Overnight markets were very ebullient as the latest Fedspeak combined with buoyant tech stocks saw risk markets rise despite tonight’s potentially risky US CPI print. The USD is somewhat mixed against the majors with Euro looking a bit better while some hawkish BOE notions are seeing a bigger bid in Pound Sterling. Kiwi is down as rate cut bets widen while the Australian dollar remains somewhat firm in comparison as it holds above the 67 cent level to stay at its near six month new high.

US bond markets were slightly firmer as 10 year Treasuries dropped below the 4.28% level while oil prices stabilised on OPEC machinations with Brent crude pushed back above the $85USD per barrel level. Gold is trying to make a comeback but is failing to extend above the $2370USD per ounce level.

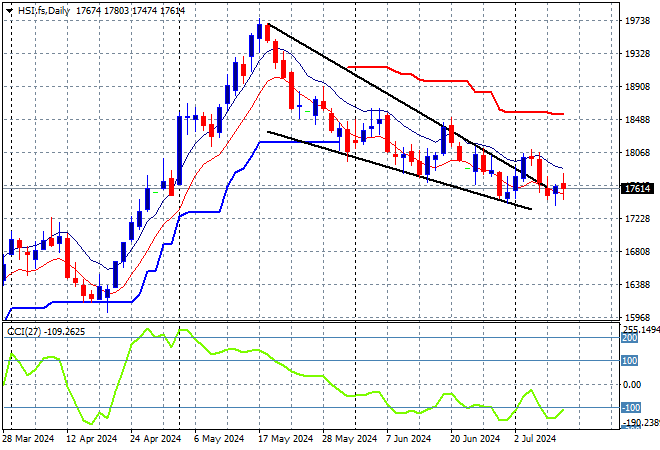

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets started lower and went down faster later in the session with the Shanghai Composite off by more than 0.7% while the Hang Seng Index initially caught a small bid before retracing 0.3% lower to 17470 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. Price action was looking way overextended but this retracement is still taking some heat out of the market although there are signs it may be over as the falling wedge pattern is starting to complete:

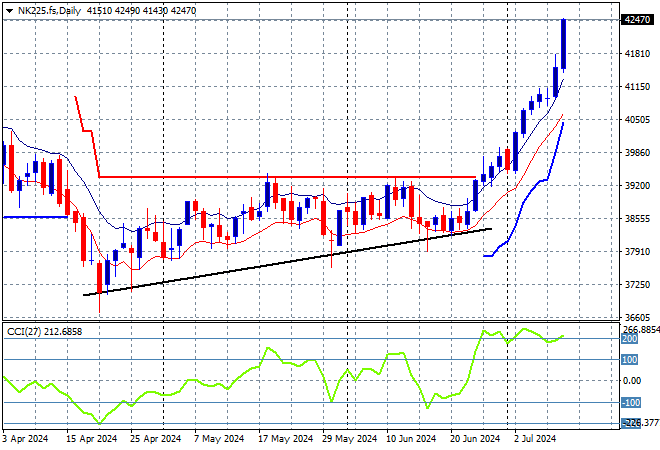

Meanwhile Japanese stock markets were flat to start with before a late rally saw the Nikkei 225 lift 0.6% to 41831 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term resistance had been defended with price action now pushing right through resistance at the 39000 point level with momentum very overbought as this breakout gets going, with futures are indicating further upside on the open:

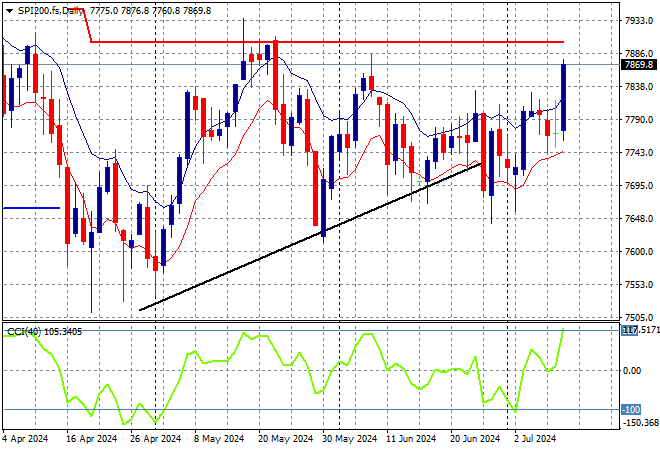

Australian stocks however kept pulling back with the ASX200 losing some 0.2% to 7817 points.

