Wall Street was able to just get itself out of a reversal overnight with a late rally by tech stocks in the absence of any economic or macro events as traders await this week’s US CPI print. The USD failed to rally back after its boost from Friday night’s US jobs report with the higher oil prices keeping risk sentiment in European shares lower. Most undollars finished the session higher with the Australian dollar continuing to hold above the 66 cent level.

10 year Treasury yields retraced slightly from their 2024 high, finishing just below the 4.4% level while Brent crude put in another pause despite upgrades by Morgan Stanley (NYSE:MS) on crude oil prices, holding just below the $90USD per barrel level. Meanwhile gold just kept on lifting higher as it builds above the $2350USD per ounce level.

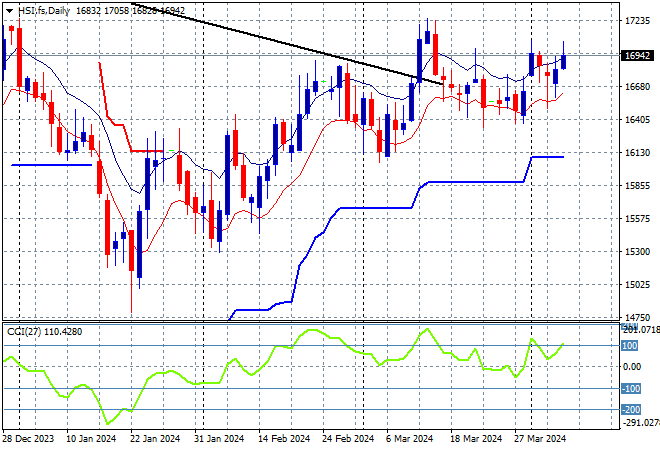

Looking at markets from yesterday’s session in Asia, where mainland and offshore Chinese share markets diverged fortunes again with the Shanghai Composite down more than 0.2% at one stage before recovering for a scratch session while the Hang Seng Index rebounded further, up 0.8% to 16828 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. However this has been thwarted as monthly resistance levels are kicking in, although support is firming at the 16400 point area:

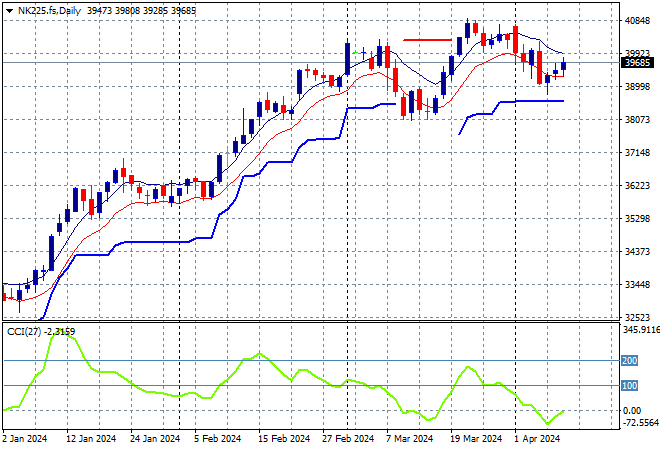

Japanese stock markets played catchupe with their regional partners as the Nikkei 225 closed 0.7% higher at 39652 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term resistance has been defended with short term price action now retracing to support at the 39000 point level. Watch the 38000 level for signs of a true breakdown:

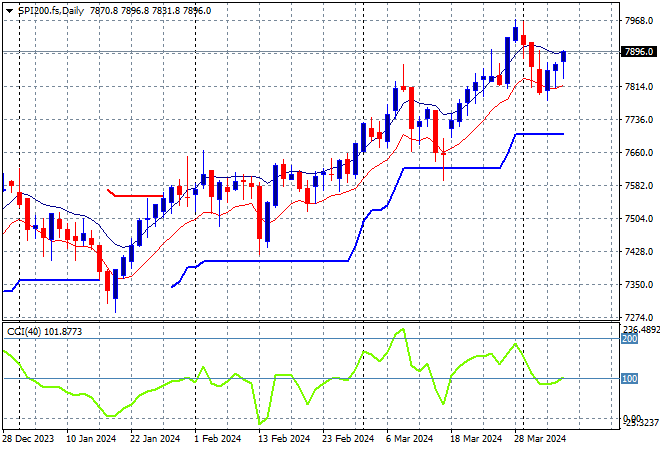

Australian stocks had a solid session with the ASX200 closing 0.5% higher to 7828 points.

SPI futures however are up at least 0.3% despite another wobbly night on Wall Street. The daily chart was looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. As I said previously, watching for any continued dip below the low moving average could see a significant pullback but watch ATR support which has been defended so far:

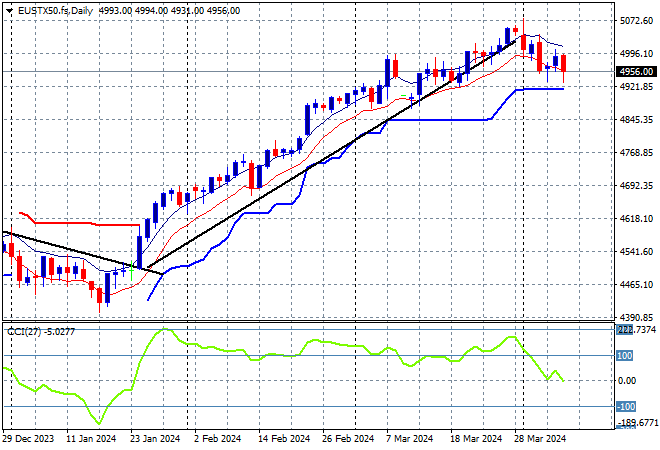

European markets dropped back across the continent with no solid leads and concerns over high oil prices as the Eurostoxx 50 Index finished 1% lower at 4990 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs but daily momentum retracing well out of an overbought phase. This was looking to turn into a larger breakout but a retracement back to short term support could give the market some breathing room. Futures are indicating another small tumble due to Wall Street’s lack of gains:

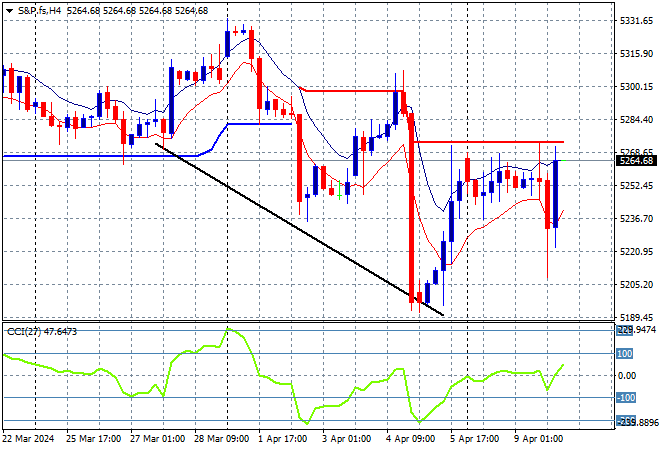

Wall Street continues to struggle with the headline Dow off a few points while the NASDAQ and S&P500 both recovering in the last hour of trade, the latter finishing 0.1% higher to get back above the 5200 point level.

The daily chart previously showed a consolidation that could have turned into a proper reversal here as price action broke below short term support as momentum became somewhat oversold. As I said previously, a break below the 5240 point area has setup for further downside but this has been thwarted so far:

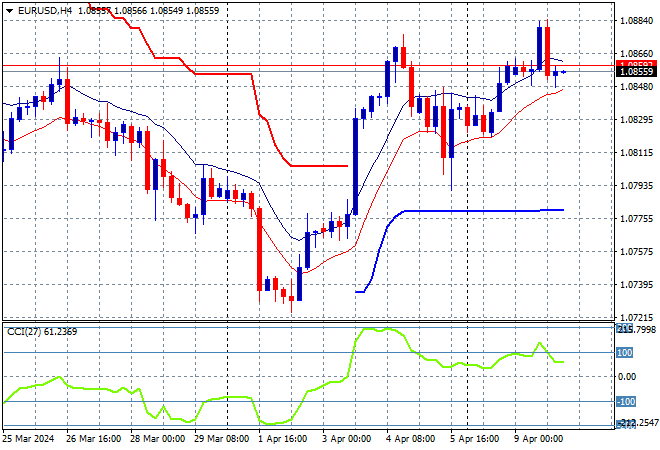

Currency markets are swinging back to an anti-USD mood despite the strong US jobs print on Friday night with pressure now mounting as various undollars broke out overnight. Euro pushed further above the 1.08 handle but has moderated somewhat early this morning.

The union currency had bottomed out at the 1.07 level as medium term price action was always suggesting a return to or below that level but this reversal in price action momentum in the short term is likely to see the 1.09 level come under threat next:

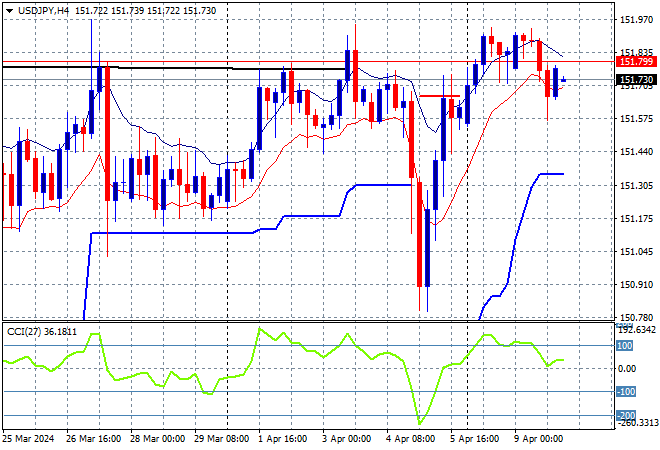

The USDJPY pair is struggling to hold out at the previous highs around the 152 level as it again comes up against strong overhead weekly resistance (horizontal black line on chart below).

