Street Calls of the Week

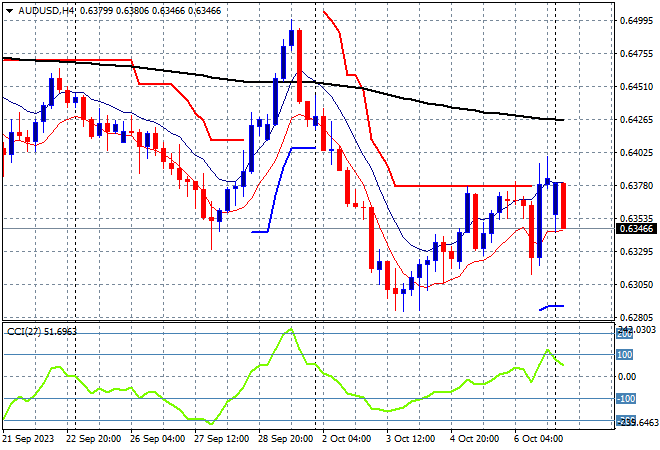

Asian share markets are mixed given the lack of trading across most of the region due to holidays in Japan and China, although mainland were open and drifted lower due to macro concerns around the attacks on Israel over the weekend. The Australian dollar pulled back most of its post-Friday climb due to the US jobs report, currently hovering around the mid 63 cent level.

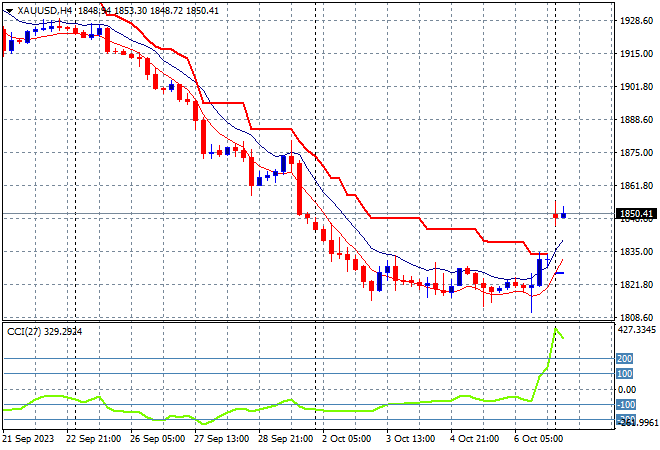

Oil prices gapped at least 4% higher across both markers on the attacks, with Brent crude spiking above the $87USD per barrel level while gold too saw a big gap after its big fill on Friday night, currently trading above the $1850USD per ounce level:

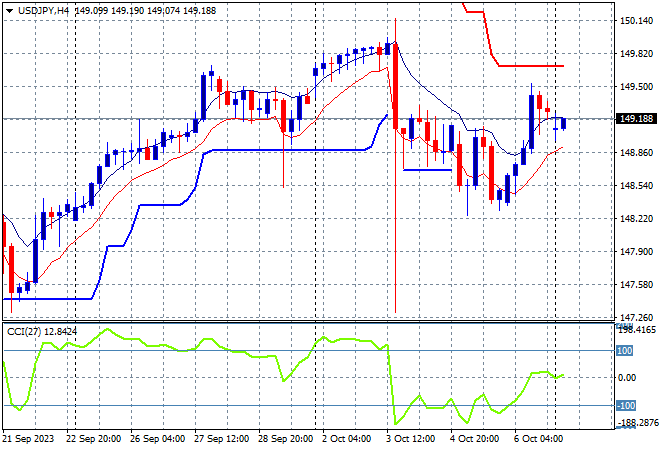

Mainland Chinese share markets are falling going into the close with the Shanghai Composite down 0.6% to 3088 points while in Hong Kong the Hang Seng Index is closed. Likewise Japanese stock markets are closed due to a holiday while thin trading in the USDJPY has seen a modest gain above the 149 level:

Australian stocks were able to claw a positive session, but only just, with the ASX200 about to close just 0.2% higher at 6968 points while the Australian dollar gapped above the mid 63 level alongside other major currency pairs as USD sells off:

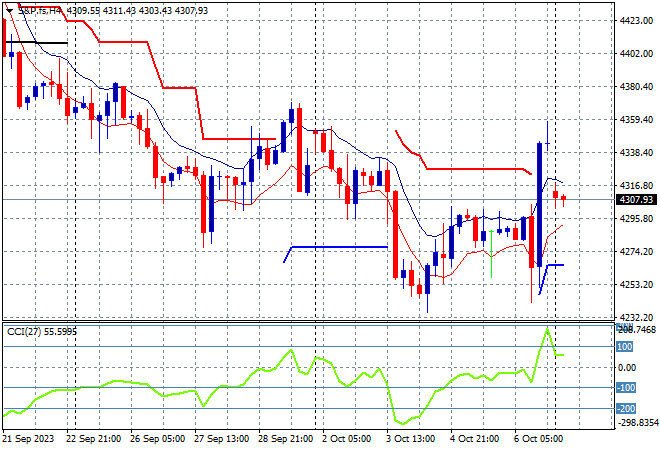

Eurostoxx and S&P futures are down at least 0.5% or so with the S&P500 four hourly chart showing a pullback to the 4300 point area after a solid session on Friday night:

The economic calendar is very light on following the US jobs report as usual, with some Fed member speeches and not much else.