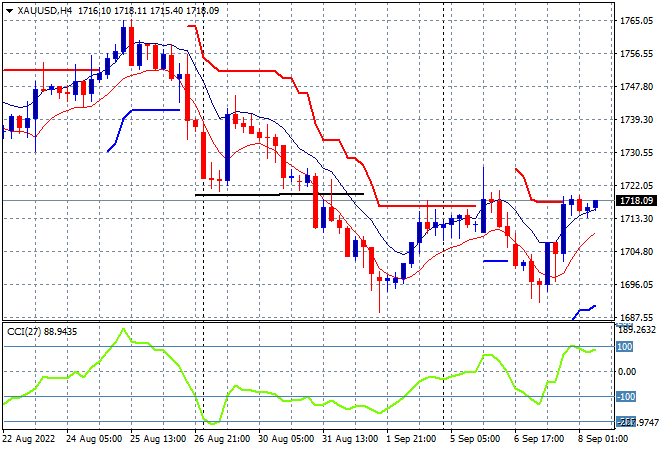

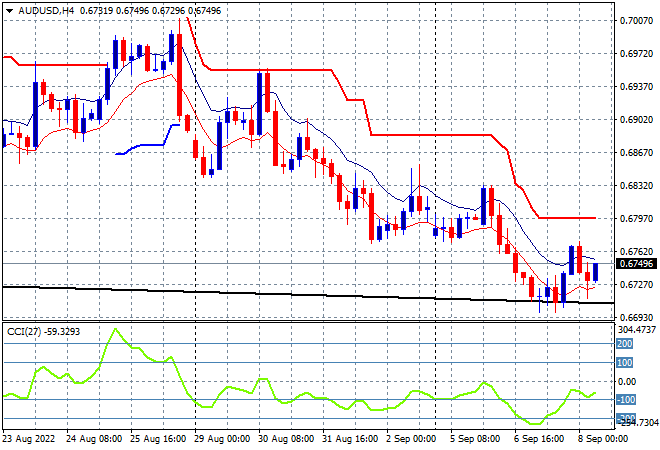

Asian stocks have rebounded in line with Wall Street although hesitation abounds in China with Japanese shares leading the charge despite a slightly higher Yen. The USD has taken back most of its overnight losses, at least against the Australian dollar which remains depressed at just over 67 cents. Meanwhile oil prices are steady but uneasy with Brent crude still just on the $88USD per barrel level while gold has returned to its intraweek high just below the $1720USD per ounce level:

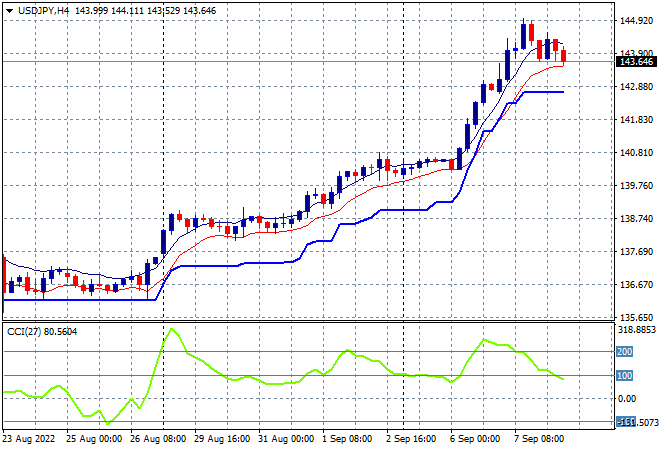

Mainland Chinese share markets are having a mild pullback with the Shanghai Composite down 0.2% to 3238 points while the Hang Seng Index is still in sell mode, down nearly 0.7% to slump below the 19,000 point level, currently at 18983 points. Japanese stock markets are the standouts however, despite the higher Yen, with the Nikkei 225 closing 2.3% higher to 28065 points while the USDJPY pair finally is having the day off and is hovering at the mid 143 level after a big blowoff move:

Australian stocks surged back, basically in line with overseas stocks despite lower commodity prices with the ASX200 closing 1.7% higher at 6848 points. The Australian dollar is still on the ropes and looks exhausted here even after the overnight bounce, which has been pulled back to remain at the mid 67 level:

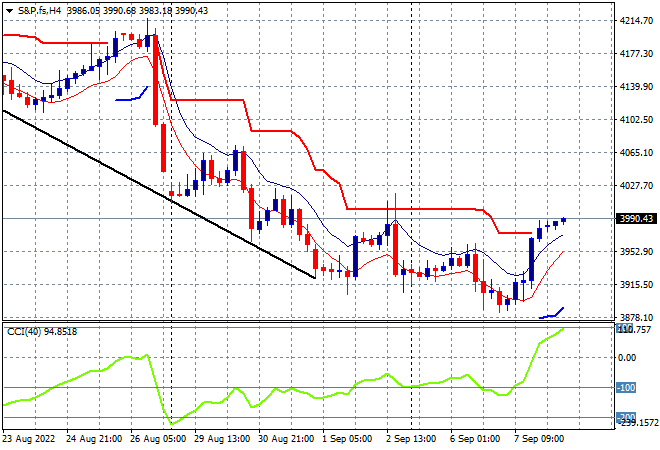

Eurostoxx and US futures are slowly heading higher after last nights rebound as we head into the London session, with the US500 four hourly futures chart showing price action still unable to punch through the 4000 point level as four hourly momentum is still a little short of being overbought as overhead resistance firms:

The economic calendar will focus squarely on the ECB meeting tonight, plus US initial jobless claims.