Friday night saw the December US NFP print mixed in a weak ISM services print which resulted in a lot of intrasession volatility on Wall Street and in currency and bond markets. US stocks barely got away with a mild scratch session while European shares fell back slightly as the USD finished where it started against Euro and Pound Sterling. The Australian dollar was pushed down to the 66 cent level but barely recovered later on in the session.

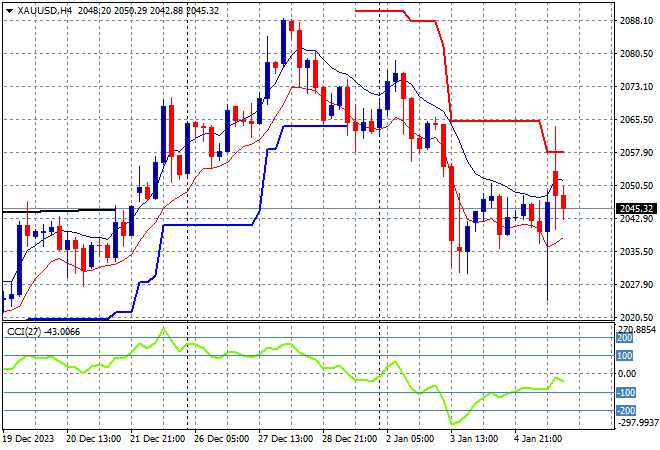

10 year Treasury yields closed up higher on the jobs data to break through the 4% level while oil prices came back again despite the start of week blip higher with Brent crude finishing below the $79USD per barrel level. Gold followed the other undollars with a lot of volatility but no direction, finishing at the $2040USD per ounce level.

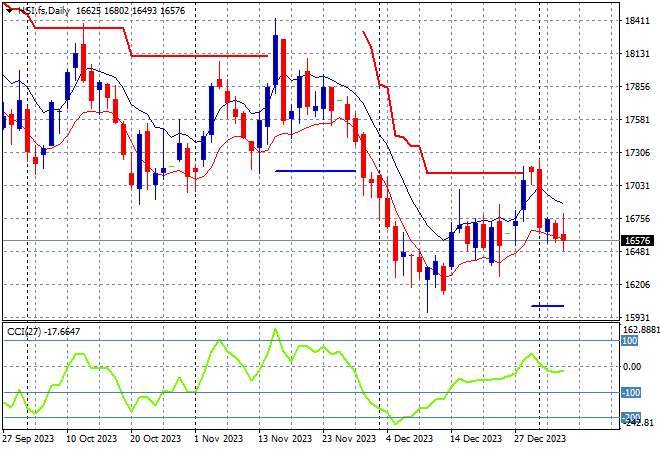

Looking at share markets in Asia from Friday’s session where mainland Chinese share markets were again unable to bounceback as the Shanghai Composite remained well below the 3000 point barrier, closing some 0.8% lower at 2925 points while in Hong Kong the Hang Seng Index went down a similar amount to 16535 points.

The daily chart was showing a significant downtrend that had gone below the May/June lows with the 19000 point support level a distant memory as medium term price action remained stuck in the 17000 point range before this new losing streak. Daily momentum readings are finally bouncing out of oversold settings as price action wants to get back above the October lows, but so far there has been only a small chance of stabilising here:

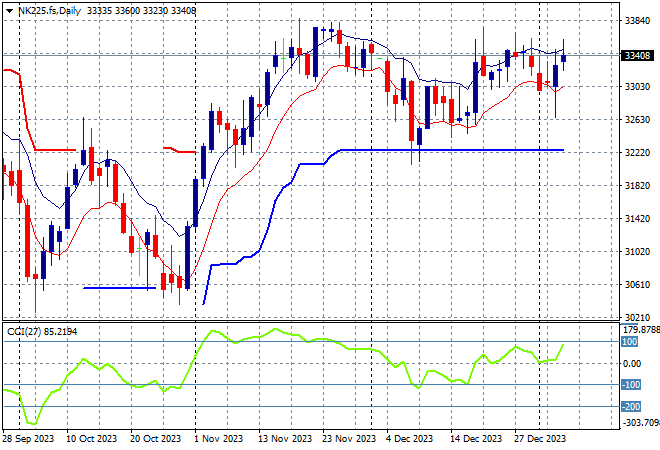

Japanese stock markets were the exception with the Nikkei 225 gaining more than 0.2% to close at 33377 points.

