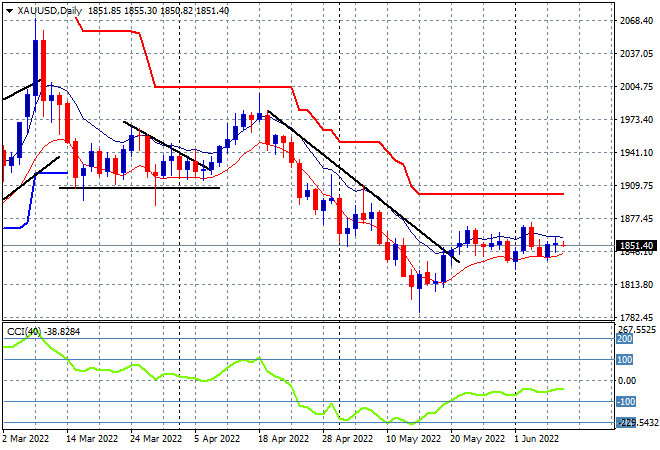

Asian share markets are wavering in confidence today after a poor lead from Wall Street overnight, with growth and inflation concerns, combined with higher commodity prices, not helping risk taking. The USD is on a tear against Yen, while the Australian dollar is slowly deflating below the 72 cent level against King Dollar. Oil prices are drifting higher as the energy crisis continues, with Brent crude well above the $123USD per barrel level while gold is still stabilising here at the $1850USD per ounce level:

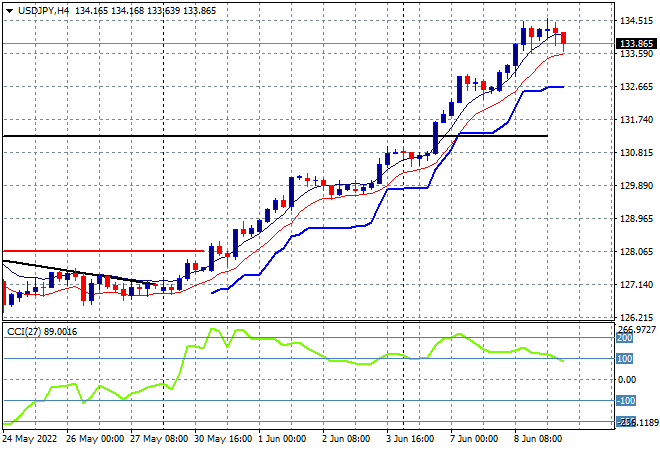

Mainland Chinese share markets fell sharply after the lunch break with the Shanghai Composite currently down 0.6% to 3243 points while the Hang Seng Index has given back more than half of its previous gains, down over 1% to retrace below the 22000 point level. Meanwhile Japanese stock markets are the only positive bourses of note, with the Nikkei 225 index closing just 0.1% higher at 28266 points while the USDJPY pair has finally put on the brakes after lifting through the 134 level overnight, slipping back below there this afternoon:

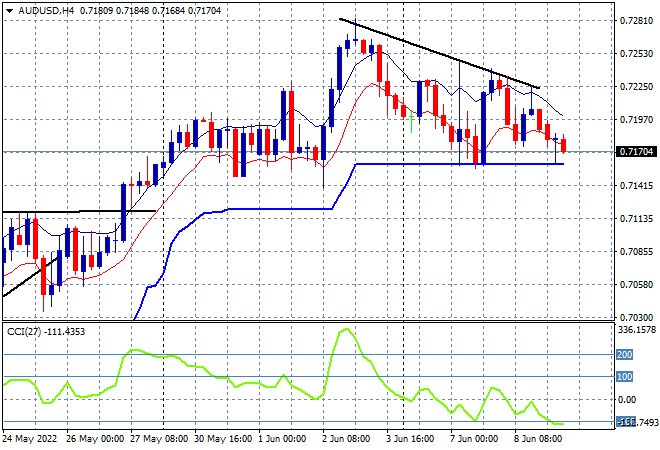

Australian stocks were the biggest losers again with the ASX200 losing almost 1.5% to finish at 7019 points while the Australian dollar is deflating again, moving below the 72 level against USD and almost back to weekly support at the mid 71 level that is now under direct threat:

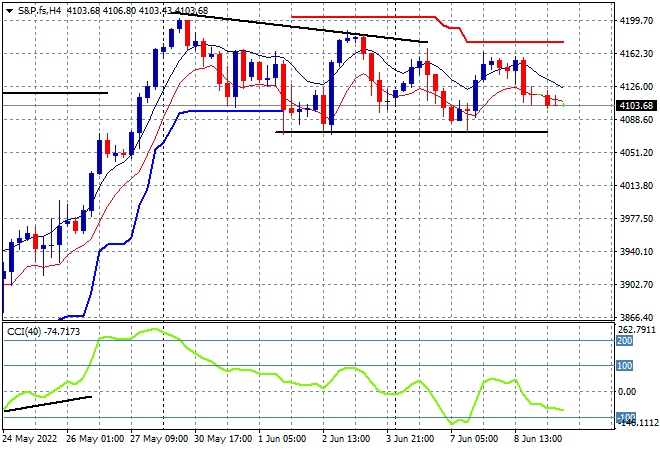

Eurostoxx and Wall Street futures are drifting lower as we head into the European open with the S&P500 four hourly futures chart showing price just holding around the start of week level, but still unable to make a new intrasession high. Key support at the 4100 point level is the area to watch with short term momentum slowly moving to the negative zone as upside potential evaporates:

The economic calendar will focus squarely on tonights ECB meeting, followed by US initial jobless claims.