SPI futures however are up a solid 1% due to the higher moves from Wall Street overnight. The daily chart was showing a potential bearish head and shoulders pattern forming with ATR daily support tentatively broken, taking price action back to the February support levels in mid April. Momentum is finally getting out of its oversold condition and is now finally back into positive territory with a return to the 7900 point level possibly on the cards:

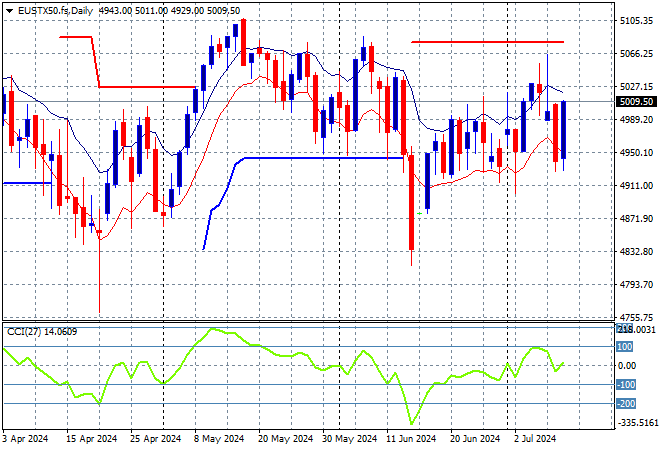

European markets are now back into positive territory as well with broad gains across the continent as the Eurostoxx 50 Index closed more than 1% higher to 4958 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance still looming at the 5000 point barrier. Former ATR support at the 4900 point level looks like the anchor point and so far has held here:

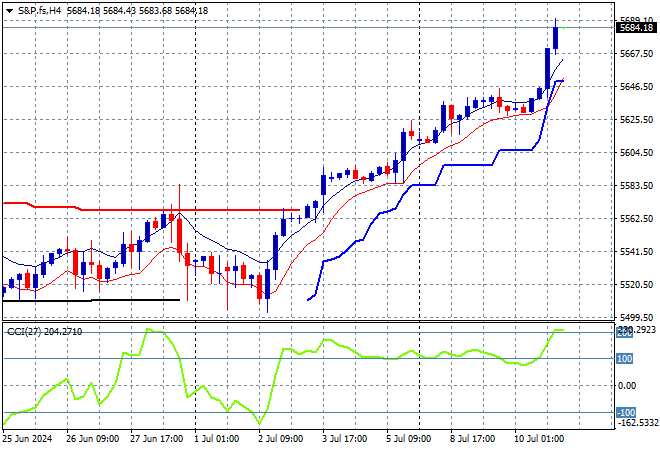

Wall Street continues to be supported by tech stocks in the main with a big upside session overnight with the NASDAQ and the S&P500 closing 1% higher, the latter finishing at 5633 points for a new record high.

The four hourly chart showed resistance overhead that had been tested last Friday before an early week slump that has now been tested and broken through, helped alongside a soaring NASDAQ. Momentum is extremely overbought going into tonight’s CPI print so watch out if further earnings disappoint:

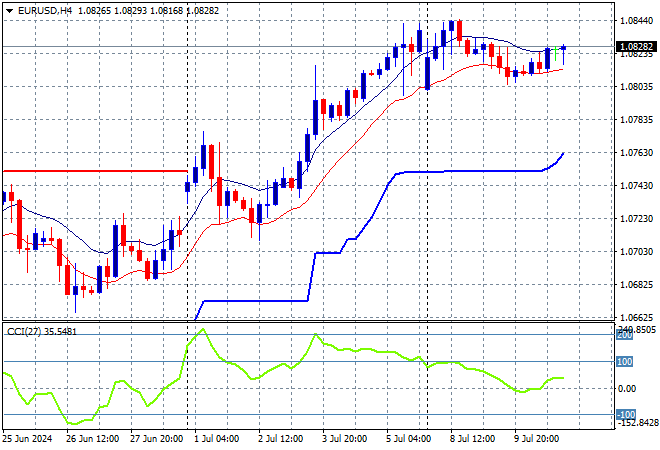

Currency markets had been coming back against a dominant USD well before the latest NFP print last week but are starting to slip somewhat as this new trading week gains momentum with almost all the undollars underperforming overnight in the wake of Fed Chair Powell’s testimony. This has caused the usual weekend gap volatility to extend into some retracement actions with Euro pulling back to just above the 1.08 handle and barely holding on to the three weekly high in the process.

The union currency had previously bottomed out at the 1.07 level before gapping higher earlier this week with more momentum now building to the upside with the 1.0750 mid level to act as support going forward, but watch the low moving average here in the short term to come under pressure:

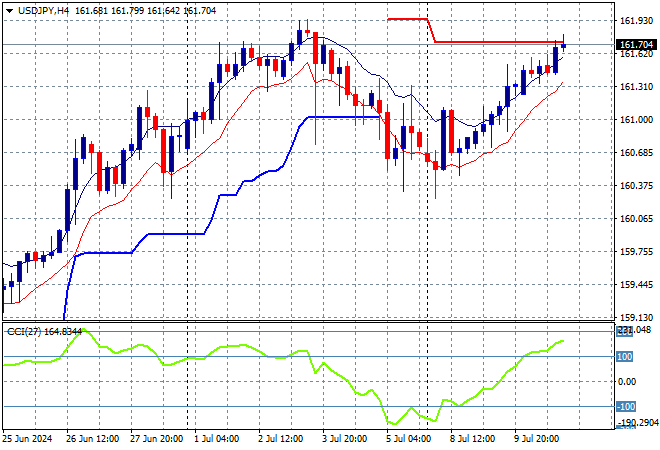

The USDJPY pair continues to find some support after retracing all of its gains for the week, pushing higher above the 161 handle overnight and trying to match the previous high just below the 162 level.

