Wall Street was unable to translate its big boost from Friday night with the higher oil prices keeping risk sentiment in check. Most undollars finished the session higher with the Australian dollar breaking out above the 66 cent level.

10 year Treasury yields made a new high for 2024 above the 4.4% level while Brent crude put in a pause, starting the week out just below the $91USD per barrel level to hold on to its new monthly high. Meanwhile gold just kept on lifting higher as it builds above the $2300USD per ounce level.

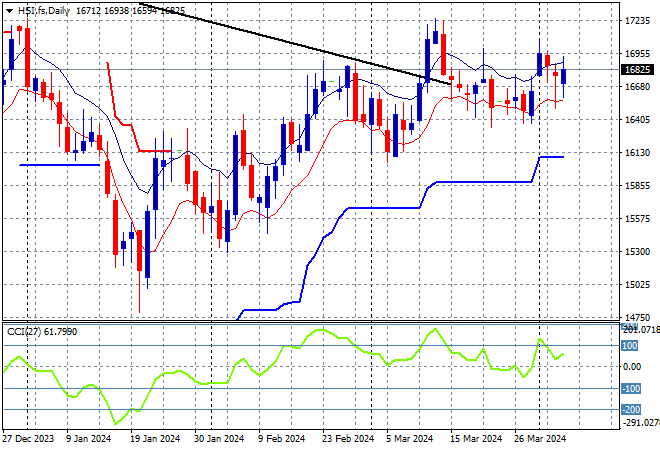

Looking at markets from yesterday’s session in Asia, where mainland and offshore Chinese share markets had a mixed start to the week with the Shanghai Composite down 0.7% while the Hang Seng Index was up by just 0.1% to 16732 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. However this has been thwarted as monthly resistance levels are kicking in, although support is firming at the 16400 point area:

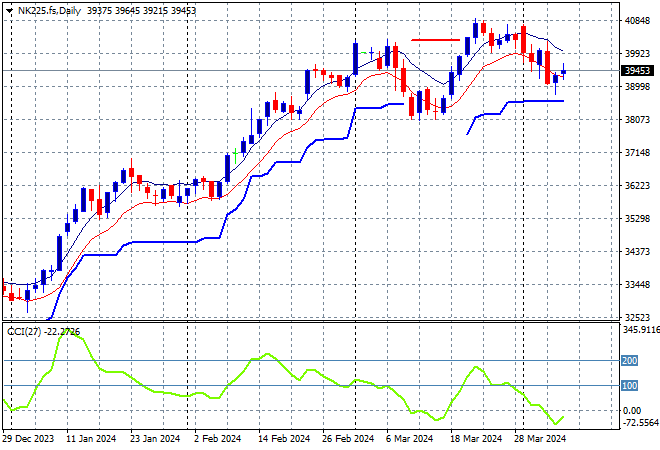

Japanese stock markets however went the other way on a weaker Yen as the Nikkei 225 closed 0.9% higher at 39347 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term resistance has been defended with short term price action now retracing to support at the 39000 point level. Watch the 38000 level for signs of a true breakdown:

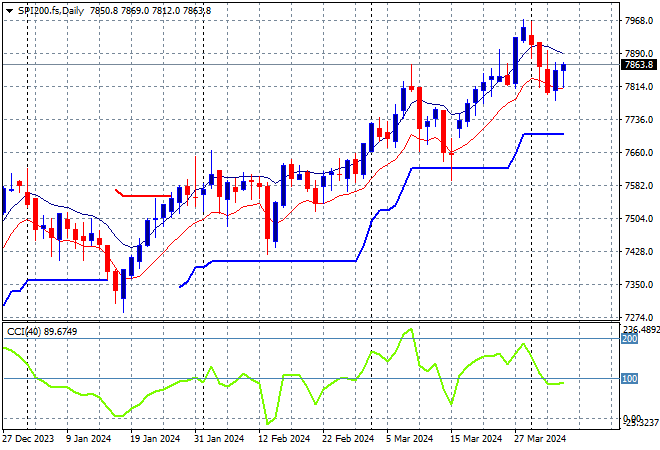

Australian stocks didn’t perform as expected with only a small recovery with the ASX200 closing 0.2% higher to 7789 points.

SPI futures however are up at least 0.4% despite Wall Street having no positive result overnight. The daily chart was looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. As I said previously, watching for any continued dip below the low moving average could see a significant pullback but watch ATR support which has been defended so far:

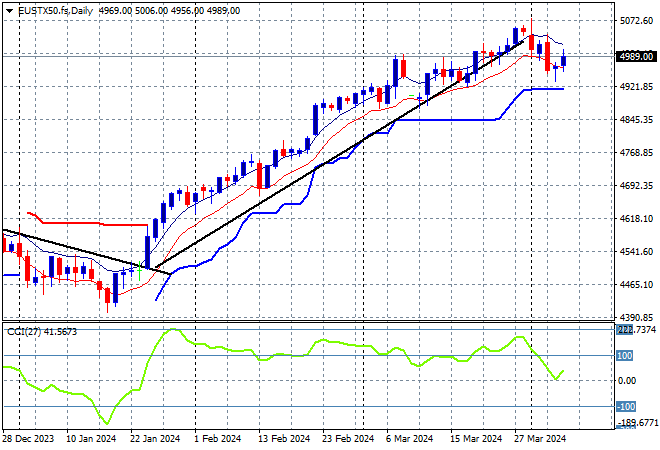

European markets mainly lifted across the continent playing catchup to Wall Street’s post NFP rally as the Eurostoxx 50 Index finished 0.6% higher at 5046 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs but daily momentum retracing well out of an overbought phase. This was looking to turn into a larger breakout but a retracement back to short term support could give the market some breathing room. Futures are now indicating a small lift higher tonight but Wall Street’s lack of gains may drag this back:

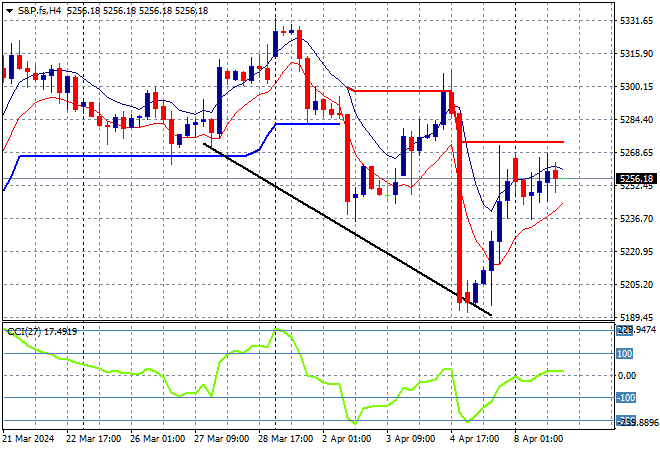

Wall Street struggled however after a very solid finish to the trading week, starting the new one with mixed results as the NASDAQ put on only a handful of points while the S&P500 lost a handful of points to finish just above the 5200 point level.

The daily chart previously showed a consolidation that could have turned into a proper reversal here as price action broke below short term support as momentum became somewhat oversold. As I said previously, a break below the 5240 point area has setup for further downside but this has been thwarted so far:

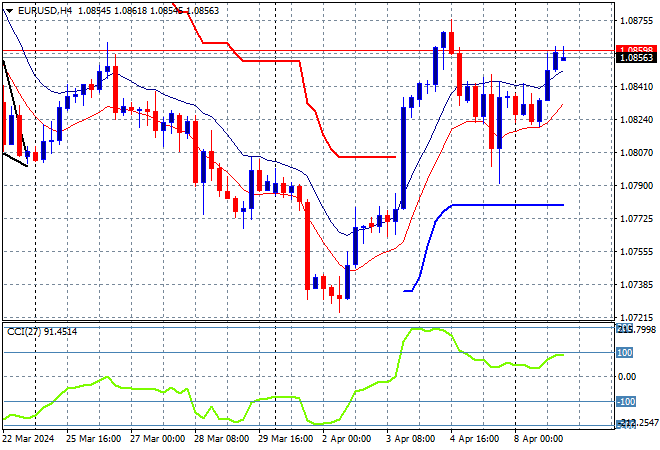

Currency markets are swinging back to an anti-USD mood despite the strong US jobs print on Friday night with pressure now mounting as various undollars broke out overnight. Euro pushed back above the 1.08 handle as a result.

The union currency had bottomed out at the 1.07 level as medium term price action was always suggesting a return to or below that level but this reversal in price action momentum in the short term is likely to see the 1.09 level come under threat next:

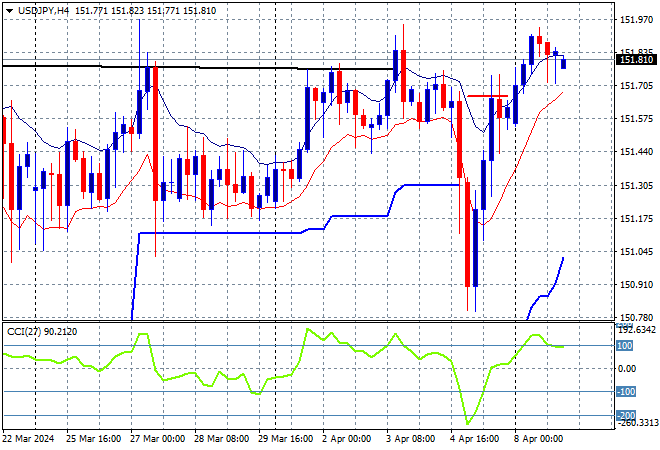

The USDJPY pair had put in roller coaster before the US jobs print and has been able to get back to its previous highs just below the 152 level as it again comes up against strong overhead weekly resistance (horizontal black line on chart below).

