Asian stock markets are looking very unsteady in the first session of the trading week as inflationary concerns weigh down risk sentiment following Friday night’s US jobs report. The latest NFP print caused uncertainty to ramp up and the USD to pullback but the weekend gap has confused even further with King Dollar back into strength as macro concerns build in Europe.

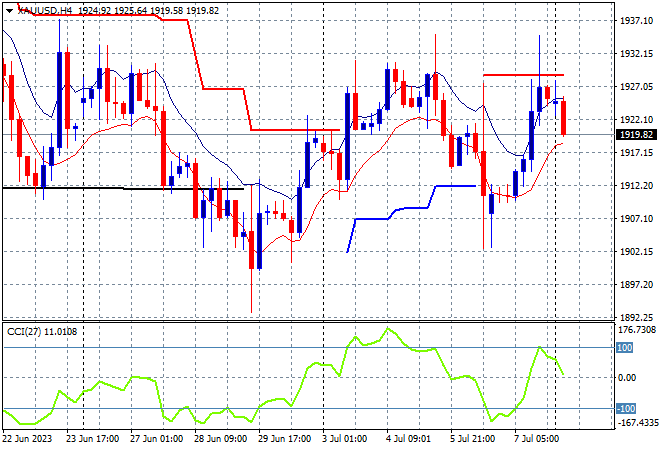

Oil prices are pulling back after a solid session on Friday night with Brent crude back below the $77USD per barrel level while gold is suffering alongside other undollars with a minor pullback below the $1920USD per ounce level:

Mainland Chinese share markets are trying to hold on to a positive sesison going into the close with the Shanghai Composite steady at 3202 points while the Hang Seng Index is up nearly 0.5% to 18449 points.

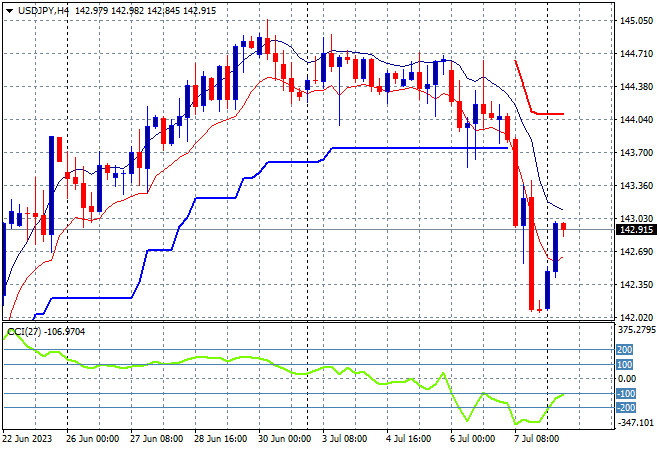

Japanese stock markets are also selling off, with the Nikkei 225 closing more than 0.6% lower at 32189 points with the USDJPY pair bouncing back from its huge selloff on Friday night after the US jobs report, gapped up through the 142 handle before settling this afternoon just below the 143 level:

Australian stocks couldn’t escape the selling with the ASX200 closing 0.5% lower to just above the key 7000 point level. The Australian dollar was looking to continue its Friday night burst higher but gapped lower this morning below the 67 handle and has continued to the mid 66 cent level as safe haven buyers stepped in for USD:

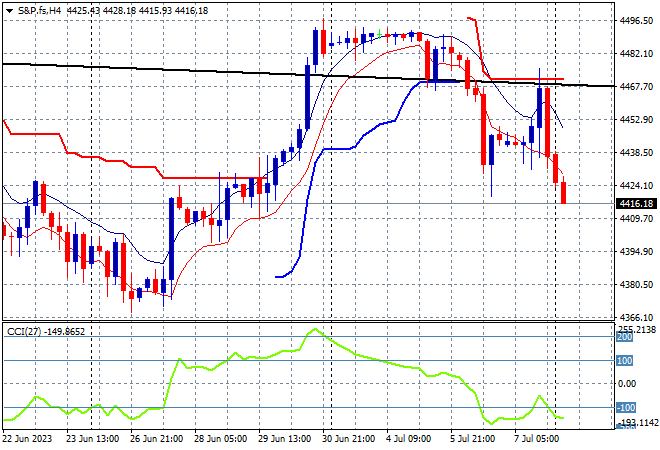

Eurostoxx and S&P futures are down more than 0.5% with the S&P500 four hourly chart showing price action continuing its rollover from Friday night after hitting resistance at the 4500 point level:

The economic calendar starts the trading week quietly as always after Friday’s US jobs report but there are quite a few Fed speeches overnight to keep an ear out for.