Risk markets consolidated overnight after absorbing the weekend shock Israel attacks with bond yields pulling back slightly after some dovish comments by Fed members, while oil prices stabilised and most equities came through unscathed. Wall Street finished slightly higher while European shares pulled back but recovered in futures. The USD was mostly unchanged against most of the major currency pairs as macro concerns continued to outweigh risk sentiment. The Australian dollar however was a standout by pushing through the 64 cent level.

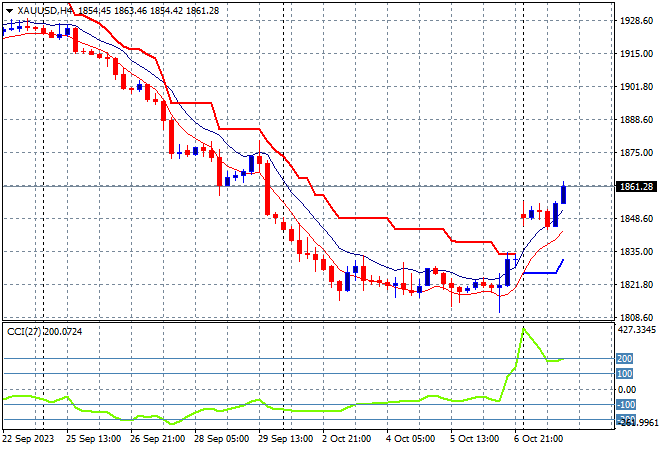

US bond markets went to new historic highs with the 10 year Treasury yield almost up through the 4.8% level while oil prices pulled back again with Brent crude pushed below the $85USD per barrel level. Gold jumped up after decelerating all week to breach the $1830USD per ounce level.

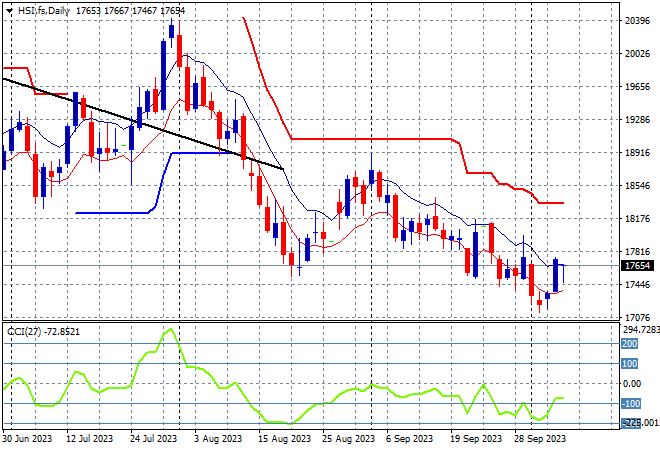

Looking at share markets in Asia from yesterday’s session with Chinese share markets falling into the close with the Shanghai Composite down 0.4% to 3096 points while in Hong Kong the Hang Seng Index was closed.

The daily chart is still showing a significant downtrend that has gone below the May/June lows with the 19000 point support level a distant memory as price action stays well below the dominant downtrend (sloping higher black line) following the previous month long consolidation. Daily momentum readings are now out of oversold mode but have not been positive for months so I only expect another dead cat bounce here:

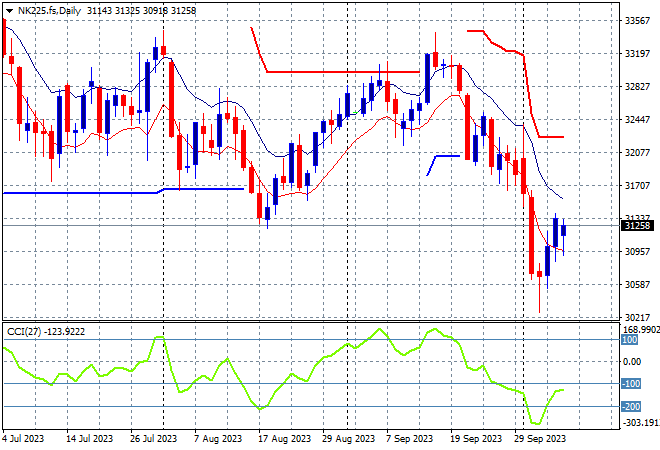

Japanese stock markets were also closed with Nikkei 225 futures looking to open slightly lower on the open this morning around the 31250 point level.

Trailing ATR daily support had been paused for sometime now as the market went sideways after a big lift recently, with a welcome consolidation above that level but that has now turned into a proper dip. Daily momentum broke into the oversold levels but has now retraced as price action bounced back from the support zone with the potential for a swing building here, as futures are indicating a modest start:

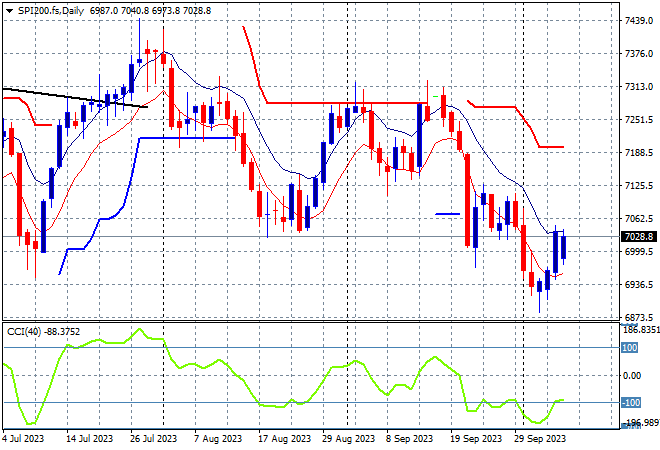

Australian stocks were able to claw a positive session, but only just, with the ASX200 closing 0.2% higher at 6970 points.

SPI futures are looking up despite the attacks on Israel over the weekend as markets will follow Wall Street’s optimism instead here although the 7000 point level is still looming as strong short term resistance. Medium term price action continue to move sideways at best:

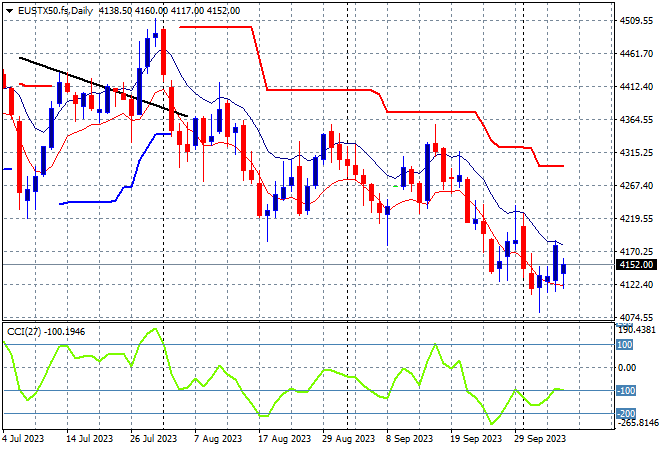

European markets fell immediately on the weekend gap with some fill post close in futures but the Eurostoxx 50 Index ended some 0.7% lower at 4122 points.

However, the daily chart still shows an overall decline with weekly support at 4100 points barely defended, as weekly resistance continues to build, now lowering to the 4300 point resistance level. There are signs of stability returning here as daily momentum now gets out of oversold mode but I remain cautious as this looks like another short term ill fated dead cat bounce:

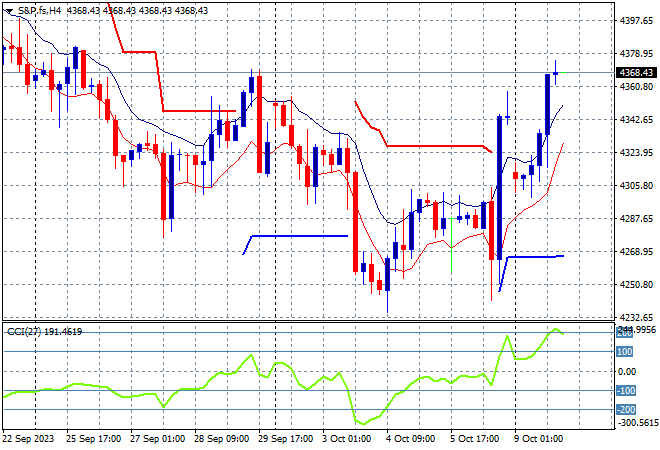

Wall Street lifted across the board despite the tensions although the NASDAQ only put on 0.4% as the S&P500 lifted nearly 0.6% higher to finish at a new weekly high at 4335 points.

The daily chart was showing price action bunching up around the recent lows at the 4260 point area with the previous session suggesting a bullish engulfing candle giving a big lift to risk sentiment. After a slight gap down, futures re-engaged to the upside with the cash session matching the previous weekly high:

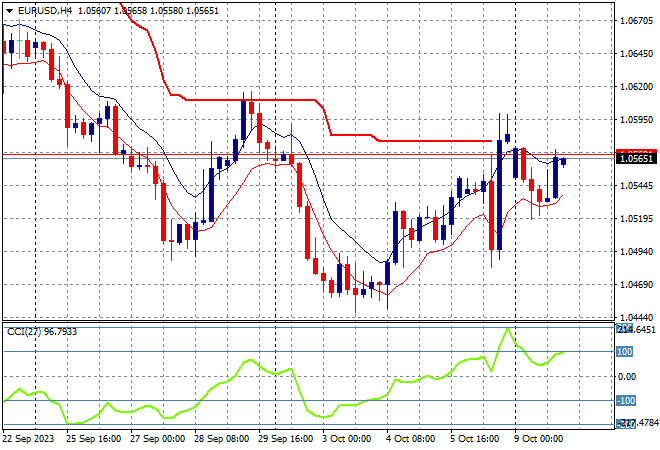

Currency markets are continuing their fight back against USD following the latest NFP print and the macro weekend oscillations giving the major currency pairs as King Dollar stabilised somewhat. European economic weakness is not yet overshadowing Euro which almost pushed through the 1.06 level on Friday night, with a slight consolidation overnight to the mid 1.05 area.

In the medium term its apparent on the four hourly chart that the union currency still really needs to have a strong return above trailing ATR resistance, now at the 1.06 handle. Short term momentum is well overbought but price action looks toppy at best:

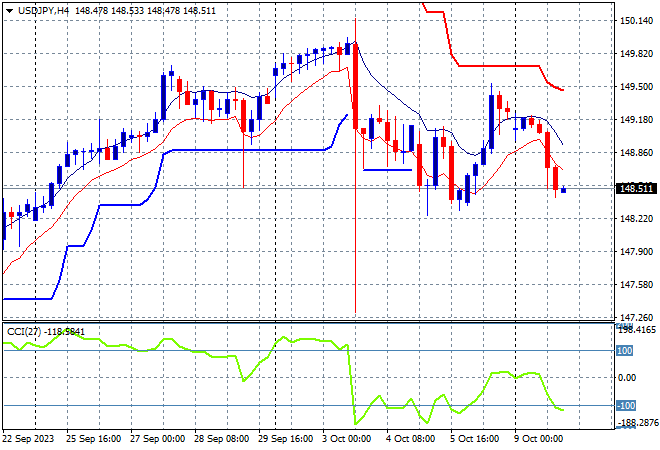

The USDJPY pair was unable to stabilise after its recent decline and big whipsaw last week with Friday’s drawdown back to the 149 level repeated overnight with a test of last week’s low at the mid 148 level underway.

Four hourly momentum shows a return to negative settings so watch out below as price action looks tenuous here in the short term:

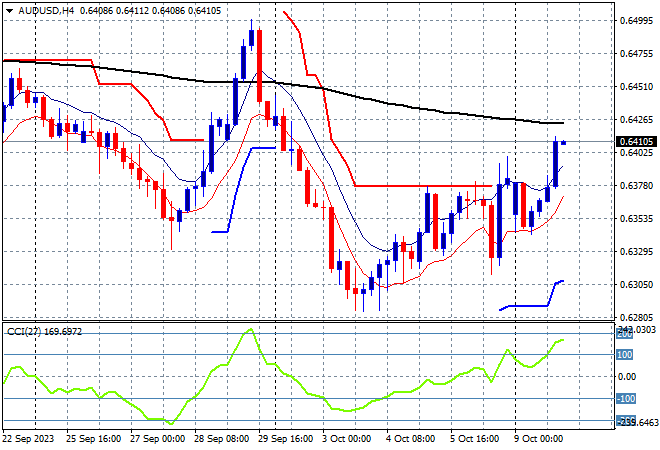

The Australian dollar had been under the pump against King Dollar for sometime with a big decline to the 62 handle in recent weeks but after finding some new life on Friday night it followed through last night following the weekend gap to push through the 64 cent level.

The Pacific Peso will remain under pressure but short term momentum looks solid here:

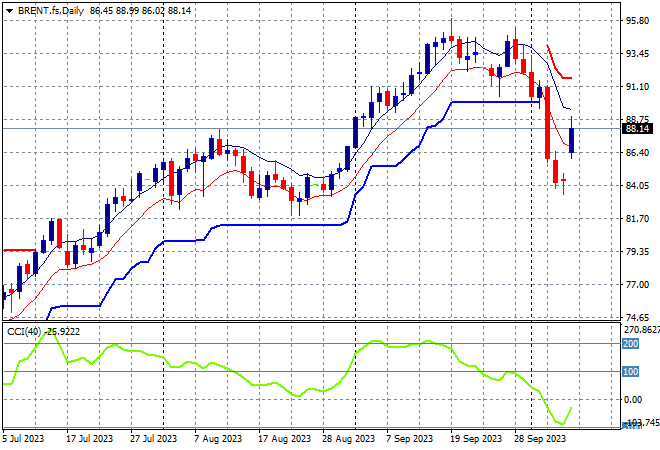

Oil markets consolidated overnight after a big weekend gap jump higher due to conflict in the Middle East but it remains to be seen if demand concerns and supply cuts will keep Brent crude elevated as it finished at the $88USD per barrel level level.

After almost reaching $100 in mid September, price is looking to return to the August levels where a point of control was established before the breakout at the $87USD per barrel area. Daily momentum has nearly returned to oversold readings, despite the overnight oscillation so beware of a dead cat bounce here:

Gold gapped considerably higher on Monday morning after halting its impressive decline on Friday night from the NFP print, jumping above the $1840USD per ounce level and then firming at the $1860 area overnight as momentum holds in the short term.

The daily chart was showing a potential bottoming action before Friday’s NFP print with this breakout possibly continuing as short term momentum remains heavily overbought but not in extreme condition as yet: