- U.S. inflation data, retail sales to drive sentiment

- Roblox stock is a buy ahead of its investor day event

- Virgin Galactic set to struggle amid growing headwinds

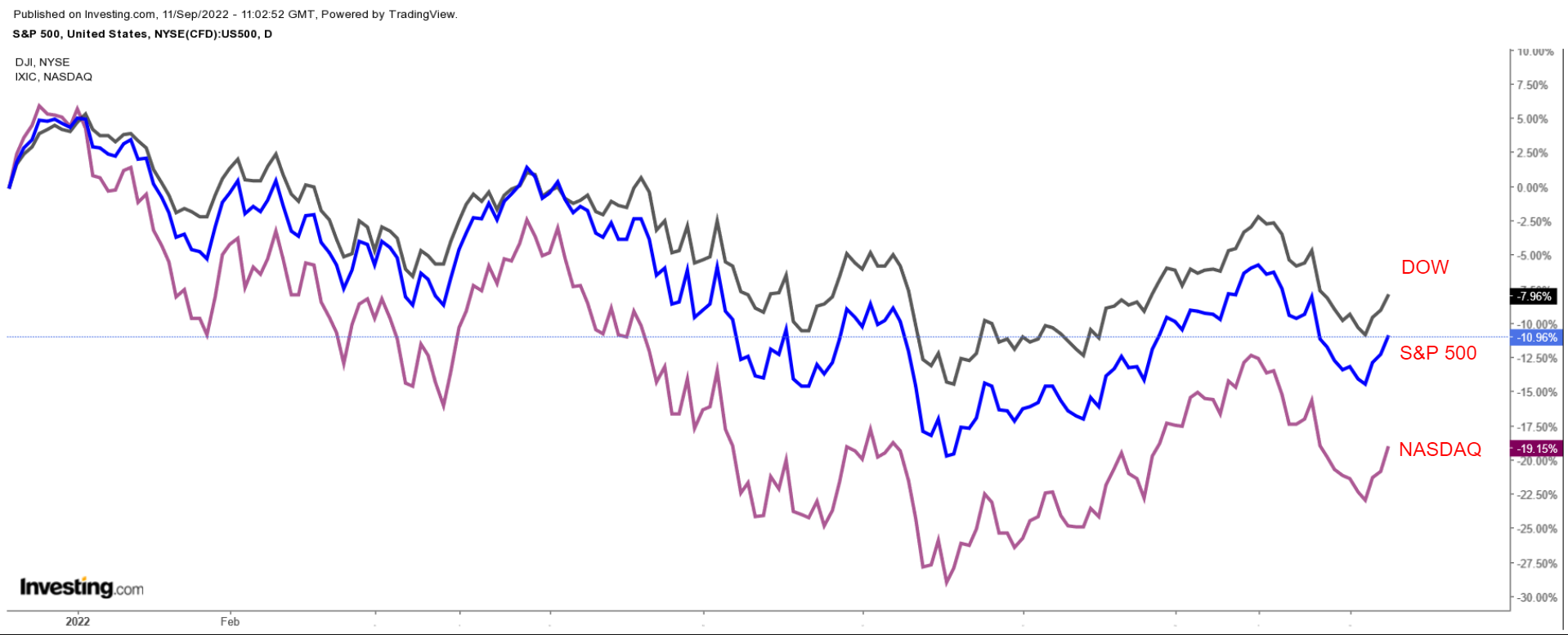

Stocks on Wall Street rallied on Friday, with the major indexes recording their first weekly gain in four weeks as investors continued to assess the path for inflation and the Federal Reserve's aggressiveness in interest rate hikes.

For the week, the blue-chip Dow Jones Industrial Average rose 2.7%, while the benchmark S&P 500 and the tech-heavy Nasdaq Composite advanced 3.6% and 4.1% respectively.

Source: Investing.com

Focus now shifts to U.S. inflation data due this coming week, with annual consumer prices expected to jump by 8.1% in August after an 8.5% rise in July.

Producer prices, initial jobless claims and multiple manufacturing reports also are on the agenda.

Elsewhere, on the earnings docket, Oracle (NYSE:ORCL), and Adobe (NASDAQ:ADBE) headline a rather slow week for corporate results.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our time frame is just for the upcoming week.

Stock To Buy: Roblox

Coming off its biggest weekly advance in three months, I expect Roblox Corp (NYSE:RBLX) stock to extend its recovery in the week ahead as the digital entertainment company hosts a highly anticipated investor day event on Thursday, Sept. 15.

Roblox founder and CEO David Baszucki will be joined by other members of the leadership team to present on the company’s long-term vision and path to profitability, as well as provide updates on key product features and technological innovations.

In addition, CFO Michael Guthrie will present a financial overview that includes August monthly metrics.

The presentations - which will be broadcast live on the Roblox YouTube channel starting at 12:00 P.M. ET - are to be followed by a live Q&A session.

Last year, shares of the social-gaming platform soared 25% during the week of its investor day event after the company revealed plans to become a leader in the metaverse space.

Roblox said last week that it will start displaying advertisements on its platform for the first time in 2023 as it seeks to diversify revenue beyond virtual goods in games.

Source: Investing.com

After soaring to a record peak of $141.60 in November 2021, RBLX stock sank to a low of $21.65 on May 10 as investors dumped unprofitable tech companies with expensive valuations amid the Fed’s aggressive rate hike plans.

Shares have since rebounded by an astonishing 110% to end at $45.53 on Friday thanks to signs of increasing engagement on its gaming platform, which helped ease fears of a substantial slowdown in its core business.

Despite the recent bounce, Roblox shares are still down about 56% year to date and are approximately 68% below their all-time high.

At current valuations, the San Mateo, Calif.-based videogame firm, which allows users to easily develop games and interact in 3D virtual worlds, has a market cap of $27.2 billion.

Stock To Dump: Virgin Galactic

I believe Virgin Galactic (NYSE:SPCE) shares are set for a challenging week ahead, with a potential visit to new all-time lows on the horizon, due to the ongoing impact of several negative factors plaguing the struggling space-tourism pioneer.

Galactic’s stock has been under heavy selling pressure ever since the company’s shock warning last month that it would postpone the start of commercial space voyages until mid-2023 amid a raft of spacecraft and regulatory issues.

Earlier in the year, the space-tourism company had hoped to start commercial service for private citizens in Q1 2023. Initially, the company’s flights to space were set to begin at the end of 2021.

In contrast, Jeff Bezos’ Blue Origin has already sent tourists to space aboard its New Shepard rocket six times through the end of last month.

The long delay at Galactic has added to already-high uncertainty over the company’s quest to take tourists to space.

It also fueled worries the company might need to raise more capital as it spends heavily to upgrade its existing spaceships and prepares to build even more.

Galactic, which reported horrible second-quarter financial results in early August, ended the period with roughly $1.1 billion in cash and investments.

Source: Investing.com

SPCE stock closed at $6.00 on Friday, not far from its record trough of $5.14 touched on May 12.

Year to date, Galactic shares are down 55.2%. Even more alarming, they stand 90% below their February 2021 all-time peak of $62.70 amid a potent combination of worsening fundamentals and a deteriorating macro backdrop.

At current valuations, the Las Cruces, N.M.-based company has a market cap of $1.55 billion, despite losing money and generating little to no revenue as of yet.

Disclosure: At the time of writing, Jesse had no position in any stock mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »