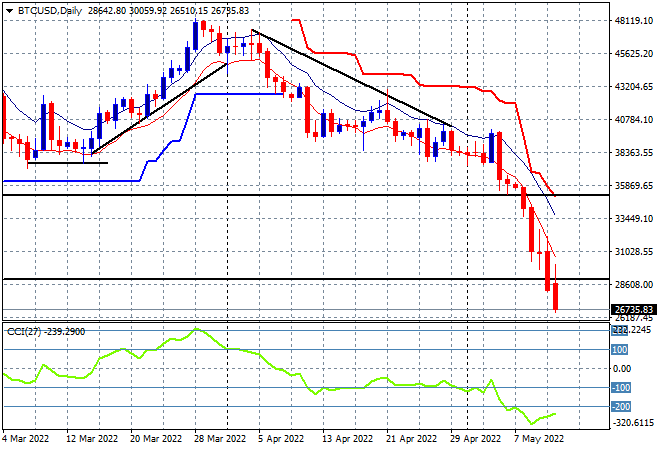

The strong inflation print from the US overnight has kept risk markets contained across Asia today with the added bonus of steep falls on Chinese bourses as the fallout to the middle kingdom economy continues. Currency markets remain constrained by a very strong USD with the Australian dollar now below the 69 handle while commodity markets including oil are slowly lifting higher, as Brent crude heads back above the $106 level. Gold is also trying to stabilise but looks weak on all the charts, currently at $1850USD per ounce while Bitcoin is falling sharply, now below $27K:

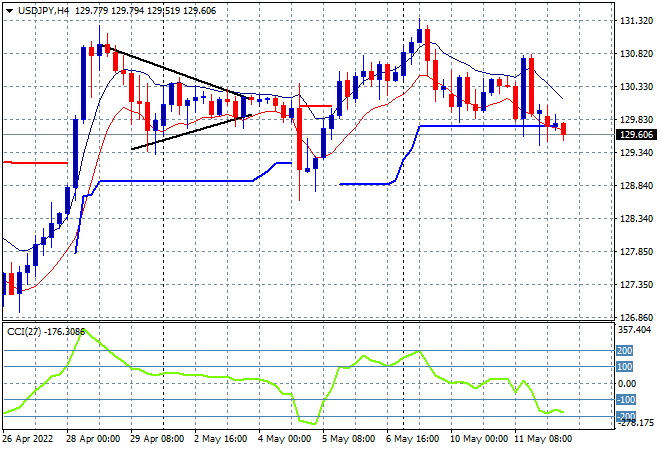

Mainland Chinese share markets did okay at the open but have sold off after private lending data shows a sharp retracement, with the Shanghai Composite currently down 0.6% to 3040 points while the Hang Seng Index has declined further, now down 2% to take back its previous gains, currently at 19389 points. Japanese stock markets are no longer treading water with the Nikkei pushed nearly 1.8% lower to 25778 points while the USDJPY pair has pulled back past its previous neutral state, now dicing with trailing ATR support below the 130 level:

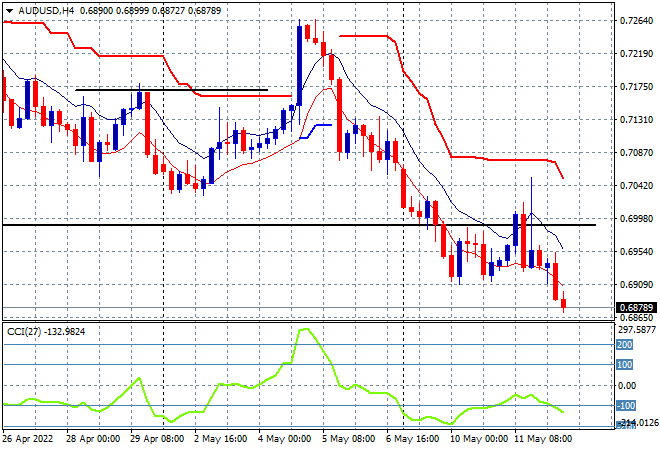

Australian stocks started off shakily but have accelerated their selling into the close with the ASX200 down nearly 2% to 6935 points. Meanwhile the Australian dollar is also unable to find a bottom here after making a new monthly low, now heading below the 69 level as momentum inverts into oversold territory again:

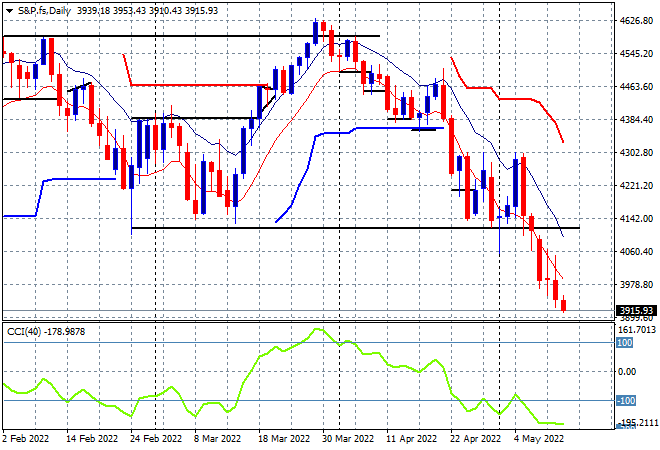

Eurostoxx and Wall Street futures are still falling as we head into the European open with the S&P500 daily chart showing price pushing right through the 4000 point level as the bear market cometh:

The economic calendar will include the latest UK GDP estimate, followed by US PPI.