- Fed rate decision, Powell comments, bank crisis developments will drive markets in the week ahead.

- Nvidia stock is set to shine amid AI buzz ahead of ‘GTC 2023’ event.

- ExxonMobil shares likely to underperform amid tumbling energy prices.

Stocks on Wall Street tumbled on Friday to end a tumultuous week dominated by worsening fears over the health of the U.S. banking sector. Those concerns have spread to Europe, as embattled Swiss lender Credit Suisse (NYSE:CS) fights for its survival.

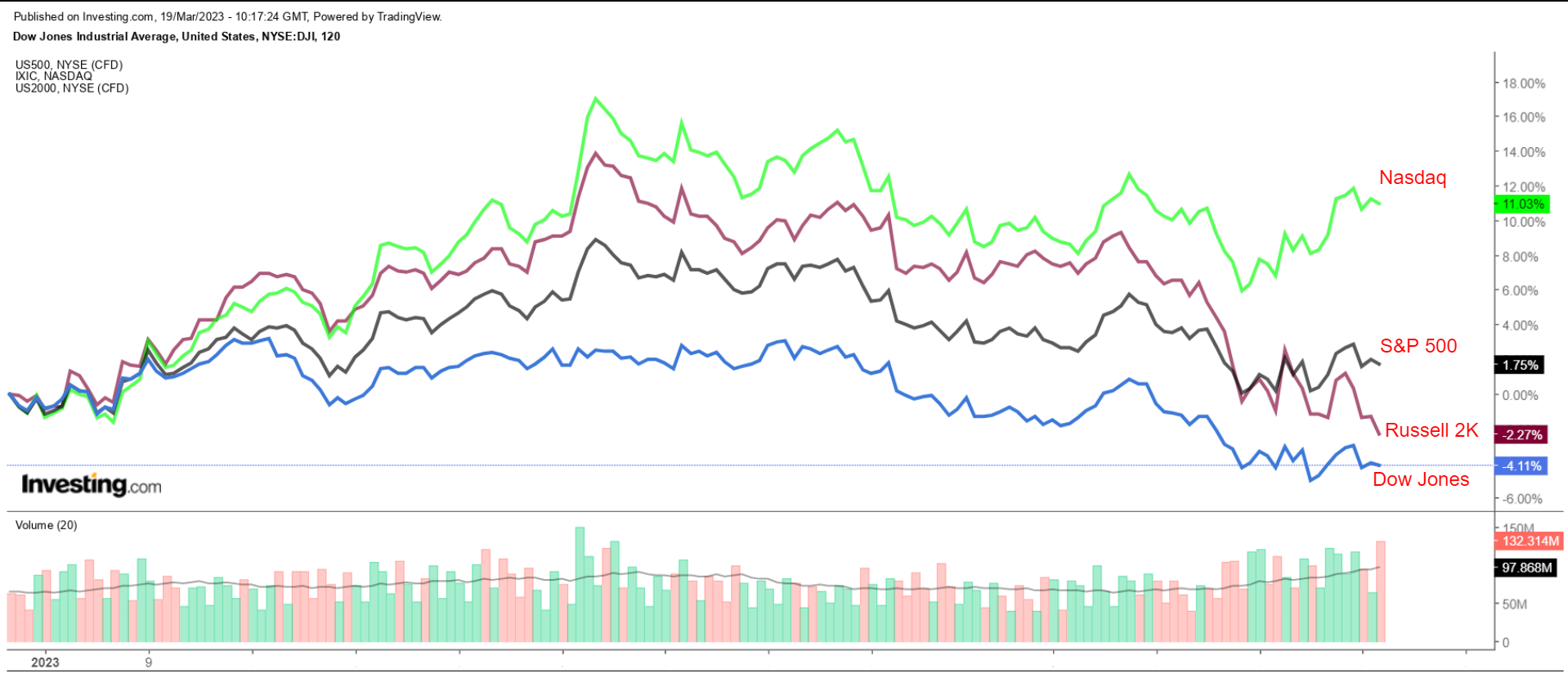

Despite Friday’s decline, the benchmark S&P 500, and the tech-heavy Nasdaq Composite both managed to score weekly gains of +1.4% and +4.4% respectively as investors bid up growth stocks due to a sharp decline in Treasury yields amid diminished expectations for further Fed rate hikes.