Short term momentum had gotten out of oversold condition but was not yet positive with price action suggesting a further pause or rollover here before the print with this move taking the pair back to last week’s finishing point. This volatility speaks volumes as it pushes aside the 158 level as longer term resistance, but could it return there on this new USD weakening trend as the BOJ tries to intervene on the ever weakening Yen:

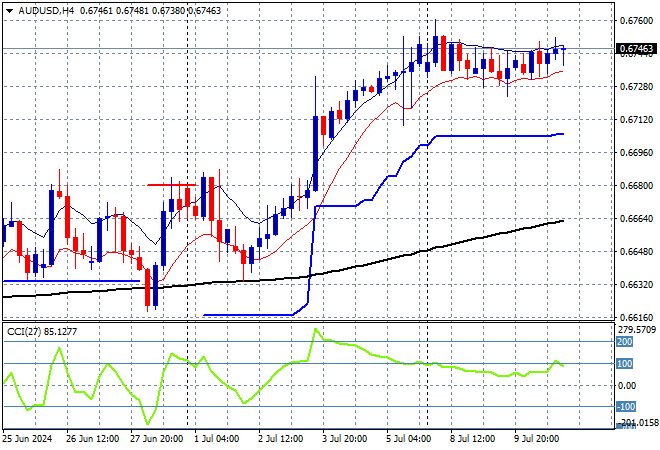

The Australian dollar is not making gains after breaking out of its holding pattern as the USD fell back, but still remains well supported above the 67 cent handle from Friday night at a new six month high as sentiment shifts more towards the RBA raising as the RBNZ looks like cutting.

So far the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone in recent weeks with price action whipsawing around the mid 66 cent level as a point of control. This move looks much more convincing with the potential to go higher as speculation of a rate hike in August building, but I’m watching short term support here which is coming under pressure:

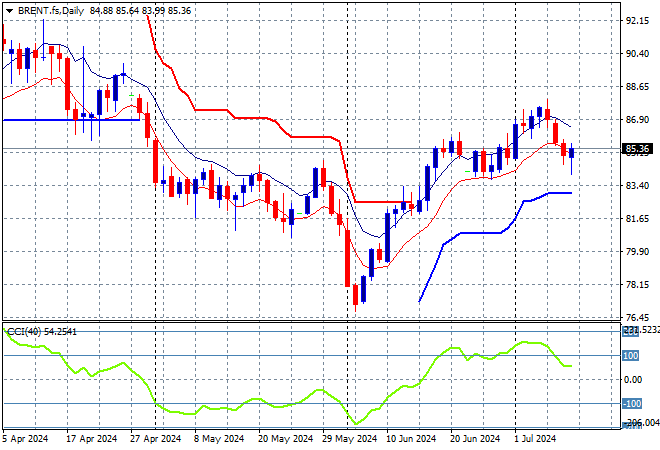

Oil markets are trying to stabilise after getting out of correction mode as the latest OPEC news gave some support with Brent crude steady at the $85USD per barrel level overnight.

After breaking out above the $83 level last month, price action has stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Watch daily ATR support here at the $86 level which is still broken and will likely be resistance for sometime with short term momentum now retracing out of overbought mode:

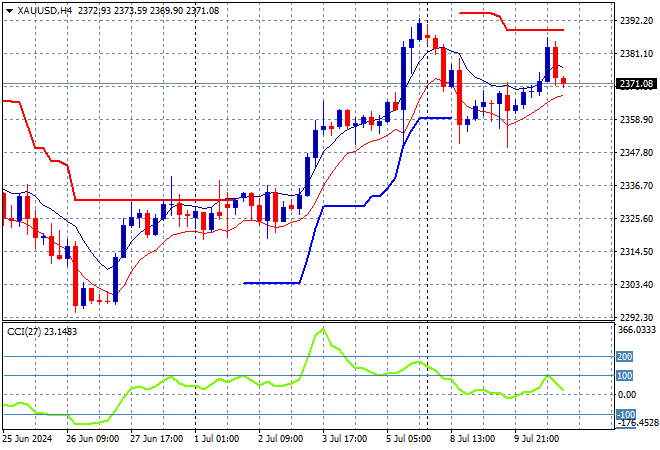

Gold is still trying to hold on to its breakout from late last week, ceasing the post weekend pullback to the $2350USD per ounce level but not yet making a new high with a flop back to the $2370 level this morning.

Still the biggest casualty of the reaction to the US jobs report last week, the shiny metal had consistent negative short term momentum with ATR resistance still ratcheting down without any potential upside. I thought this could break even lower but shows that the $2300 level is key support going forward: