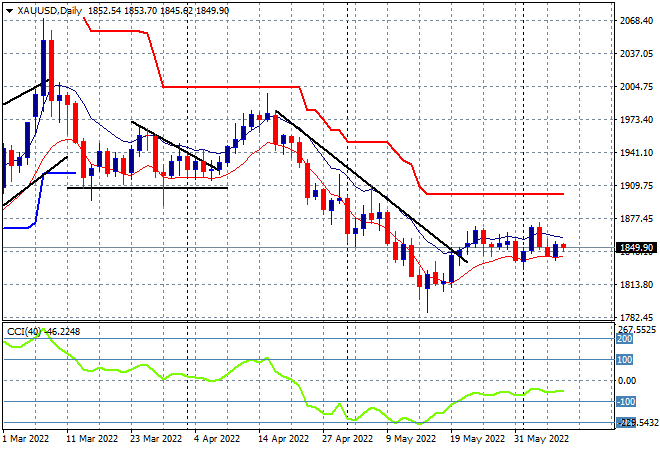

Asian share markets are doing a lot better today with a solid lead from Wall Street, combined with higher commodity prices helping the risk taking. The USD is on a tear against Yen, while the Australian dollar is hovering at the 72 cent level against King Dollar. Oil prices are drifting slightly higher as the energy crisis continues, with Brent crude well above the $120USD per barrel level while gold is still stabilising here at the $1850USD per ounce level:

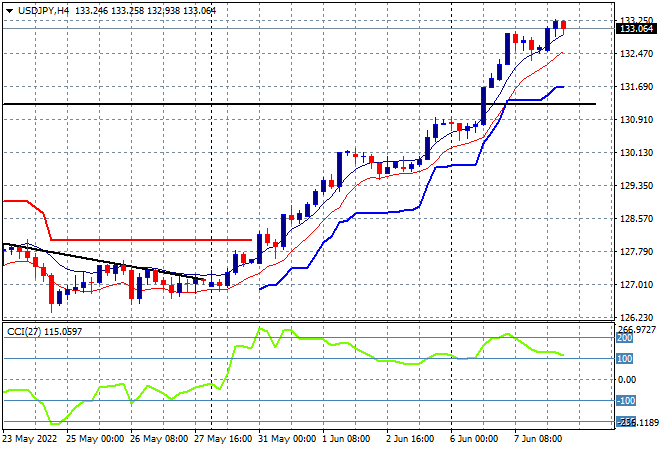

Mainland Chinese share markets are again looking to put in scratch sessions today with the Shanghai Composite currently up 0.2% to 3249 points while the Hang Seng Index has climbed nearly 2% to almost get back above the 22000 point level. Meanwhile Japanese stock markets are pushing forward again, with the Nikkei 225 index closing nearly 1% higher at 28219 points while the USDJPY pair has now lifted through the 133 level in its epic rise:

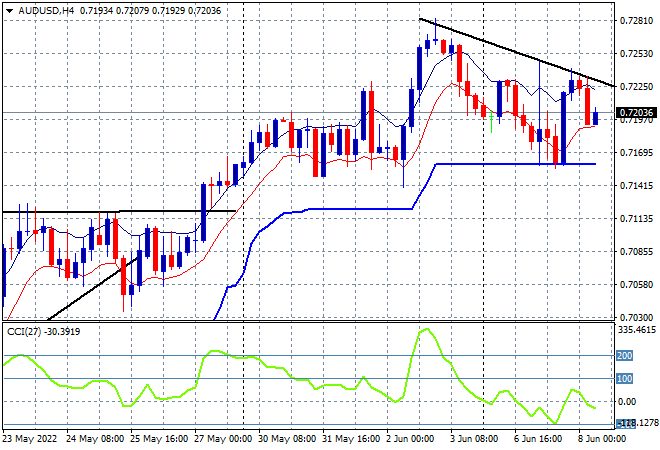

Australian stocks came back a little post the RBA rate hike palaver with the ASX200almost gaining 0.4% to finish at 7121 points while the Australian dollar is slowly deflating again, hovering just above the 72 level against USD as its weekly uptrend slowly consolidates:

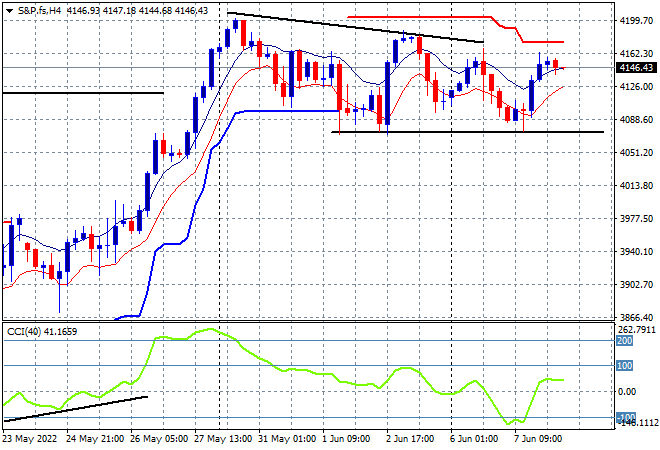

Eurostoxx and Wall Street futures are somewhat mixed as we head into the European open with the S&P500 four hourly futures chart showing price just holding above the start of week level, but not yet making a new intrasession high. Key support at the 4100 point level is the area to watch with short term momentum is neutral at best as upside potential could be limited here:

The economic calendar includes Euro wide GDP 3Q estimates, then US wholesale inventories.