A bit of a sour start to the trading week with Asian share markets generally lower across the region despite the positive lead from Wall Street on Friday night as the latest US jobs print came in slightly higher than expected. This volatility is mainly due to the aftermath of French elections and some PBOC bond machinations that are dominating Chinese markets. The USD was weak against all the majors in the wake of the NFP print but has gapped slightly higher over the weekend with the Australian dollar slipping back to the 67 cent level.

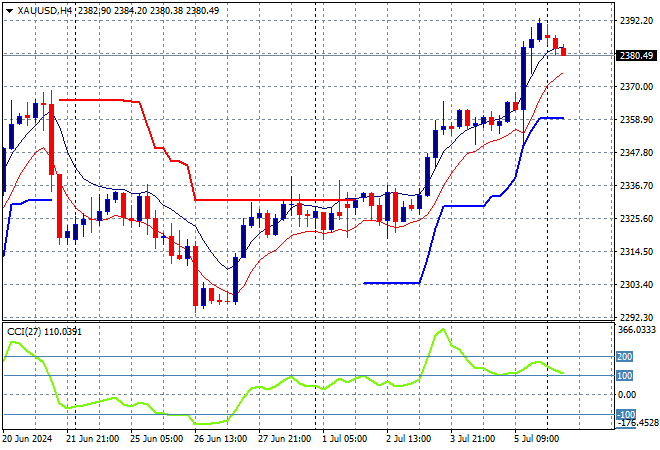

Oil prices are failing to hold at their recent highs with Brent crude down slightly to the $86USD per barrel level while gold is also slightly lower, falling back to the $2380USD per ounce level:

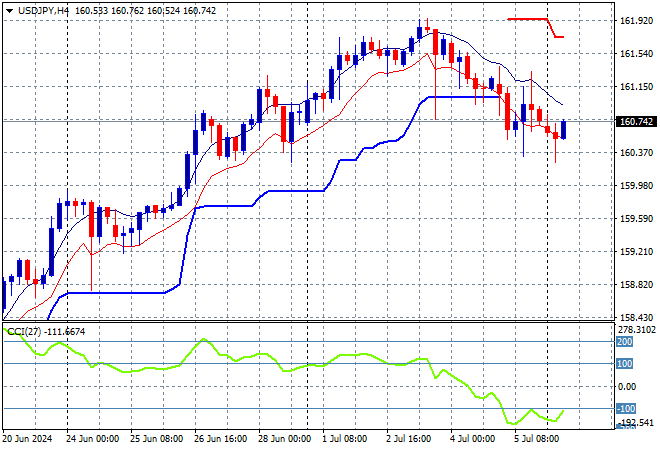

Mainland Chinese share markets are falling sharply again with the Shanghai Composite off by nearly 1% while the Hang Seng Index is down nearly 2% to 17485 points as the bears circle. Meanwhile Japanese stock markets are retracing slightly on Yen concerns with the Nikkei 225 down 0.2% or so to 40780 points as the USDJPY pair remains below the 161 level but slightly up on the weekend gap due to the slightly stronger USD:

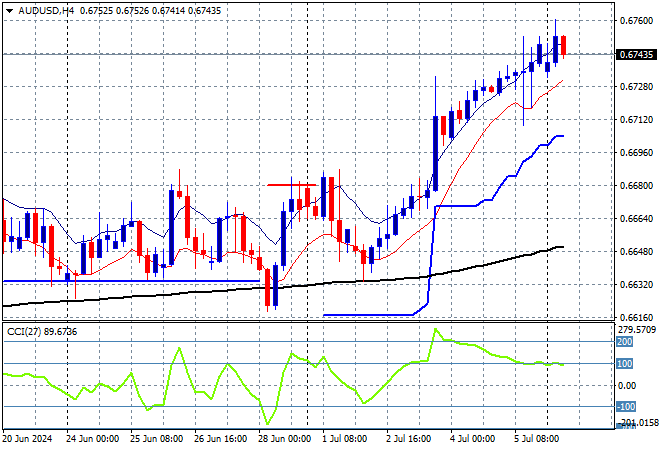

Australian stocks are also losing ground with the ASX200 falling just over 0.6% to 7763 points while the Australian dollar is holding steady above the 67 cent level, wanting to hold on to its recent breakout:

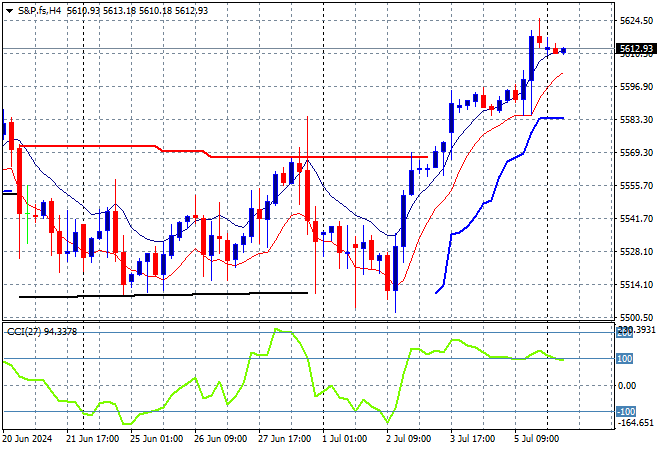

S&P and Eurostoxx futures are both down 0.2 to 0.3% or so as we head into the London session with the S&P500 four hourly chart showing price action wanting to advance above the 5500 point level which continues to act as support:

The economic calendar starts the trading week quietly as usual, following Friday’s US non farm payroll aka unemployment figures with just a few Treasury auctions.