The very positive lead from Wall Street has translated into green across the board here in Asia as all stock markets have advanced in the absence of economic news and events. That may change tonight with the latest German and US core inflation prints. The Australian dollar has hit a six month high as it extends above the 67 cent level.

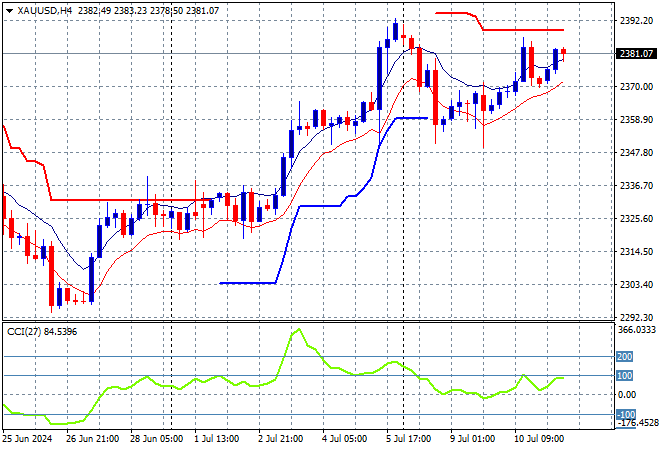

Oil prices are trying to get back to their recent highs with Brent crude holding above the $85USD per barrel level while gold is trying to comeback after its poor start to the week, climbing slightly above the $2380USD per ounce level:

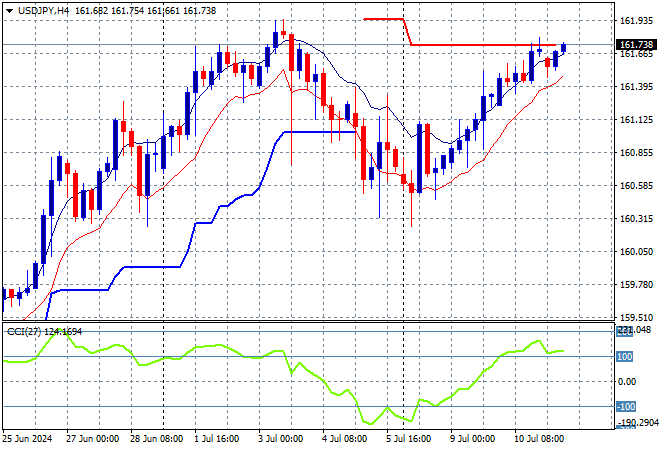

Mainland Chinese share markets are heading higher with the Shanghai Composite up 1% while the Hang Seng Index is catching an ever stronger bid, up 2% to 17837 points. Meanwhile Japanese stock markets are joining in on the fun with the Nikkei 225 up 0.9% at 42224 points as the USDJPY pair continues its overnight lift above the 161 level to almost get back to last week’s closing level:

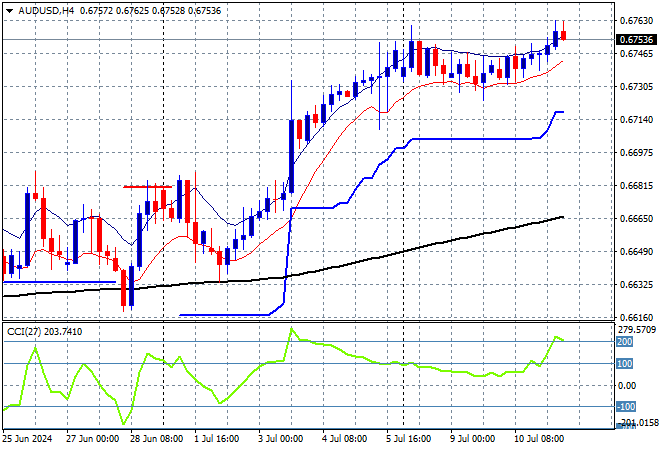

Australian stocks are having a good day too with the ASX200 gaining nearly 1% to 7889 points while the Australian dollar is holding steady above the 67 cent level, wanting to hold on to its recent breakout:

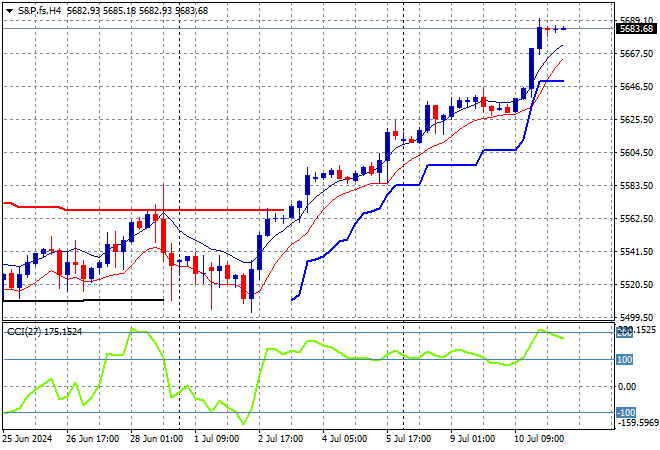

S&P and Eurostoxx futures are up slightly as we head into the London session with the S&P500 four hourly chart showing price action wanting to advance even further above the 5600 point level which is key support:

The economic calendar includes German inflation and UK GDP before the big one – US core inflation.