The medium term picture remains somewhat optimistic as Yen sold off due to BOJ meanderings but momentum is now trying to get out of oversold mode while ATR support remains firm but under pressure at the 151 handle proper:

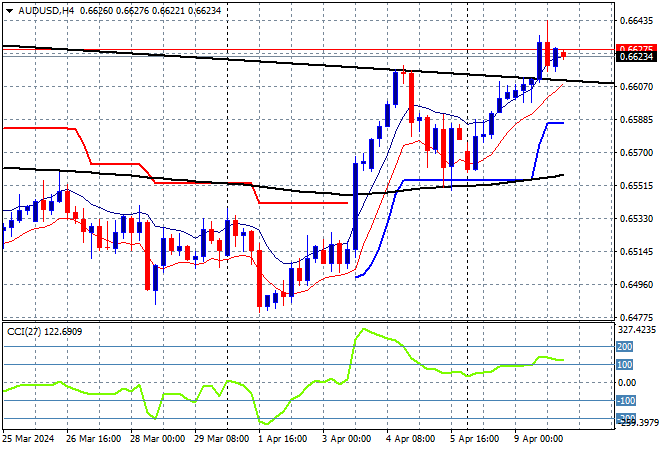

The Australian dollar was able to continue its mild breakout overnight to push slightly further above the 66 handle, solidifying short term support.

The Aussie has been under medium and long term pressure for sometime before the RBA and Fed meetings and while the previous temporary surge looked strong, it wasn’t overbought on the four hourly chart and had not surpassed support from last week’s consolidation phase. While this looks good in the short term, longer term resistance could kick in at the 66 cent handle:

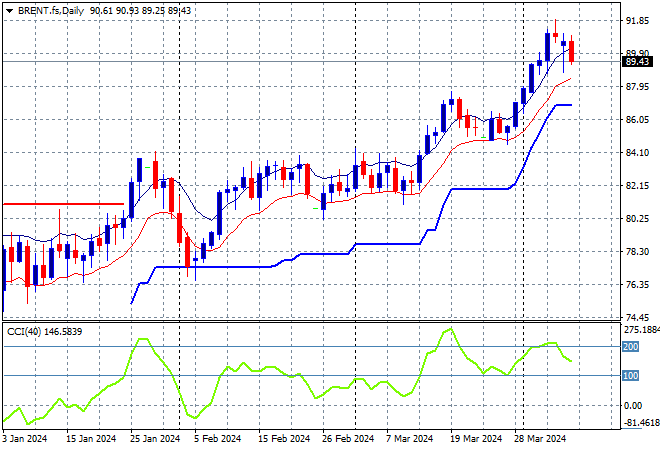

Oil markets are pausing their breakouts following the attacks on Russian refineries with Brent crude retracing slightly below the $90USD per barrel level overnight.

After retracing down to trailing ATR daily support at the $77 level, price had been bunching up around the February highs at the $84 level with short term momentum definitely overbought and signalling potential upside from here, although now well overextended. I expect a further pause or mild retracement in this trading week:

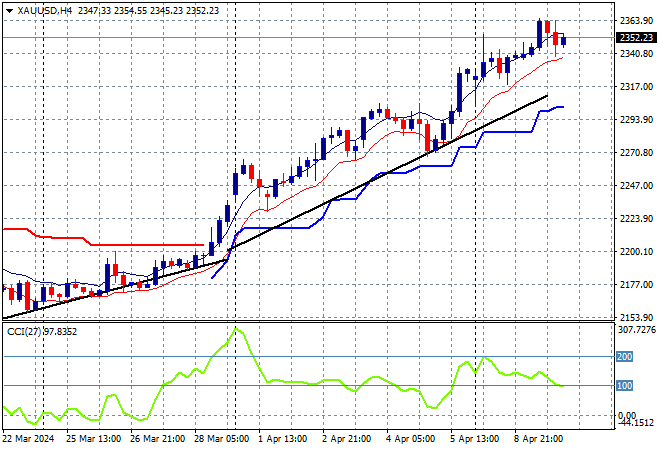

Gold just keeps climbing to new highs through any volatility, again pushing aside the USD to remain above the $2300USD per ounce level, closing at $2352 overnight.

In the previous week momentum was nearly off the charts – never a good sign – with short term support at the $2100 level turning to what could be rock solid medium term support but still the critical area to watch ahead on a likely pullback due to excessive volatility.