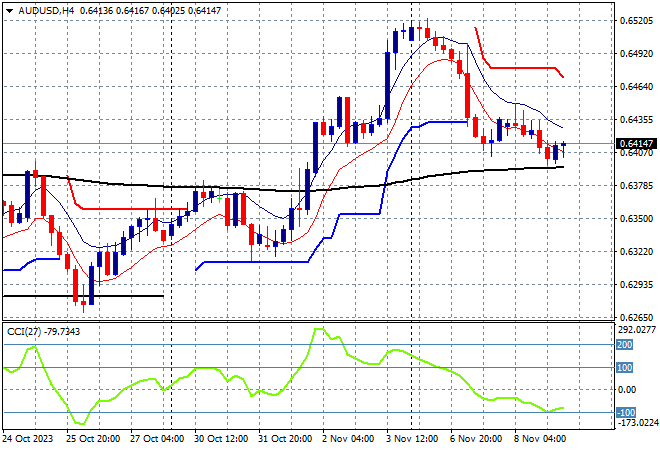

Asian share markets are moving back into a positive mood despite a wobbly Wall Street overnight as Chinese inflation dropped to the soft side yet again. The Australian dollar remains at a weekly low following the expected RBA rate rise at just above 64 cents.

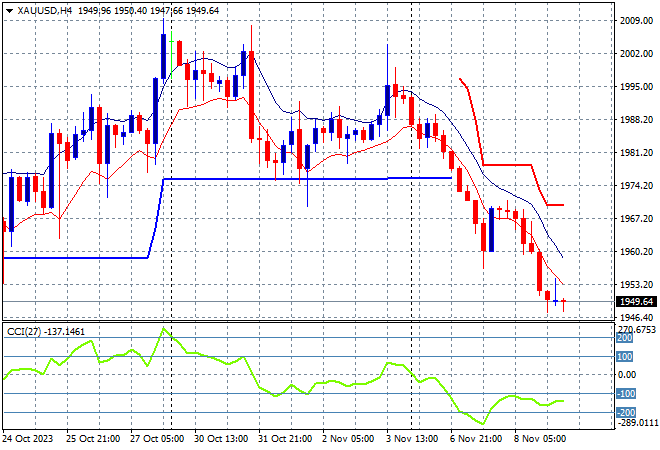

Oil prices are failing to stabilise, with Brent crude remaining below the $80USD per barrel level while gold is also dropping back, currently just below the key $1950USD per ounce level to take out short term support:

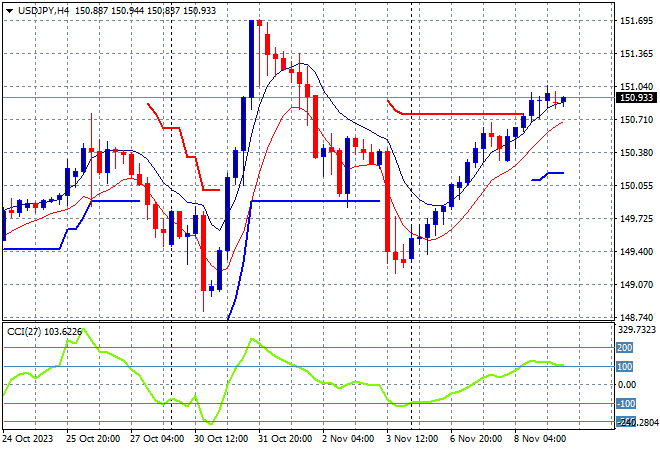

Mainland Chinese share markets are still treading water with the Shanghai Composite up only 0.1% at 3055 points while in Hong Kong the Hang Seng Index continues to slide, down 0.3% to 17513 points. Japanese stock markets finally rebounded on the weaker Yen with the Nikkei 225 gaining just over 1% to 32534 points while the USDJPY pair continues its recovery to almost breach the 151 level:

Australian stocks were finally able to push the ASX200 back above the 7000 point level with a 0.2% gain while the Australian dollar is just holding on above the 64 cent level:

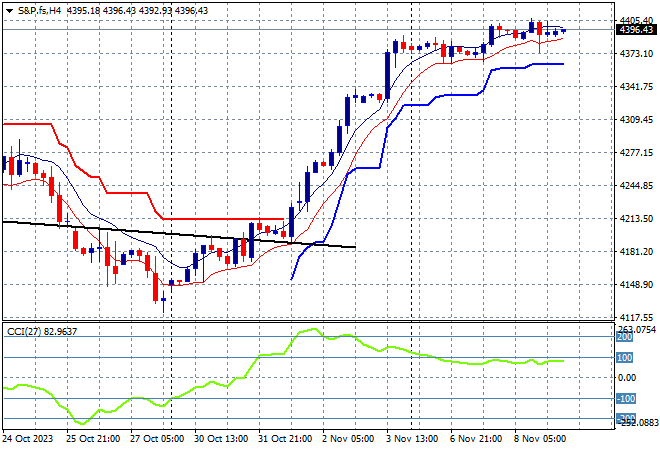

S&P and Eurostoxx futures are holding steady going into the London open as the S&P500 four hourly chart shows support firming as price action slowly moves up a series of small steps following last week’s rebound above the 4300 point level:

The economic calendar includes US initial jobless claims plus quite a few Fed speeches.