Stock markets are looking healthier throughout Asia as the latest Chinese inflation print came in softer than expected while Wall Street is still waiting on next week’s FOMC meeting before ramping up its recent rally. Japanese bourses have shrugged off their recent selling while local stocks are still looking weak as the Australian dollar surges above the 67 cent level.

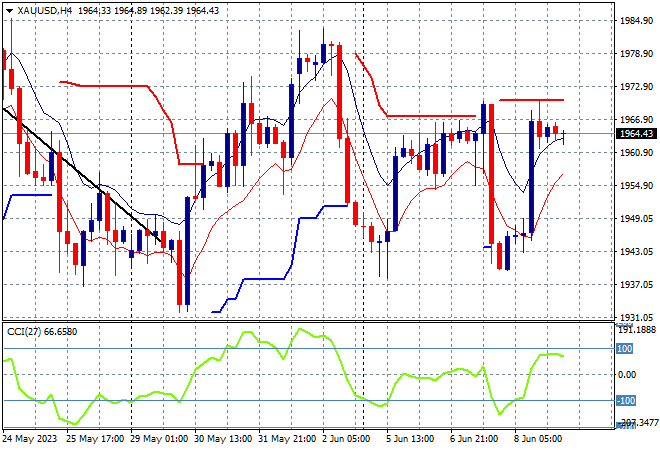

Oil prices are retracing slightly with Brent crude holding just at the $75USD per barrel level while gold is trying to claw back its mid week losses, but unable to make a new weekly high at the $1960USD per ounce level:

Mainland Chinese share markets are lifting going into the close with the Shanghai Composite up 0.3% to get back above the 3200 point level while the Hang Seng Index is up a similar amount to remain well above the 19000 point level.

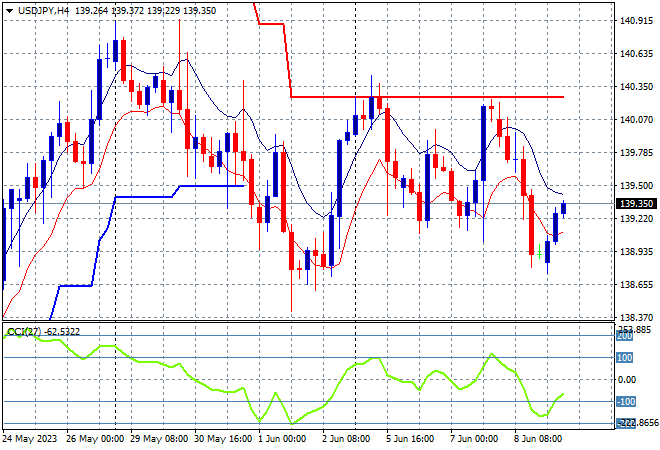

Japanese stock markets are back with a vengeance with the Nikkei 225 up more than 1.8% to almost recover its recent losses, currently at 32225 points as the USDJPY pair bounces back slightly after pushed below the 139 level overnight:

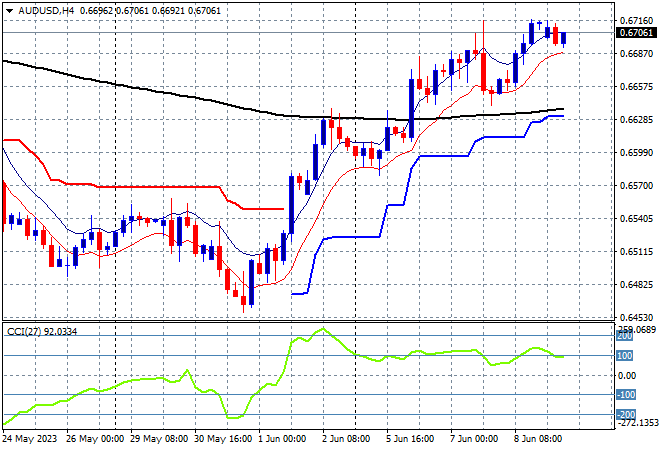

Australian stocks are putting in a minor positive session to finish the trading week with the ASX200 about to close 0.3% higher at 7122 points. The Australian dollar is holding on above the 67 handle after a minor selloff in USD overnight, building on its post RBA rate rise gains:

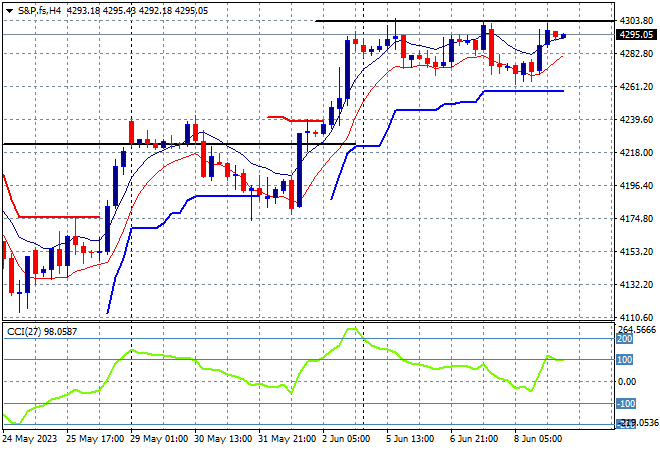

Eurostoxx and S&P futures are lifting slightly going into the London open with Wall Street trying hard to hold on to its post NFP bounce going into next week’s FOMC meeting after last night’s initial jobless claim surprise.

The S&P500 four hourly chart is showing a desire to get back to the 4300 point level after bursting through resistance at the 4200 area on Friday night, but is not yet making new session highs:

The economic calendar finishes the week with Canadian unemployment and private US oil rig count.