The medium term picture remains somewhat optimistic as Yen sold off due to BOJ meanderings but momentum is now trying to get out of oversold mode while ATR support remains firm but under pressure at the 151 handle proper:

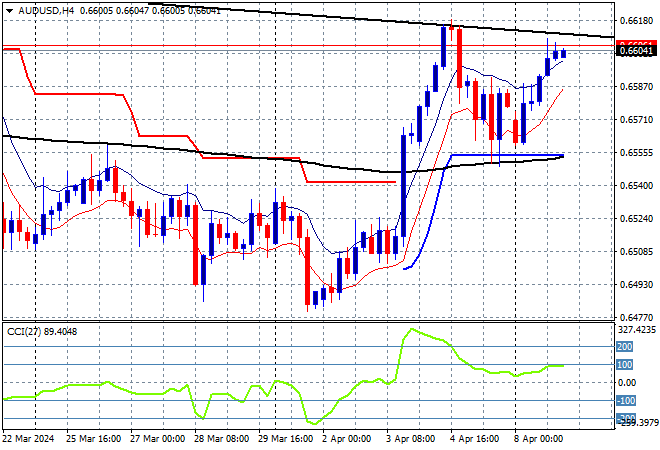

The Australian dollar was one of the weaker undollars from Friday night, but was able to breakout slightly overnight to just get above the 66 handle to remain above short term support.

The Aussie has been under medium and long term pressure for sometime before the RBA and Fed meetings and while the previous temporary surge looked strong, it wasn’t overbought on the four hourly chart and had not surpassed support from last week’s consolidation phase. While this looks good in the short term, longer term resistance is likely to kick in at the 66 cent handle:

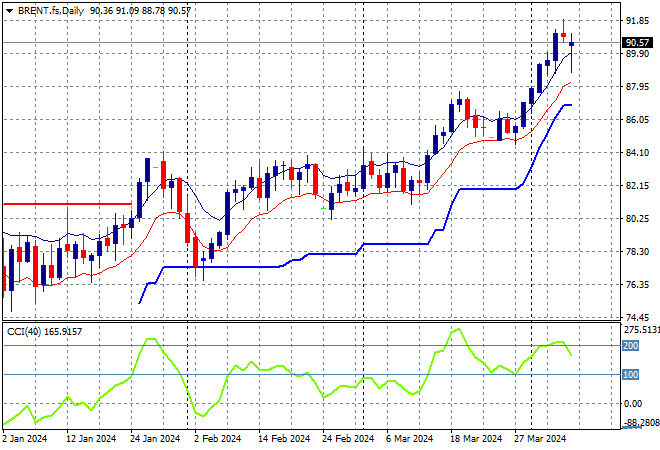

Oil markets are pausing their breakouts following the attacks on Russian refineries with Brent crude steadying just below the $91USD per barrel level over the weekend, capping off a very strong week of gains.

After retracing down to trailing ATR daily support at the $77 level, price had been bunching up around the February highs at the $84 level with short term momentum definitely overbought and signalling potential upside from here, although now well overextended. I expect a further pause or mild retracement in this trading week:

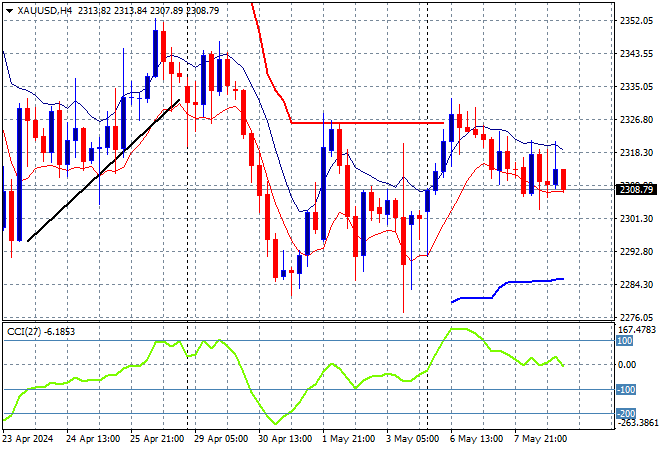

Gold just keeps climbing to new highs through any volatility, pushing aside the USD to remain above the $2300USD per ounce level, closing at $2338 overnight.

In the previous week momentum was nearly off the charts – never a good sign – with short term support at the $2100 level turning to what could be rock solid medium term support but still the critical area to watch ahead on a likely pullback due to excessive volatility.