Trailing ATR daily support was being threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum now fully retracing from the overbought zone but wanting to neutralise. Correlations with a stronger Yen are breaking down here with a selloff back to ATR support at 32000 points unlikely so far but a lack of a new daily high is telling:

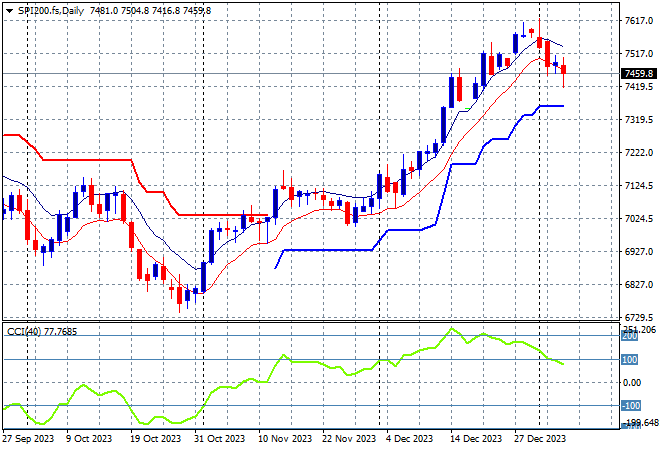

Australian stocks were able to finish with a scratch session with the ASX200 closing the week out just below the 7500 point level at 7489 points.

SPI futures are looking to repeat that mood with almost no change due to the meagre gains on Wall Street from Friday night. The daily chart is still looking very optimistic here in the medium term with short term price action however suggesting a possible reversal underway as daily momentum starts to wane and resistance at the 7600 point level builds. Watch for any dip below the low moving average:

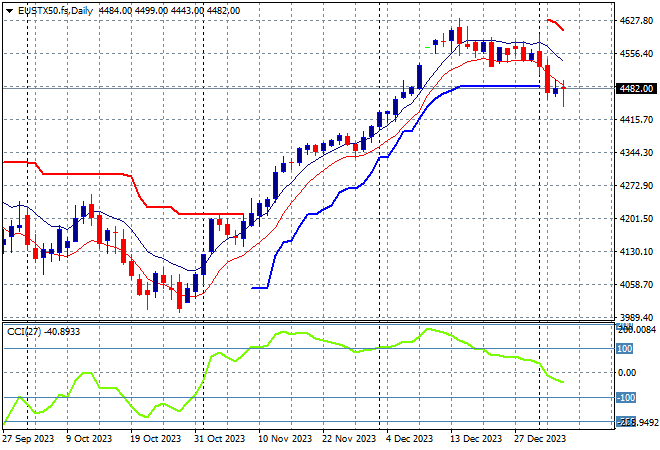

European markets were unable to follow through on their recent rebound with mild losses across the continent as the Eurostoxx 50 Index finished more than 0.2% lower at 4463 points.

The daily chart shows weekly support remaining firm at the 4480 point level but a failure to make a new high above the early December 4600 point level is starting to drag overall momentum down with a full retracement now below overbought settings. Futures are indicating a possible rollover so watch daily support very closely in the sessions ahead with volatility rising:

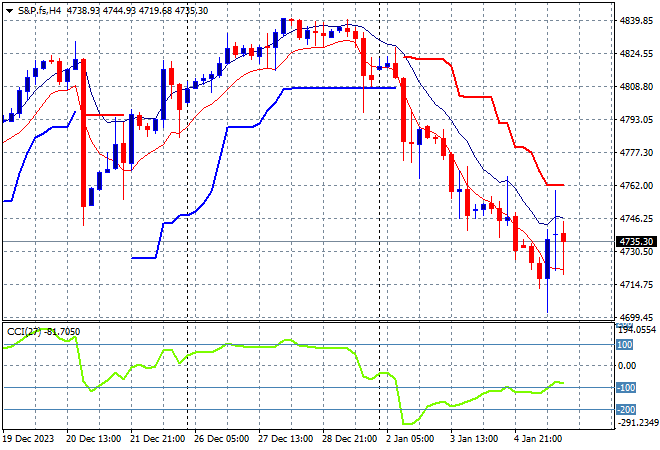

Wall Street was able to get through some big intrasession volatility with very small upside at the end of the session as the NASDAQ put on just 0.1% while the S&P500 closed 0.2% higher at 4697 points.

Short term momentum is now retracing out of overbought territory on the four hourly chart, indicating the Xmas rally is likely over with price action dipping well below the low moving average band. The next step to test here is trailing ATR support at the 4700 point level proper which is likely just a consolidation phase on thin trading volume:

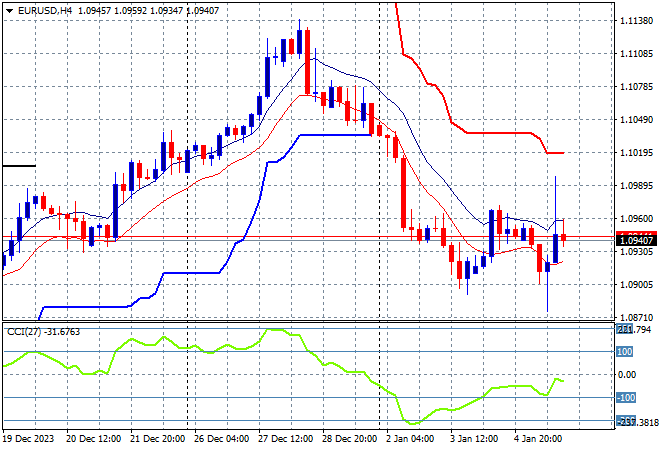

Currency markets were consolidating on the back of the FOMC minutes before Friday night’s NFP print with King Dollar still dominating the general trend. Volatility on Friday night due to the weak ISM print saw some wide ranges but effectively no change for Euro which remains anchored near the 1.09 handle again.