Meanwhile, the blue-chip Dow Jones Industrial Average ended the week down -0.2%. The small-cap Russell 2000 lost -2.7% after diving 8.4% in the prior week.

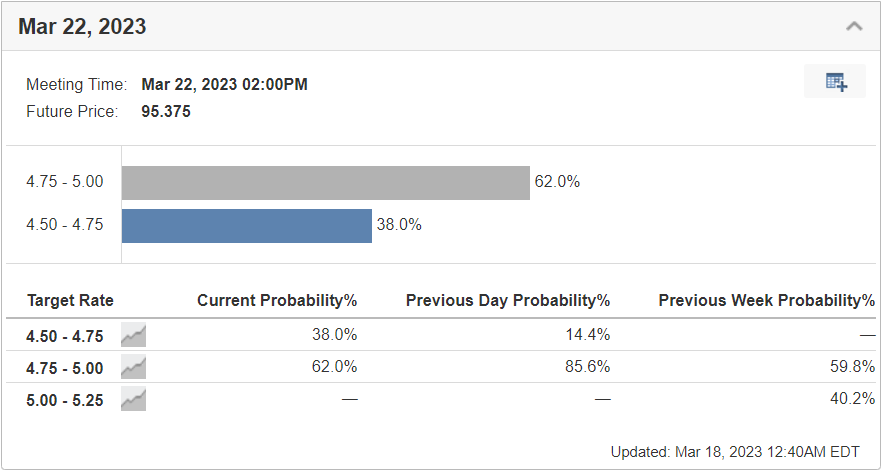

The week ahead will surely be an eventful one as the U.S. central bank’s monetary policy-setting committee holds a crucial two-day meeting concluding on Wednesday. As of Sunday morning, futures trading implies a 62% probability of a 25-basis point rate hike and a 38% chance of no hike at all, according to Investing.com’s Fed Rate Monitor Tool.

The odds for a 50-point move are now effectively off the table after being a betting favorite just a few weeks ago amid the recent signs of turmoil in the banking sector.

Fed Chair Jerome Powell’s comments will be in focus as investors ramp up bets the U.S. central bank will pause its tightening cycle and even cut rates by the end of the year due to fresh uncertainties around the health of U.S. banks.

Outside of the Fed drama, investors will continue to be fixated on developments surrounding the banking turmoil on both sides of the Atlantic amid fears over a global banking crisis.

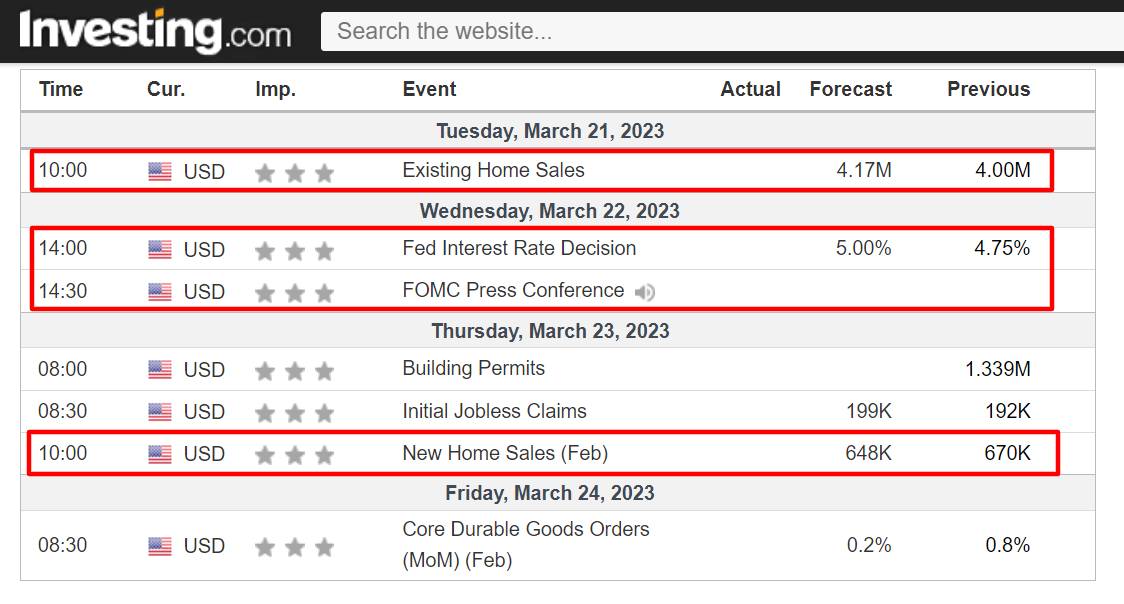

Meanwhile, on the economic calendar, most important will be reports on existing home sales, new home sales, and durable goods orders.

