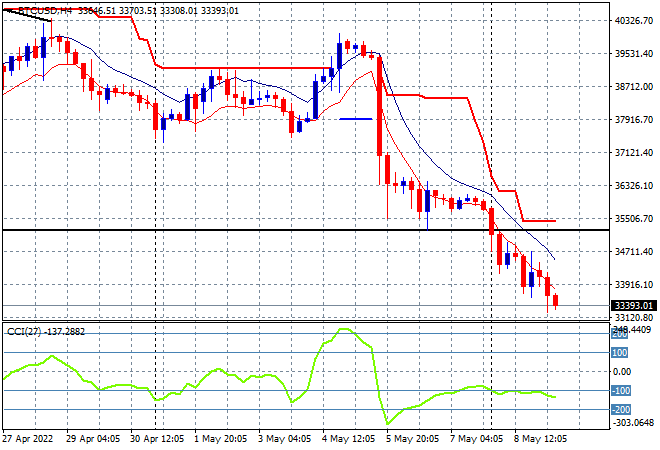

Its another sea of red out there for Asian stocks as we start the new trading week in the shadow of big falls on European and US share markets on Friday night as the latest US jobs report solidifies the Fed’s stance on hiking rates. All the major currency pairs continue to fall with the Australian dollar just crossing below the 70 handle while oil markets are stable, gold prices continue to falter during the Asian session, currently down to $1870USD per ounce. Bitcoin did even worse, losing over 5% to cross below the $34K level, making a new monthly low:

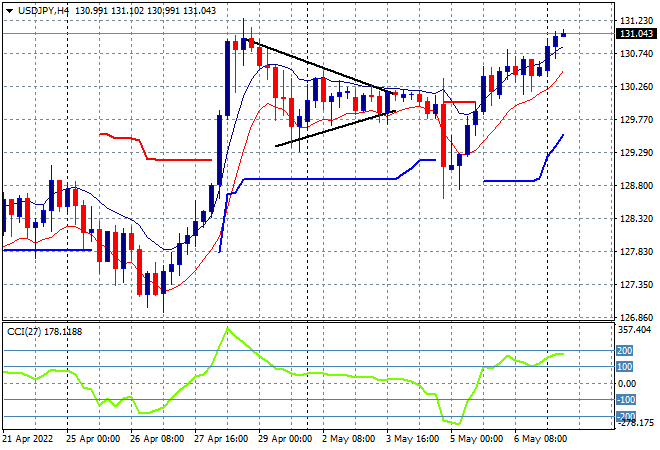

Mainland Chinese share markets are treading water with the Shanghai Composite currently putting in a scratch session at 3001 points while the Hang Seng Index is closed for the National Day holiday. Japanese stock markets have played catchup on risk aversion with the Nikkei closing 2.5% lower at 26319 points while the USDJPY pair has lifted again matching the previous weekly high, currently above the 131 level:

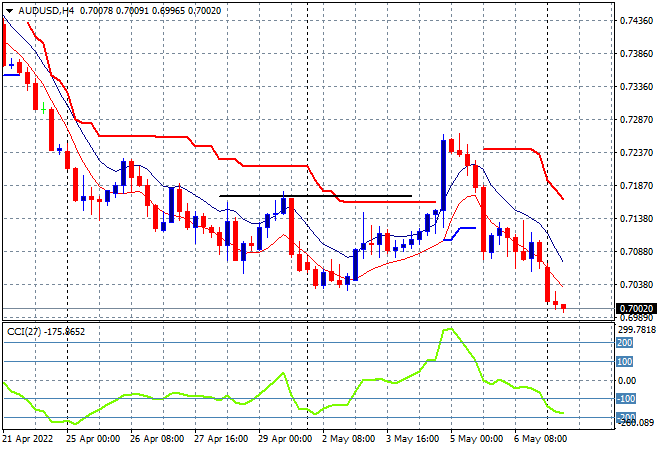

Australian stocks could not escape the risk aversion either with the ASX200 down more than 1.2% to close at 7120 points. Meanwhile the Australian dollar is also making new weekly and monthly lows, cracking through the 70 handle:

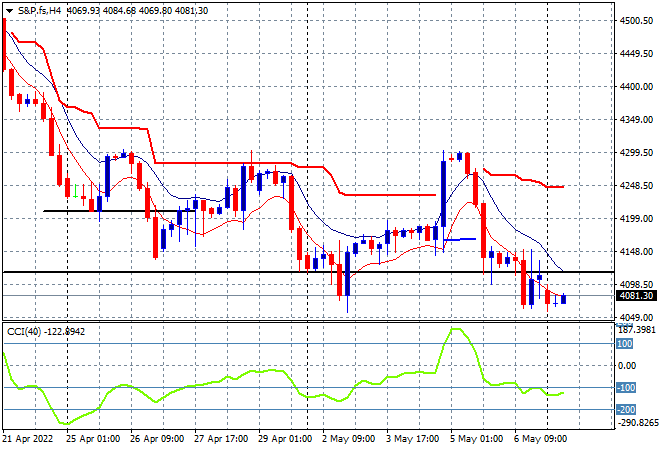

Eurostoxx and Wall Street futures are still on the floor after Friday night’s performance with the S&P500 four hourly chart showing price wanting to return to the start of last week’s low just below the 4100 point level as the 4000 point terminus looms:

The economic calendar starts the new trading week quietly with a few BOE and Fed speeches plus some Treasury auctions.