Risk sentiment is doing better as markets anticipate tonight’s US jobs report with US bond markets calming done after a drop in yields earlier in the week. Wall Street finally found a bid, helped by tech stocks while European bourses had a breather as the USD also fell back a little helping Euro pause its dramatic decline. The Australian dollar was also able to climb out of its recent rut to just break through the 66 cent level this morning.

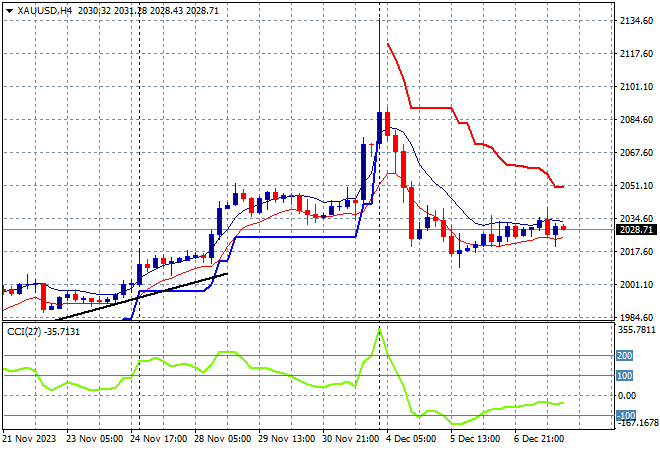

US Treasury yields saw a slight pullback across curve as 10 year Treasuries stabilised around the 4.1% level while oil prices are trying to also calm down recent volatility with Brent crude hovernign just above the $74USD per barrel level. Gold’s blowout and subsequent reversal on the Monday morning open is still consolidating but slowly getting back on trend with a slight rise to the $2030USD per ounce level.

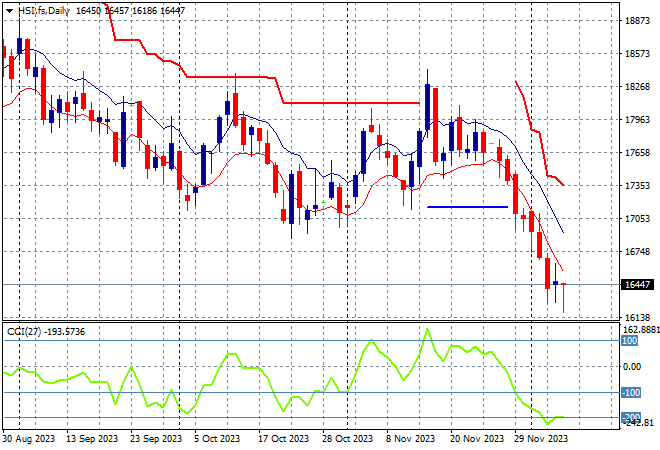

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were unable to close higher with the Shanghai Composite down marginally to 2966 points while in Hong Kong the Hang Seng Index gave back most of its recent rebound, down 0.7% to 16345 points.

The daily chart was showing a significant downtrend that had gone below the May/June lows with the 19000 point support level a distant memory as medium term price action remained stuck in the 17000 point range before this new losing streak. Daily momentum readings are solidly back to oversold settings with price action now below the October lows, but possibly stabilising here:

Japanese stock markets were also in a tizzy, with the Nikkei 225 down nearly 1.8% to 32858 points.

Trailing ATR daily support is now being threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum now fully retracing from the overbought zone. Correlations with a stronger Yen are in play again as I remain wary of a selloff back to ATR support at 32000 points:

Australian stocks were able to escape the selling but only just with the ASX200 closing 0.1% lower to remain above the 7100 point level at 7173 points.

SPI futures are indicating at least a 0.2% drop on the open, despite the bounce on Wall Street overnight. The daily chart is again looking more optimistic here in the medium term with short term price action filling a hole against the tide and firming somewhat here with a possible reverse head and shoulders pattern forming, but resistance at 7200 points is looming overhead:

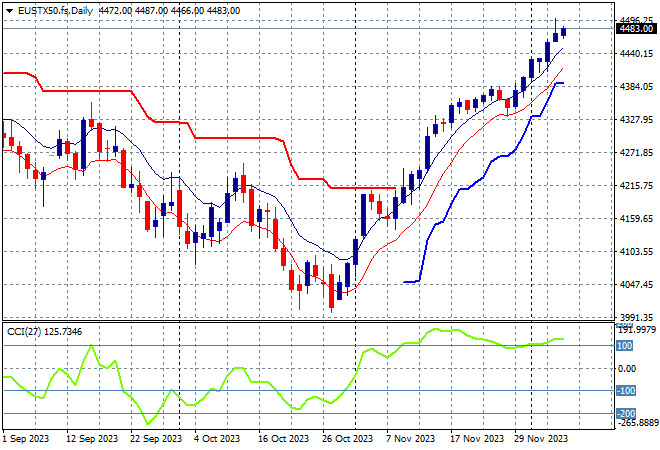

European markets were able to pause slightly following their recent good sessions with scratch results across the continent, as the Eurostoxx 50 Index eventually finished 0.2% lower at 4473 points.

The daily chart shows weekly resistance at the 4300 point resistance level taken out with this large bounce setting up for further gains as momentum remains quite firm and nice overbought. Support is now upgraded to at least the 4300 point level and despite Euro rebounding overnight there are no roadblocks here until tonight’s NFP:

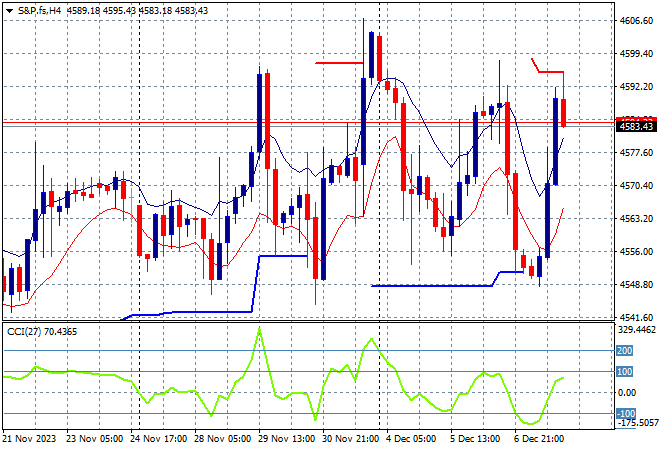

Wall Street found some positive momentum with tech stocks leading the way as the NASDAQ surged nearly 1.4% while the S&P500 gained 0.8% to close at 4585 points, just shy of a new weekly high.

Short term momentum is now back into positive territory with another swing play bouncing off trailing ATR support on the four hourly chart. Key support at the 4540 point area has not been breached yet despite this volatile shake out in the past few sessions, but watch out for any break above the 4600 point area tonight:

Currency markets saw a slight pullback in the US Dollar Index overnight with USD seeing a retracement against Euro mainly which finally paused its fall lower with a bounce off the new weekly that still failed to get back above the 1.08 handle.

The union currency remains well below its recent weekly lows after topping out at the 1.10 level earlier last week, as it failed to maintain momentum above the daily trendline. Short term momentum is now setting up a swing play from being well oversold but tonight’s NFP could turn this into a dead cat bounce:

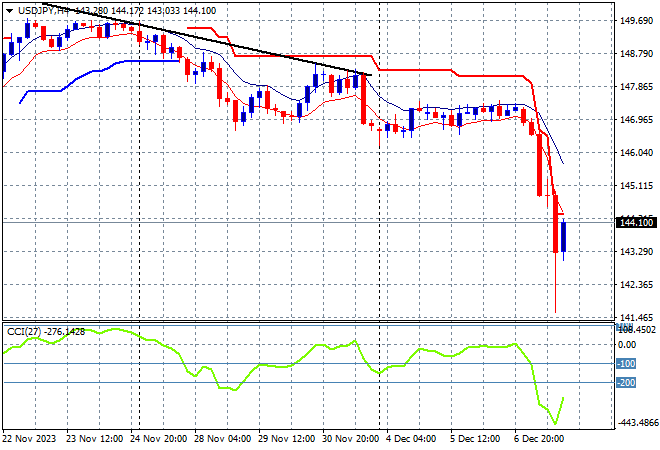

The USDJPY pair conversely saw a big rise in Yen after some BOJ machinations yesterday with a drop straight down to the 141 handle and a subsequent bounce back to the 144 level as of this morning.

Four hourly momentum showed the way with price action unable to breach trailing ATR resistance but this is a very volatile situation so watch for a potential break above the 144 level in today’s session before more volatility this evening:

The Australian dollar is also on the rebound in a big play overnight, surging back to the 66 handle against USD but still not quite into positive short term momentum territory.

The Pacific Peso remains under medium and long term pressure with short term momentum trying to get back into more sustainable upside zone but the recent failure to breach the 67 cent level remains telling. I’m still watching for a further pullback to the November lows:

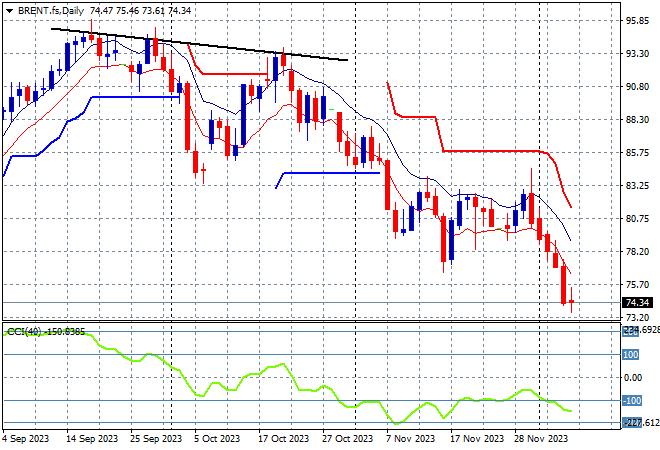

Oil markets remain volatile with the growing conflict in the Middle East and potential OPEC with another down session overnight with Brent crude pushed below the $75USD per barrel level.

After almost reaching $100 in mid September, price was looking to return to the August levels around the $85 area where a point of control had been established before the recent breakout. Daily momentum is still in oversold settings with this failed test of support at the August level setting up for further falls below:

Gold is again quite calm following its recent wild ride with its previous surge through the $2100USD per ounce level now contained and brought back to last week’s price action area of support just below the $2030 level, but is starting to slowly climb higher again.

Watch out for more profit taking if price action breaks below trailing ATR support and of course, the magical $2000 level: