Asian share markets are doing much better given the stronger result on Wall Street overnight plus the return of Japanese markets. A slightly weaker USD is also seeing the Australian dollar lift higher but remains stuck below a short term resistance level but still just above the 67 cent level in afternoon trade.

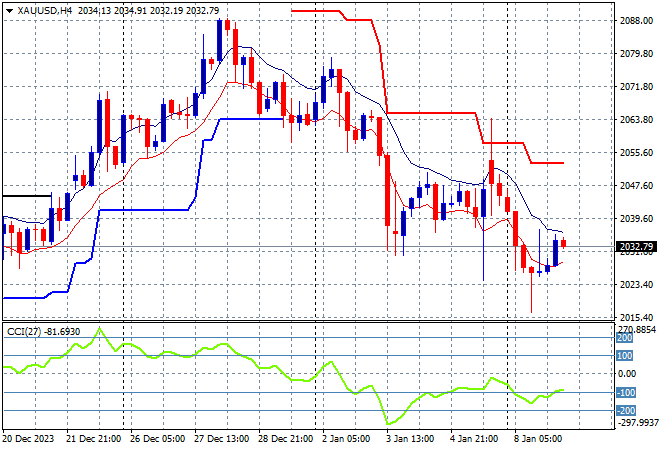

Oil prices are pulling back with Brent crude heading back to the $76USD per barrel level while gold is lifting slightly on some weak USD action, after nearly breaking down to the $2000USD per ounce level, currently hovering above the $2030USD per ounce level:

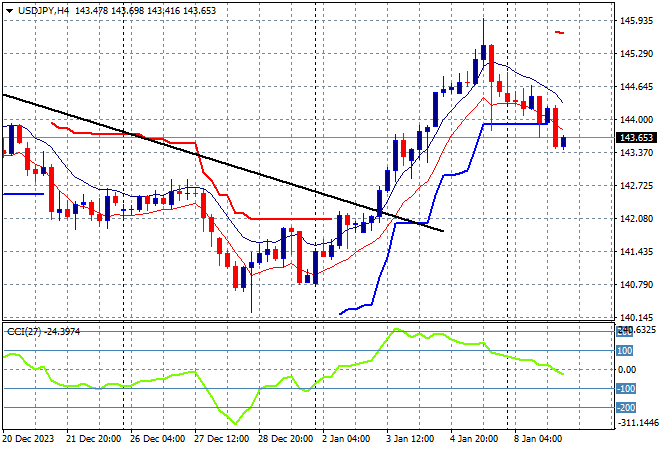

Mainland Chinese share markets were up initially but have fallen back in afternoon trade as the Shanghai Composite again retreats below the 2900 point barrier, currently some 0.2% lower at 2882 points while in Hong Kong the Hang Seng Index is down slightly to 16242 points. Japanese stock markets have reopened and played catchup with the Nikkei 225 closing some 1% higher at 33745 points with the USDJPY pair however in retreat as it goes below the 144 level:

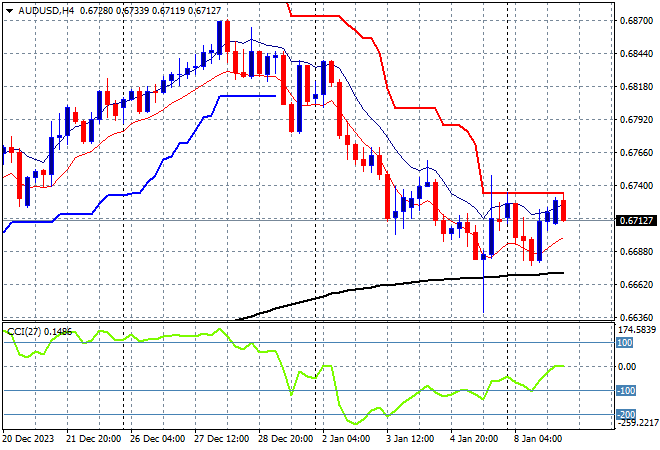

Australian stocks were finally able to get moving, with the ASX200 closing 1% higher at 7520 points while the Australian dollar has tried to breakout above the 67 handle in afternoon trade, but remains under resistance at the 67.40 level:

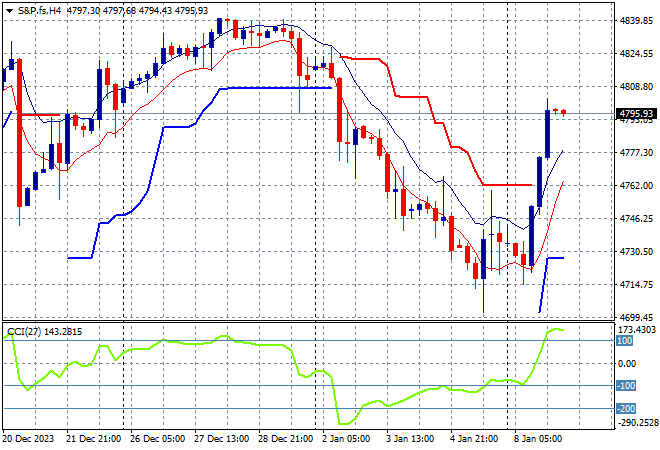

S&P and Eurostoxx futures are holding on to their gains from overnight trade but not making any further advances with the S&P500 four hourly chart showing an attempt to get back to the start of year position above the 4800 point level with short term momentum very overbought:

The economic calendar includes Euro wide unemployment and a few Fed speeches.