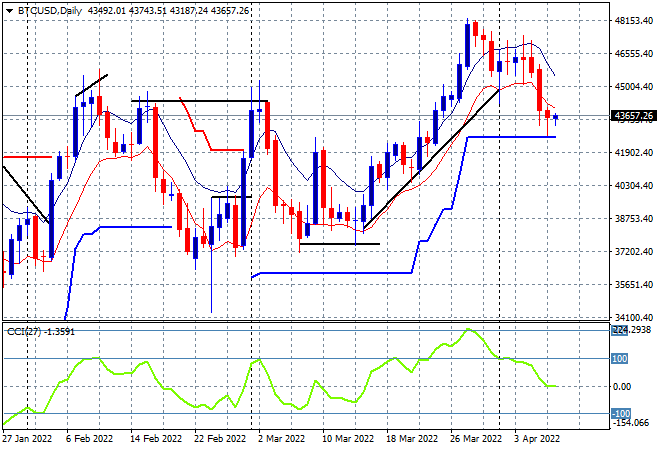

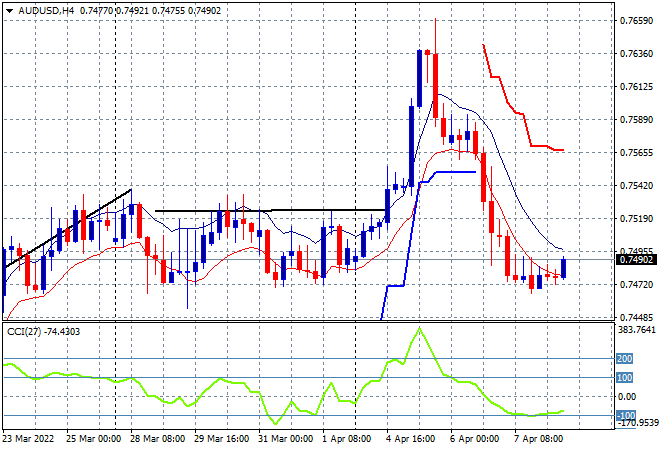

A relatively good session across Asian stock markets today as risk sentiment firms somewhat overnight despite the ECB overnight joining the hawkish set. The Australian dollar is trying to breakout of its week long funk, about to cross back above the 75 handle while the USD remains strong against the other major currency pairs, particularly Euro. Oil markets are looking week with Brent crude about to break below the critical $100USD per barrel level while gold is largely unchanged as Bitcoin deflates to daily support, currently at the $43K level and going nowhere:

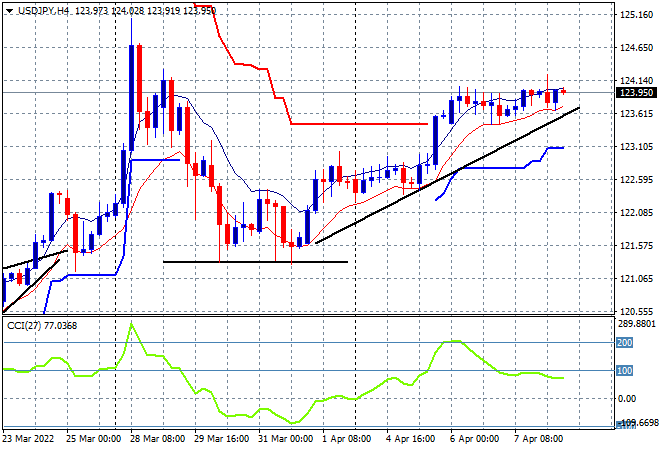

Mainland Chinese share markets are unsettled given the ongoing COVID domestic problems, with the Shanghai Composite currently up 0.5% to 3253 points while the Hang Seng Index has down more than 0.3% to 21737 points. Japanese stock markets are quite unsteady with the Nikkei 225 likely to put in a scratch session here, currently up 0.1% to 26931 points while the USDJPY pair is pausing once again, this time consolidating just below the 124 level after its mid week breakout on USD strength continues to build potential:

Australian stocks were the best in the region again with the ASX200 looking to close 0.5% higher, but still shy of the 7500 point level, while the Australian dollar has stopped falling, now looking to get back above the 75 handle as selling seems exhausted here:

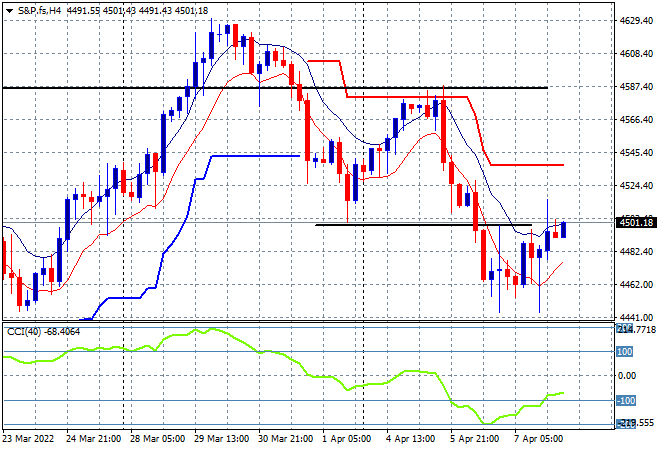

Eurostoxx and Wall Street futures are lifting after the wide ranging sessions overnight where the BTFD obviously stepped in to calm nerves. The S&P500 four hourly chart shows a bounce off the 4470 point level, but this could quickly turn into another tumble down a set of stairs although the signs of a short term upswing are building:

The economic calendar finishes the trading week with a whimper with a few secondary ECB and Fed speeches to look out for.