A mixed start to the trading week here in Asia following the US jobs report on Friday night which came in hotter than expected and caused Wall Street to spike higher. This hasn’t translated into gains on Asian share markets today however with some pushback on USD as well, with the Australian dollar for instance just below the 66 cent level.

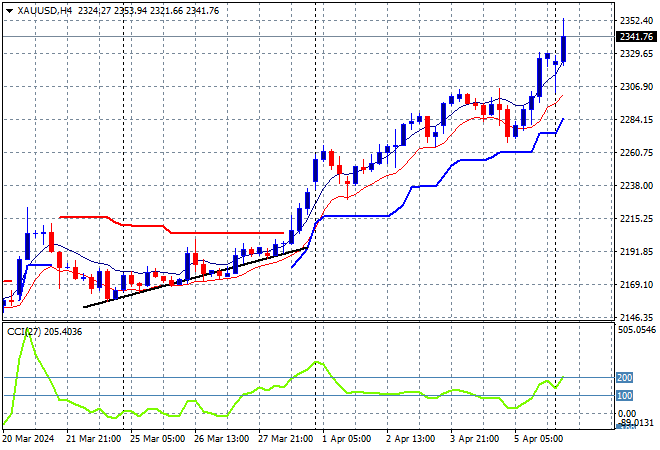

Oil prices have gapped down over the weekend on macro concerns in the Middle East with Brent crude still well above previous weekly resistance, but falling below the $90USD per barrel level while gold is still going straight up, currently at the $2340USD per ounce level:

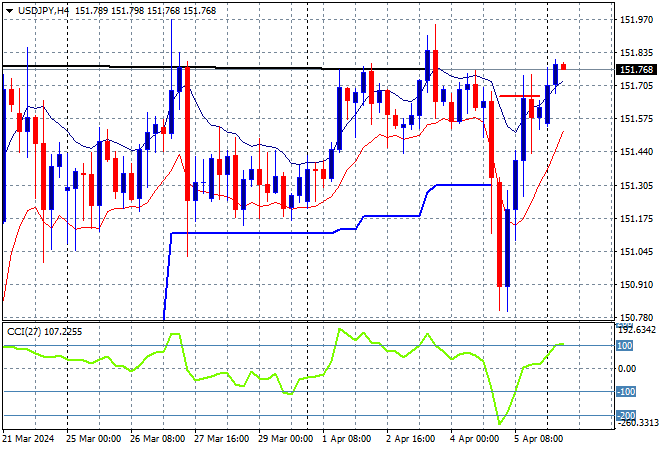

Mainland and offshore Chinese share markets are having a mixed start to the week with the Shanghai Composite down 0.2% while the Hang Seng Index is off by just 0.1% to 16709 points. Japanese stock markets however went the other day on a weaker Yen as the Nikkei 225 closed 0.7% higher at 39285 points with the USDJPY pair getting back on track to the recent weekly highs:

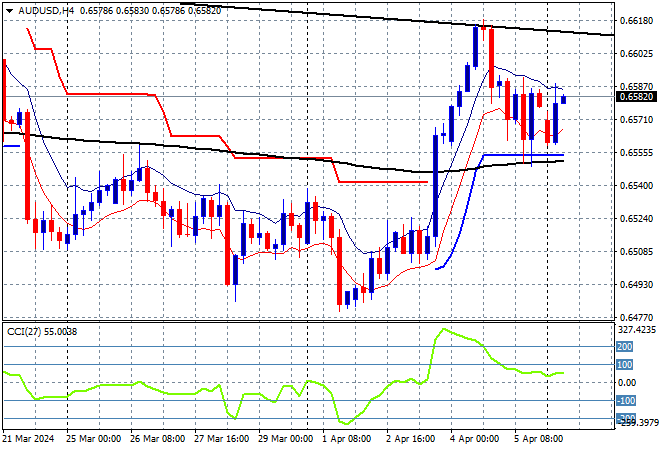

Australian stocks didn’t perform as expected with only a small recovery with the ASX200 closing 0.1% higher to 7779 points while the Australian dollar is also not moving much with a small gap down over the weekend to then return back to where it finished on Friday night just below the 66 cent level:

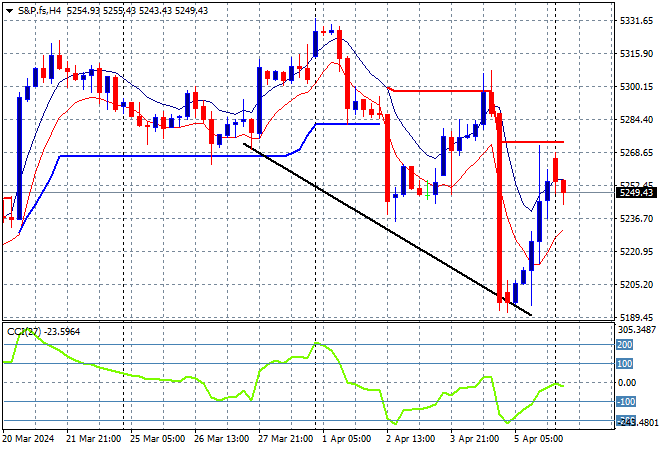

S&P and Eurostoxx futures are trying to catch up to each other with action on Wall Street overnight looking a bit mixed as we head into the London session with European shares likely to rise slightly on the open while the S&P500 four hourly chart shows price action still in a technical downtrend:

The economic calendar tonight is always slow after the US jobs report with just a few Treasury auctions tonight.