Asian stock markets are trying to find their feet after an unsteady start to the trading week as inflationary concerns in the US are still weighing down risk sentiment following Friday night’s US jobs report. The USD remains weak against the majors with local stocks seeing a bounceback on better than expected business confidence as the Australian dollar approaches 67 cents against King Dollar.

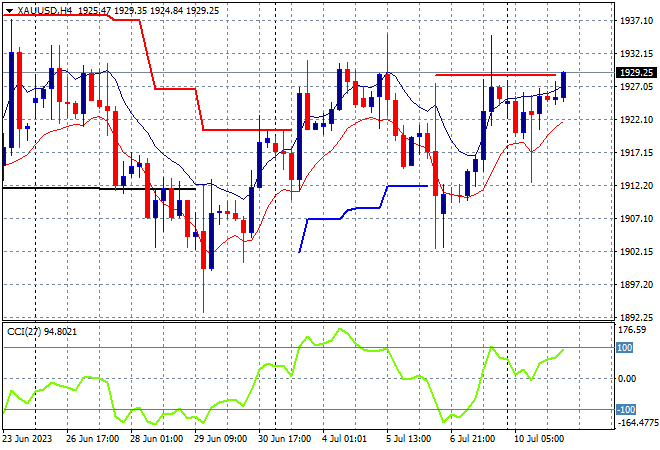

Oil prices are pushing higher as it tries to launch from its solid session on Friday night with Brent crude back above the $78USD per barrel level while gold is also finding a little bit of life here just below the $1930USD per ounce level:

Mainland Chinese share markets are holding on to a very session going into the close with the Shanghai Composite up more than 0.4% at 3218 points while in Hong Kong, the Hang Seng Index is up nearly 1.4% to 18732 points, continuing the start of week bounce.

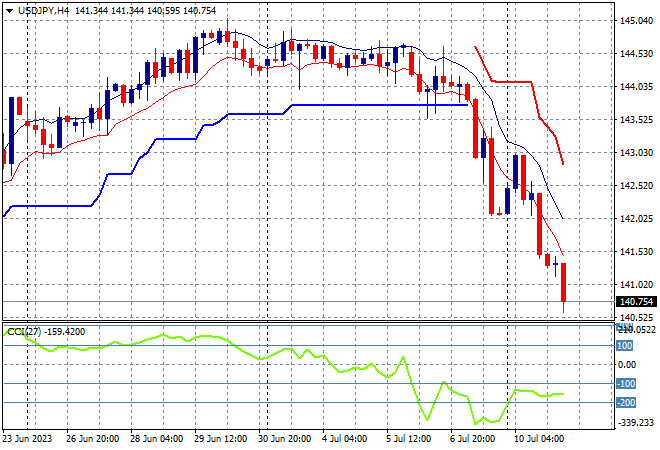

Japanese stock markets however remain cautious, with the Nikkei 225 closing just 0.2% higher at 32263 points with the USDJPY pair continuing its own selloff with a fall below the 141 level after gapping through the 142 handle yesterday:

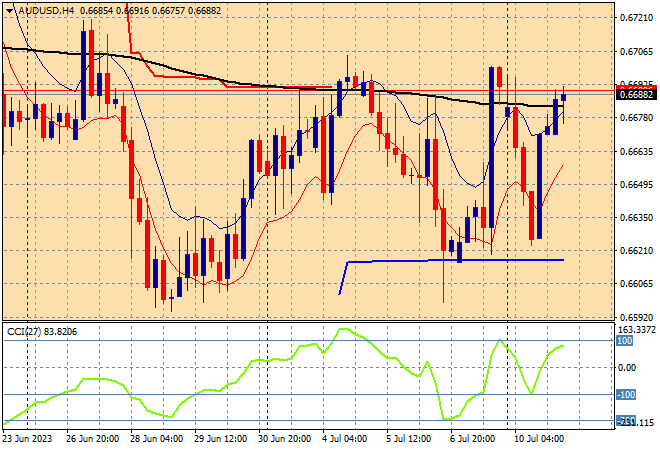

Australian stocks zoomed higher on increased business confidence with the ASX200 closing nearly 1.4% higher at 7095 points. The Australian dollar also continued its small rebound overnight, hitting the 66.70 level this afternoon but not yet above its Friday night high where the 67 handle is proving too tough as short term resistance:

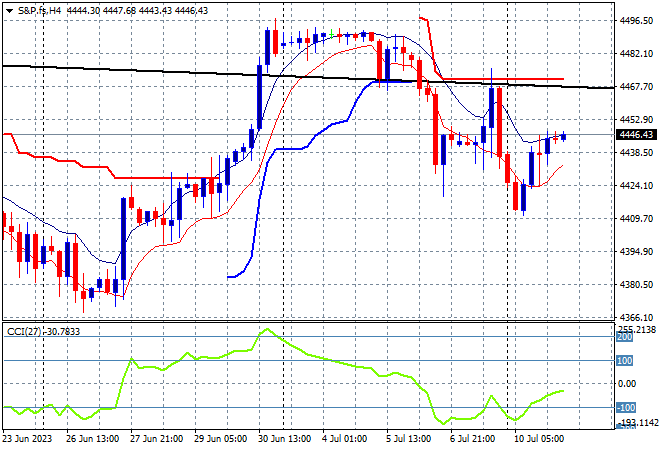

Eurostoxx and S&P futures are up nearly 0.4% although the latter is pulling back slightly with the S&P500 four hourly chart showing price action wanting to fill its rollover from Friday night but may find resistance at the 4500 point level too hard to beat:

The economic calendar tonight includes the closely watched German ZEW survey, then a few more Fed speeches.