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including Nike (NYSE:NKE), Foot Locker (NYSE:FL), GameStop (NYSE:GME), and General Mills (NYSE:GIS).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see further downside.

Remember though, my timeframe is just for the week ahead, March 20-24.

Stock To Buy: Nvidia

I expect Nvidia's (NASDAQ:NVDA) stock to extend its march higher in the week ahead as the tech giant hosts its highly anticipated ‘GTC 2023’ event, at which it is likely to show off its latest advancements in generative AI, the metaverse, cloud computing, large language models, robotics, and more.

The four-day annual conference kicks off on Monday, March 20, and will end on Thursday, March 23, and will be broadcast live on the Nvidia website.

Most of the spotlight will fall on CEO Jensen Huang’s keynote speech scheduled for Tuesday at 8:00 AM PDT/11:00 AM EST. According to the description, Huang will share how emerging trends and innovations, such as the power of modern artificial intelligence, deep learning, and accelerated computing, are driving transformation in the tech industry.

In addition to the keynote speech, Huang will also participate in a discussion with the co-founder and chief scientist of ChatGPT-parent OpenAI, Ilya Sutskever, on Wednesday morning.

Furthermore, other key members of Nvidia’s leadership team are expected to reveal fresh details on the tech company’s new products and features, with some discussion on AI chips anticipated.

Shares of Nvidia have rallied in the week of its GTC event in four of the last five years. At its last GTC event in March 2022, NVDA shares jumped almost 10% after showcasing its innovative ‘Omniverse’ metaverse platform and revealing upbeat news on graphics, gaming, and autonomous self-driving technology.

NVDA stock ended at $257.25 on Friday, the best level since April 5, 2022. At current levels, the Santa Clara, California-based chipmaker has a market cap of $634.4 billion, making it the sixth most valuable company trading on the U.S. stock exchange, ahead of names like Tesla (NASDAQ:TSLA), Meta Platforms (NASDAQ:META), Visa (NYSE:V), JPMorgan Chase (NYSE:JPM), and Walmart (NYSE:WMT).

Despite broader market turmoil, shares of the semiconductor giant have been on a major uptrend since the start of 2023 as investors piled back into the battered growth stocks of yesteryear.

Year-to-date, Nvidia’s stock is up a whopping 76%, however it still stands roughly 26% below the November 2021 record high of $346.47.

Stock To Sell: ExxonMobil

Fresh off their biggest weekly loss of the year, I believe ExxonMobil (NYSE:XOM) shares will suffer another challenging week ahead amid falling global energy prices due to the increasingly uncertain economic climate.

Crude oil futures took a dive on Friday, with U.S. WTI prices falling below $70 a barrel for the first time since December 2021. The U.S. benchmark suffered its worst week since April 2020, plunging -13%.

Despite sizable losses, I reckon there is still more downside on the horizon given the downbeat near-term outlook for global oil demand, combined with weak underlying fundamentals and fragile chart technicals.

The ongoing banking crisis has accelerated the slowdown timeline for the economy in my view and increased the odds of a deep recession in the coming months.

As could be expected, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of Exxon’s first-quarter earnings update due next month, with analysts slashing their EPS estimates 10 times over the last 90 days, compared to just five upward revisions.

XOM stock sank over 7% last week to notch its worst weekly performance since mid-September. Shares closed Friday’s session at $99.84, after touching a low of $98.02 a day earlier, which was the weakest level since Oct. 13, 2022.

After an upbeat start to the year, Exxon has seen its ascent take a turn lower, pulling back 16.5% after reaching a new record peak of $119.63 on Feb. 5.

Year-to-date, shares are down 9.5%, underperforming the broader market by a wide margin.

At current levels, Exxon has a market cap of $406.5 billion, making it the largest U.S. oil producer and the 11th most valuable public company in the world.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.