The union currency was looking weak but with the potential for a swing trade higher before the print but short term momentum remains negative with price action still well below trailing ATR resistance as it remains near the December lows:

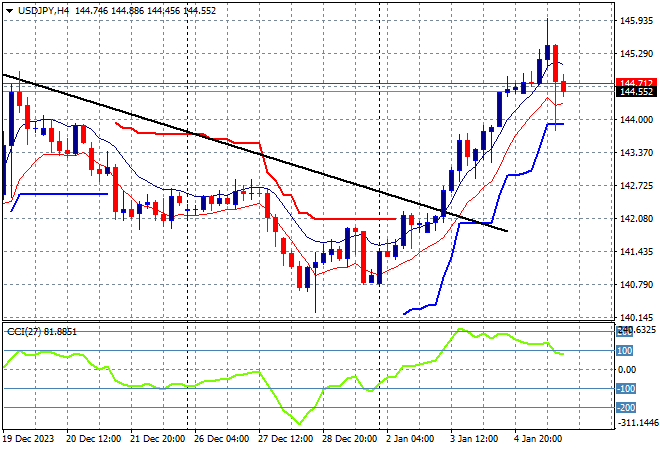

The USDJPY pair also tried another breakout but volatility kept it in check to finish at the mid 144 level on Friday night.

Four hourly momentum is now slipping from overbought readings and the medium term trend (sloping black line) remains broken here but I think this move was a little too fast so watch for a possible retracement:

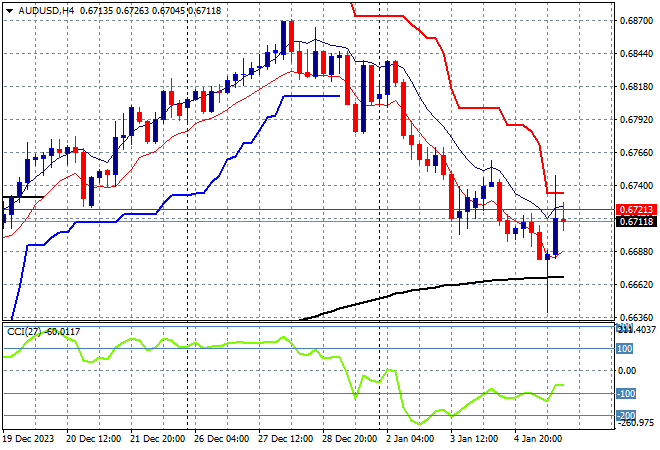

The Australian dollar had a wide range as well but is still within its two week long trend with the 67 handle proving tough to climb over.

The Aussie has been under medium and long term pressure for sometime with the latest rally just a relief valve being let off with short term momentum returning to oversold territory as traders positioned for the NFP print and still have another month for the RBA to come back from holidays:

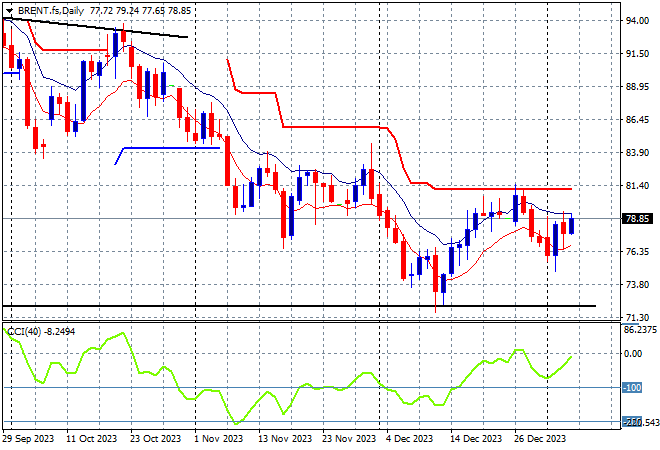

Oil markets saw a mild move higher overnight with Brent crude finishing just below the $79USD per barrel level as it remains contained.

After almost reaching $100 in mid September, price was looking to return to the August levels around the $85 area where a point of control had been established before the recent breakout failed to push above trailing resistance at the $80 level. Daily momentum failed to get out of negative settings but is having another go here despite a possible retest of the December lows nearer the $70USD per barrel level soon:

Gold is mimicking the other undollars with a wide ranging session that saw it almost get back to the start of week levels before settling down at the $2040USD per ounce level as it too remains anchored near the early December levels.

Profit taking may return here so watch the low moving average on the daily chart for signs of another possible dip with daily momentum still in the oversold zone: