Asian share markets are in mixed form going into the final session of the week as Yen tries to stabilise following big gains against USD while risk sentiment in China remains quite negative. Traders are positioning for tonight’s US employment print – the non farm payroll report – which could come in a lot softer than expected.

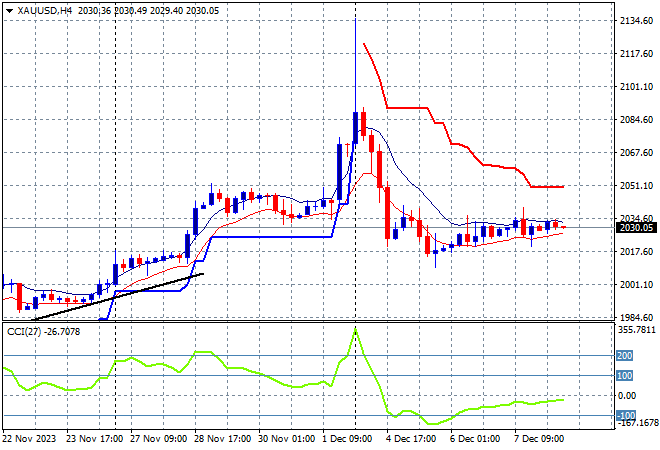

Oil prices are starting to rebound after some steep falls this week with Brent crude about to break above the $76USD per barrel level while gold is slowly inching higher having exploded in recent sessions to new record high with some heat taken out around the $2030USD per ounce level:

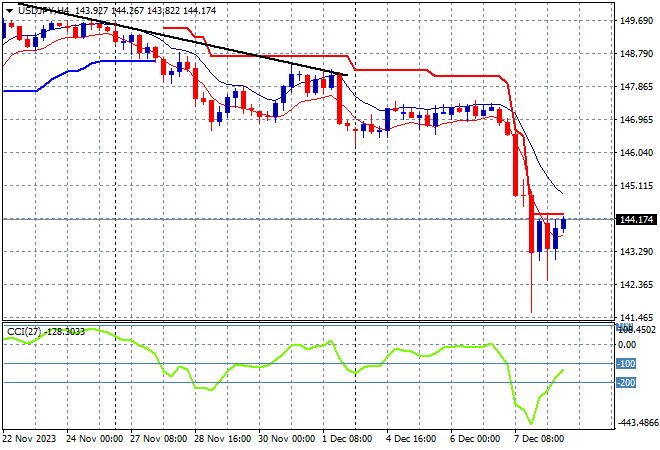

Mainland Chinese share markets have given up most of their gains going into near the close with the Shanghai Composite up just 0.2% to 2969 points while in Hong Kong the Hang Seng Index is also putting in a scratch session as it remains in deep trouble, currently at 16313 points. Japanese stock markets are falling the most as the BOJ angles for more moderation, with the Nikkei 225 down nearly 1.8% to 32307 points while the USDJPY pair is trying to steady at the 144 handle after some recent epic volatility:

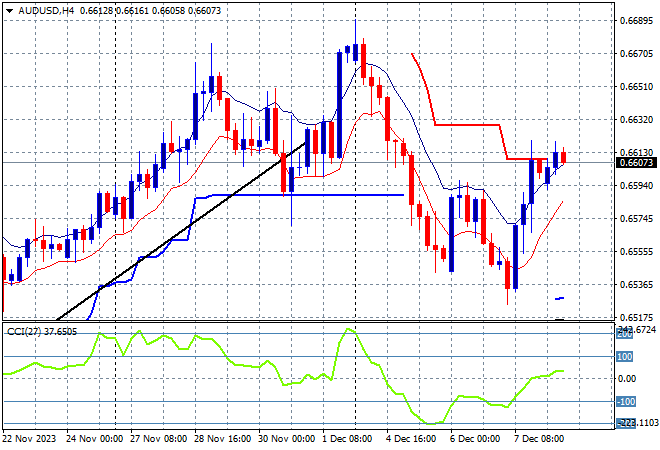

Australian stocks were able to escape the selling again with the ASX200 closing 0.3% higher to almost breach the 7200 point level at 7193 points while the Australian dollar is continuing its rebound but can’t find more upside above the 66 cent level as traders await tonight’s NFP print:

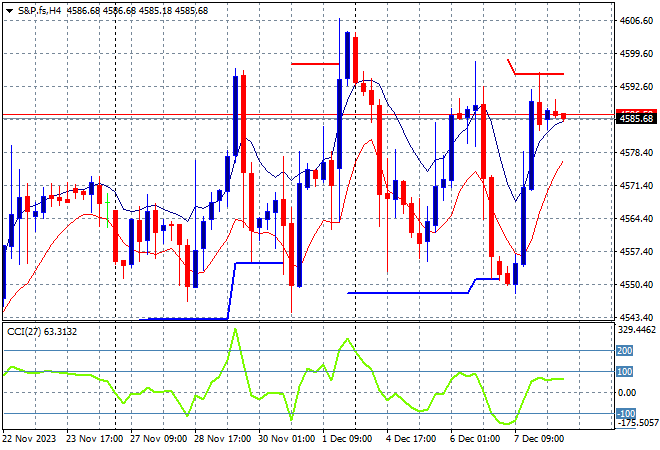

S&P and Eurostoxx futures are steady going into the London open as the S&P500 four hourly chart shows support still firm at the 4500 point level with price action trying to test recent session highs at the 4600 point level as this see-saw horizontal pattern continues:

The economic calendar finishes the week with the big one on the calendar – US jobs or non-farm payrolls – which will set the risk sentiment for the remainder of the trading year.