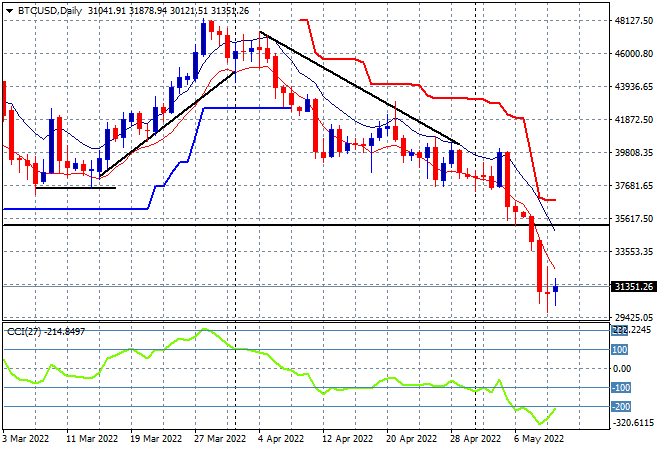

Asian markets are trying to bounceback with only Chinese bourses doing the heavy lifting as local stocks were put off by the slump in consumer sentiment. Currency markets remain spooked by a strong USD although the Australian dollar is trying to bounce off the 69 handle while commodity markets including oil are slowly lifting higher, as Brent crude heads back above the $105 level. Gold is also trying to stabilise but looks weak on all the charts, currently at $1843USD per ounce while Bitcoin is oscillating just above the $30K level and on track for a new yearly low:

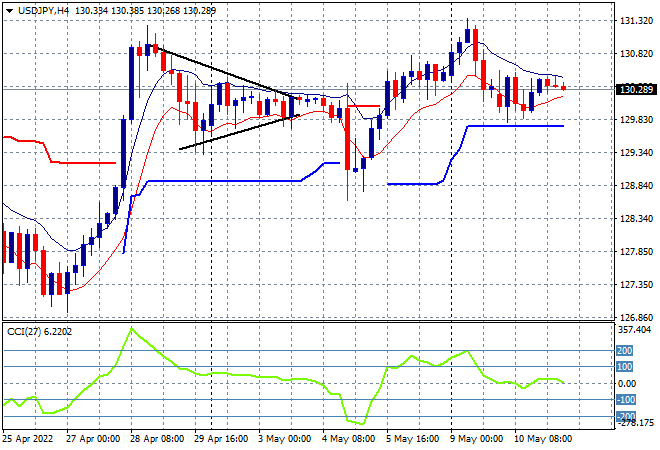

Mainland Chinese share markets jumped out of the gate with the Shanghai Composite currently up 1.3% at 3076 points while the Hang Seng Index has advanced further, now up 1.7% to almost get back above the 20000 point level, currently at 19971 points. Japanese stock markets are still treading water with the Nikkei closing 0.2% higher at 26213 points while the USDJPY pair has pulled back to a neutral state, unable to advance but respecting support at the 130 level:

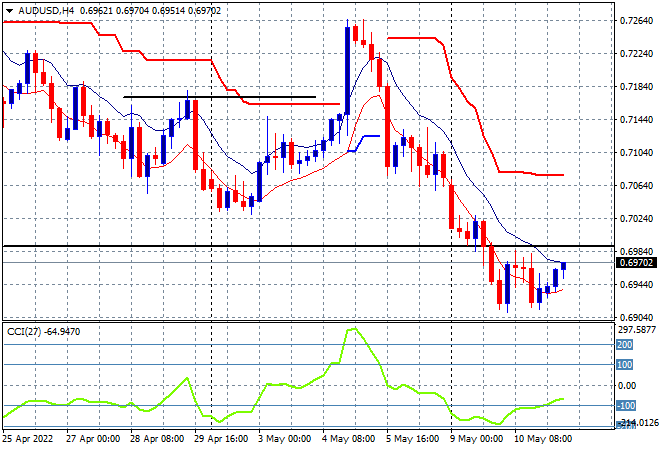

Australian stocks started off poorly but have recovered to finally put in a new daily high with the ASX200 finishing up just 0.2% to 7064 points. Meanwhile the Australian dollar is trying to find a bottom here after making a new monthly low, still below the 70 handle but bouncing off the 69 level for now as momentum inverts:

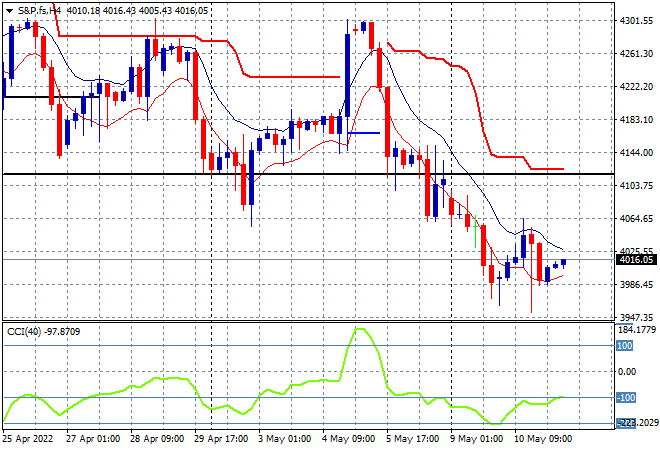

Eurostoxx and Wall Street futures are seeing a bounce ahead of the European open with the S&P500 four hourly chart showing price wanting to stay above the 4000 point level and stave off what looks like a formal bear market with a failed breakout overnight keeping traders on edge:

The economic calendar will be dominated by both German and US inflation prints tonight.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.