The poor start to the trading week has been reversed and then some with Asian share markets higher and stronger across the region despite the mixed lead from Wall Street overnight. A new round of earnings will hit US stocks tonight with expectations dampened somewhat, but most banks calling for higher results across the indicies. The USD remains somewhat firm after the weekend gap but some majors are coming back as Euro in particular stabilises while the Australian dollar is just holding above the 67 cent level.

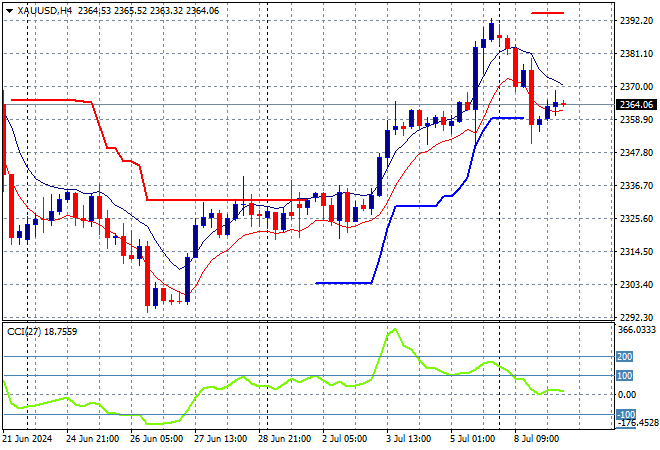

Oil prices are failing to hold at their recent highs with Brent crude still below the $86USD per barrel level while gold is trying to comeback after its poor start to the week, steady at the $2360USD per ounce level:

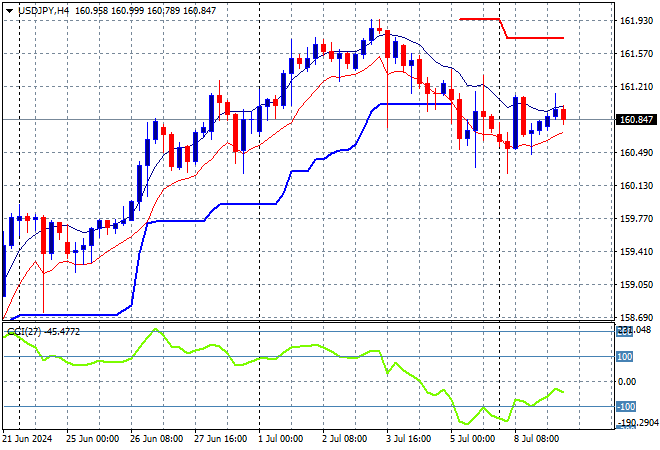

Mainland Chinese share markets are heading higher later in the session with the Shanghai Composite up more than 1% while the Hang Seng Index is steady at 17542 points. Meanwhile Japanese stock markets are doing the heaviest of lifting with the Nikkei 225 up nearly 2% or so to 41580 points as the USDJPY pair remains below the 161 level but slightly up on the weekend gap due to the stronger USD:

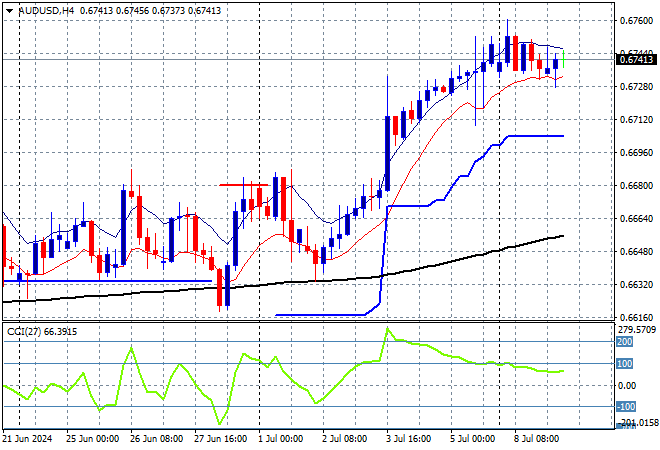

Australian stocks are bouncing back as well with the ASX200 gaining just over 0.8% to 7829 points while the Australian dollar is holding steady above the 67 cent level, wanting to hold on to its recent breakout:

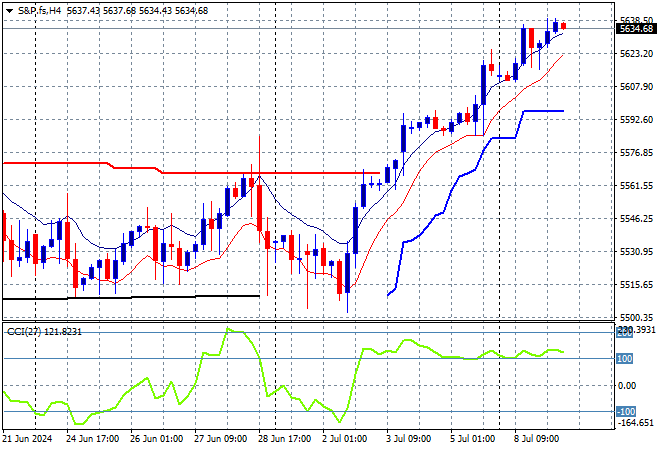

S&P and Eurostoxx futures are down slightly as we head into the London session with the S&P500 four hourly chart showing price action wanting to advance above the 5500 point level which continues to act as support:

The economic calendar is relatively empty until later in the session with a testimony by Fed Chair Powell.